AUTHOR : SOFI PARK

DATE : 28/12/2023

In recent years, the surge in digital transactions has necessitated robust cybersecurity measures.

Payment provider cyber products, encompassing a range of technological solutions, have emerged as the frontline defenders against evolving cyber threats.

Definition of Payment Provider Cyber Products

Importance in the Indian Market

Payment provider[1] cyber products refer to a suite of technological solutions employed by payment service providers to secure and streamline online transactions. These products encompass encryption mechanisms, secure interfaces, and advanced fraud detection systems.

With the Indian government’s push towards a cashless economy, the significance of payment provider cyber products has never been more pronounced. Ensuring the security of financial transactions is pivotal in building trust among businesses and consumers alike.

Evolution of Payment Provider Cyber Products

Historical Overview

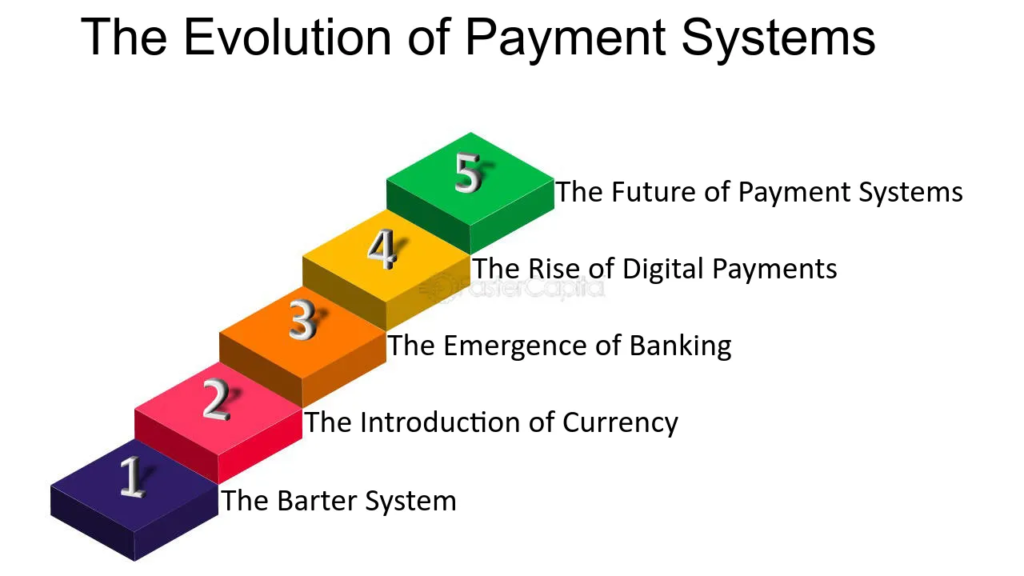

The journey of payment provider cyber products[2] traces back to the early days of online transactions when basic encryption methods were employed. Over time, technological advancements have led to the development of sophisticated solutions.

Technological Advancements

The landscape of cybersecurity is dynamic, with continuous innovations in response to emerging threats. Payment providers now leverage cutting-edge technologies to stay ahead of cybercriminals, providing a secure environment for users.

Key Features of Payment Provider Cyber Products

Encryption and Security Measures

One of the primary features of these products is robust encryption. Advanced cryptographic techniques are implemented to safeguard sensitive data, making it nearly impossible for unauthorized entities to compromise security.

Integration Capabilities

Payment provide cyber products seamlessly integrate with various platforms and systems. This integration enhances the overall security infrastructure and ensures a smooth user experience during transactions.

User-Friendly Interfaces

While security is paramount, user experience is not neglected. Modern cyber products strike a balance between robust security measures and user-friendly interfaces, making them accessible to businesses and consumers alike.

Major Players in the Indian Market

Overview of Leading Payment Providers

India’s digital payment[3] landscape is diverse, with several major players offering a range of cyber products. Companies like [Company A], [Company B], and [Company C] are at the forefront, providing innovative solutions.

Competitive Landscape

Competition among payment providers has led to continuous improvements in cyber products. The competitive landscape fosters innovation, pushing companies to enhance security features and offer cutting-edge solutions.

Cyber Threats in the Payment Industry

Types of Cyber Attacks

Payment providers face various cyber threats, including phishing attacks, malware, and data breaches. Understanding these threats is crucial for developing effective cybersecurity strategies.

Impact on Payment Providers

Payment providers must be vigilant in implementing measures to detect and prevent such attacks proactively.

Strategies for Cybersecurity in Payment Products

Proactive Measures

To stay ahead of cyber threats, payment providers adopt proactive measures. Regular security audits, threat intelligence sharing, and employee training programs are integral components of a comprehensive cybersecurity strategy.

Collaboration and Information Sharing

Collaboration among industry stakeholders is vital for a united front against cyber threats. Payment providers often engage in information sharing initiatives to collectively strengthen the industry’s cybersecurity posture.

Regulatory Framework

Government Initiatives

Recognizing the critical role of cybersecurity in the financial sector, the Indian government has implemented initiatives to enhance regulations. Compliance with these regulations is mandatory for payment providers.

Compliance Requirements

Payment providers must adhere to strict compliance requirements to operate in the Indian market. These requirements ensure a baseline of security measures, fostering a secure environment for digital transactions[4].

Benefits for Businesses and Consumers

Enhanced Security

The adoption of payment provider cyber products translates to enhanced security for businesses and consumers. Secure transactions build trust, encouraging more individuals and businesses to participate in the digital economy[5].

Convenience and Efficiency

Beyond security, these products contribute to the convenience and efficiency of transactions. Seamless payment processes, quick authorizations, and real-time fraud detection enhance the overall experience for users.

Challenges and Solutions

Addressing Security Concerns

While advancements have been made, challenges persist. Payment providers continuously work on addressing security concerns, investing in research and development to stay one step ahead of cyber threats.

Continuous Innovation

The landscape of cybersecurity is ever-evolving. Payment providers must embrace a culture of continuous innovation to adapt to new threats and technologies, ensuring a resilient defense against cyber attacks.

Future Trends in Payment Provider Cyber Products

Integration of AI and Machine Learning

The future of payment provider cyber products lies in the integration of artificial intelligence (AI) and machine learning (ML). These technologies enable real-time threat detection and adaptive security measures.

Blockchain Technology

Blockchain, known for its decentralized and tamper-resistant nature, is gaining traction in the payment industry. Its potential to enhance security and transparency makes it a promising addition to payment provider cyber products.

Conclusion

In conclusion, payment provider cyber products are indispensable guardians of the digital economy in India. As technology advances, so do cyber threats, making it imperative for businesses and consumers to embrace secure payment solutions. The proactive adoption of advanced cybersecurity measures not only safeguards transactions but also propels the nation towards a digital future.

FAQs

- Are payment provider cyber products suitable for small businesses?

- Yes, many solutions cater to the specific needs of small businesses, providing scalable and affordable cybersecurity measures.

- How often should businesses conduct security audits of their payment systems?

- Regular security audits are recommended, with the frequency depending on the volume of transactions and the evolving threat landscape.

- What role does user education play in enhancing cybersecurity for digital payments?

- User education is crucial in preventing phishing attacks and ensuring that individuals adopt secure practices during online transactions.

- Can blockchain technology completely eliminate fraud in digital payments?

- It significantly reduces fraud but does not eliminate it entirely.

- How do payment providers collaborate to combat cyber threats?

- Payment providers often participate in information-sharing networks, collaborate on threat intelligence, and engage in joint initiatives to strengthen cybersecurity collectively.