AUTHOR: SELENA GIL

DATE: 3/1/2024

India’s payment provider data-driven landscape has witnessed a transformation propelled by the advent of data-driven marketing strategies. The convergence of technology, consumer behavior analysis, and digital payment systems has significantly reshaped how payment providers approach their marketing endeavors in the country.

Introduction

In recent years, the payment sector in India has experienced an evolution. With the surge in digital transactions, payment providers have harnessed the power of data-driven marketing in India to enhance their services and meet the diverse needs of consumers. Leveraging data has become the cornerstone for devising effective marketing strategies in this competitive landscape.

Understanding Data-Driven Marketing Strategies

Data serves as the fuel for modern marketing campaigns for payment providers in India. From transaction histories and user behavior patterns to demographic information, a myriad of data types are analyzed and utilized. Cutting-edge tools and technologies aid in processing and interpreting this data, enabling providers to create targeted and personalized marketing initiatives.

Challenges and Opportunities in India’s Payment Sector

Despite the promising prospects, navigating the Indian payment market isn’t without challenges. Regulatory complexities and the ever-evolving landscape pose hurdles. However, these challenges also present opportunities for innovation and growth, Payment Provider Data-Driven Marketing driving providers to find unique solutions to establish a stronger foothold.

Key Metrics and Analytics in Payment Provider Marketing

Measuring the effectiveness of marketing efforts[1] is crucial. Understanding these metrics helps in refining strategies and optimizing outcomes.

Customizing Marketing Strategies for Diverse Payment Options

India boasts a diverse payment ecosystem[2], comprising various methods like mobile wallets, UPIs, cards, and more. Providers need to tailor their marketing approaches to suit each method and cater to specific customer segments, ensuring a more personalized experience.

Ethical Considerations and Data Privacy

While leveraging data is essential, it’s equally imperative to uphold ethical standards and ensure data privacy. Payment providers must strike a balance between utilizing customer data for personalized marketing and respecting privacy concerns, thereby building trust among consumers.

Successful Case Studies in Data-Driven Payment Marketing

Several success stories highlight the impact of data-driven[3] marketing in the Indian payment sector. Examining these cases provides valuable insights into crafting effective strategies that resonate with the audience and drive desired outcomes.

Future Trends and Innovations in Payment Provider Marketing

Looking ahead, the future of data-driven marketing in India’s payment sector appears promising. Emerging technologies like AI and machine learning are anticipated to further revolutionize marketing[4] approaches, offering new avenues for innovation and engagement.

Understanding the Role of Consumer Insights

Consumer insights are the bedrock of successful data-driven marketing for payment providers in India. Analyzing user behavior, preferences, and Payment Provider Data-Driven Marketing in India transaction patterns provides invaluable information. Payment Provider Data-Driven Marketing in India This deeper understanding empowers providers to craft more relevant and targeted marketing strategies, ultimately enhancing user engagement.

The Impact of Personalization in Payment Provider Marketing

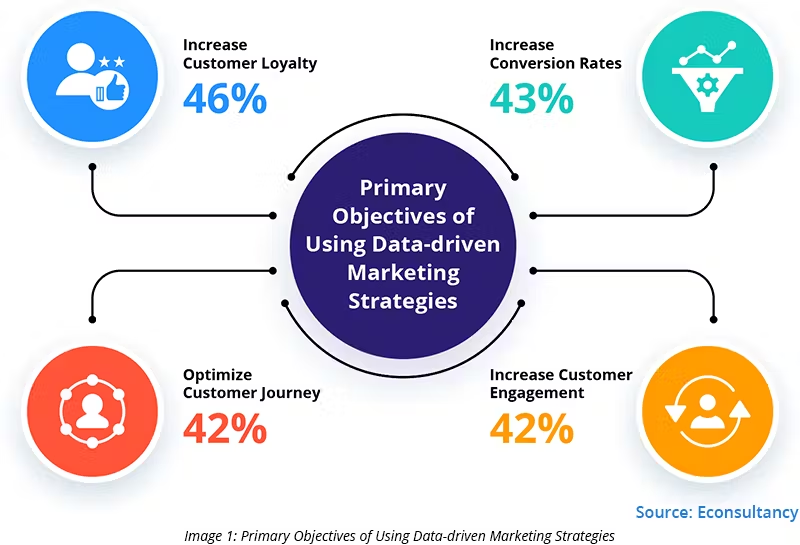

Personalization has emerged as a game-changer in the realm of payment provider marketing. This fosters stronger connections with users, driving loyalty and increasing the likelihood of conversion.

Navigating Regulatory Frameworks for Data Usage

Adhering to stringent regulatory frameworks is pivotal to leveraging consumer data. India’s evolving data privacy laws necessitate compliance to safeguard user information. Payment[5] providers must navigate these regulations effectively while harnessing the power of data for marketing initiatives.

Collaborations and Partnerships for Enhanced Marketing

Strategic collaborations and partnerships have proven beneficial for payment providers.

Conclusion

In conclusion, data-driven marketing has become the linchpin for payment providers in India to thrive in a dynamic and competitive landscape. Harnessing the power of data while maintaining ethical standards will continue to define success in this ever-evolving sector.

FAQs

- How crucial is data-driven marketing for payment providers in India? Data-driven marketing is imperative, as it enables providers to understand consumer behavior and tailor services accordingly, enhancing user experiences.

- What challenges do payment providers face in implementing data-driven strategies? Regulatory complexities and ensuring data privacy pose significant challenges in implementing data-driven marketing strategies.

- How can payment providers ensure ethical usage of consumer data? Providers can uphold ethical standards by implementing robust data privacy measures and transparently communicating their data usage policies to customers.

- What role do emerging technologies play in the future of payment provider marketing? Technologies like AI and machine learning are expected to drive innovation and enable more sophisticated, targeted marketing approaches.

- Why is it crucial for payment providers to customize marketing strategies for diverse payment options? Customization ensures that marketing efforts resonate with users of different payment methods, leading to higher engagement and conversion rates.