AUTHOR : BELLA

DATE : FEBRUARY 29, 2024

Introduction to Payment Providers

In today’s digital age, payment providers play a crucial role in facilitating seamless financial transactions Whether it’s purchasing goods online, transferring funds, or paying bills, digital payment solutions have become an integral part of everyday life

Digital Payment Landscape in India

India has undergone a significant transformation[1] in its payment landscape driven by the surge in smartphone usage, enhanced internet connectivity, and governmental efforts like Digital India and the Unified Payments Interface (UPI). The country[2] has emerged as one of the fastest-growing markets for digital payments globally.

Role of Payment Providers

Payment providers act as intermediaries between consumers, merchants, and financial institutions, enabling secure and efficient transfer of funds. They offer a range of services [3], including mobile wallets, payment gateways, and peer-to-peer transfer platforms, making transactions quick and convenient.

Key Players in India

Several prominent payment providers operate in the Indian market, including Paytm, PhonePe, Google Pay, and Amazon Pay. These platforms have gained significant traction among users, offering diverse payment options and value-added services [4].

Features of Payment Provider Digital Applications

Payment provider applications boast user-friendly interfaces, making it easy for users to navigate and conduct transactions. They also prioritize security, employing robust encryption [5] techniques and multi-factor authentication to safeguard sensitive information. Additionally, these apps offer a wide range of payment options, including UPI, credit/debit cards, net banking, and mobile wallets, catering to diverse consumer preferences.

Integration with E-commerce Platforms

Payment provider apps seamlessly integrate with e-commerce platforms, offering a hassle-free checkout experience for customers. By streamlining the payment process, these apps enhance user satisfaction and build trust, ultimately driving higher conversion rates for businesses.

Mobile Wallets vs. Payment Gateways

While mobile wallets store funds digitally for future transactions, payment gateways facilitate real-time authorization of online payments. Individual users often favor mobile wallets for their day-to-day expenditures, while businesses opt for payment gateways to ensure the secure processing of online transactions.

Regulatory Framework

The Reserve Bank of India (RBI) regulates payment providers to ensure transparency, accountability, and consumer protection. Payment providers must adhere to regulatory guidelines, obtain necessary licenses, and comply with data security standards to operate legally in the country.

Challenges Faced

Despite their widespread adoption, payment providers face challenges such as cybersecurity threats, technical glitches, and intense competition from rivals. Addressing these challenges requires continuous innovation, investment in technology infrastructure, and collaboration with regulatory authorities.

Future Outlook

The future of payment provider digital applications in India looks promising, with ongoing innovations in payment technology and increasing consumer acceptance of digital payments. As smartphone usage continues to rise and internet connectivity improves, the adoption of digital payment solutions is expected to soar, driving further growth in the sector.

Impact on Indian Economy

The widespread adoption of digital payment solutions has significant implications for the Indian economy. It promotes financial inclusion by providing access to banking services for underserved populations, reduces the dependence on cash transactions, and contributes to the government’s cashless initiatives.

Case Studies

Several businesses across various sectors have leveraged payment provider apps to streamline their payment processes and enhance customer experiences. From small retailers to large e-commerce platforms, these case studies demonstrate the tangible benefits of embracing digital payment solutions.

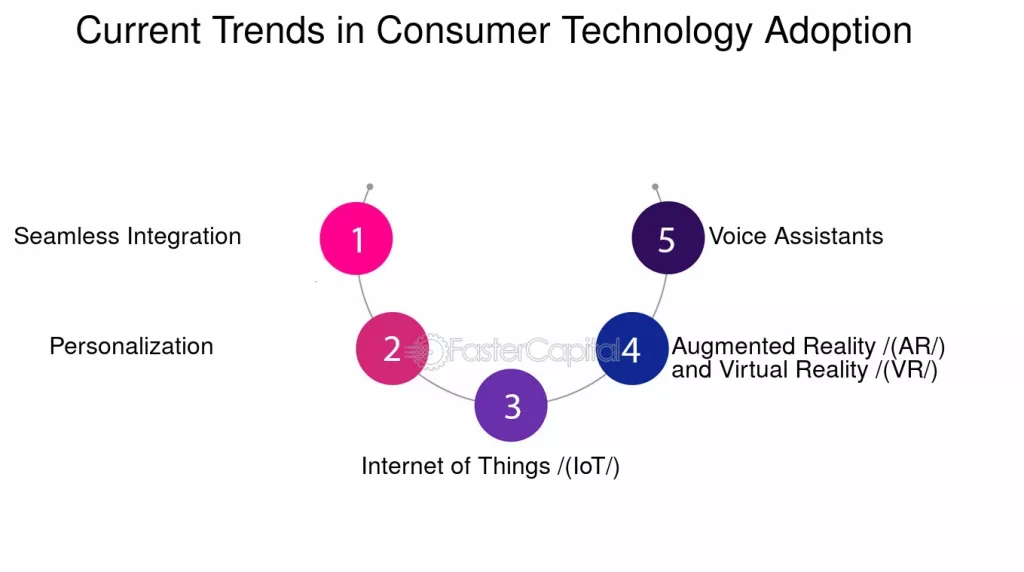

Consumer Adoption Trends

Consumer inclinations are gravitating towards digital payments, driven by the allure of convenience, security, and incentives provided by payment provider apps. Millennials and Gen , in particular, are driving the adoption of digital payment solutions, preferring the ease and flexibility they offer over traditional payment methods.

Partnerships and Collaborations

Payment providers often collaborate with banks, merchants, and technology companies to expand their reach and enhance their service offerings. These partnerships aim to improve the overall payment infrastructure, foster innovation, and address emerging market needs.

Conclusion

In conclusion, payment provider digital applications have revolutionized the way financial transactions are conducted in India. With their user-friendly interfaces, robust security measures, and diverse payment options, these apps have become indispensable tools for consumers and businesses alike. As the digital payment landscape continues to evolve, payment providers must stay ahead of the curve by embracing innovation and addressing emerging challenges to sustain their growth trajectory.

FAQs

- Are payment provider apps safe to use?

- Yes, payment provider apps employ advanced security measures such as encryption and multi-factor authentication to protect user data and transactions.

- Yes, payment provider apps employ advanced security measures such as encryption and multi-factor authentication to protect user data and transactions.

- Can I use multiple payment provider apps simultaneously?

- Yes, users can download and use multiple payment provider apps based on their preferences and specific requirements.

- Yes, users can download and use multiple payment provider apps based on their preferences and specific requirements.

- Do payment-provider apps charge any fees for transactions?

- Some payment provider apps may levy transaction fees or convenience charges for certain services. It’s essential to review the fee structure before using the app.

- Some payment provider apps may levy transaction fees or convenience charges for certain services. It’s essential to review the fee structure before using the app.

- How can businesses benefit from integrating payment provider apps?

- By integrating payment provider apps, businesses can streamline their payment processes, enhance customer satisfaction, and boost sales conversion rates.

- By integrating payment provider apps, businesses can streamline their payment processes, enhance customer satisfaction, and boost sales conversion rates.

- Are there any limitations to the amount I can transact using payment provider apps?

- Payment provider apps may have transaction limits imposed by regulatory authorities or the app itself. Users should check the app’s terms and conditions for details on transaction limits.