AUTHOR : HAANA TINE

DATE:04/01/2024

Introduction

In the bustling landscape of India’s financial technology, payment providers have become integral to the success of businesses. Direct marketing analytics a powerful tool for extracting insights from data, is now converging with payment services, creating a paradigm shift in the way businesses understand and approach their customers.

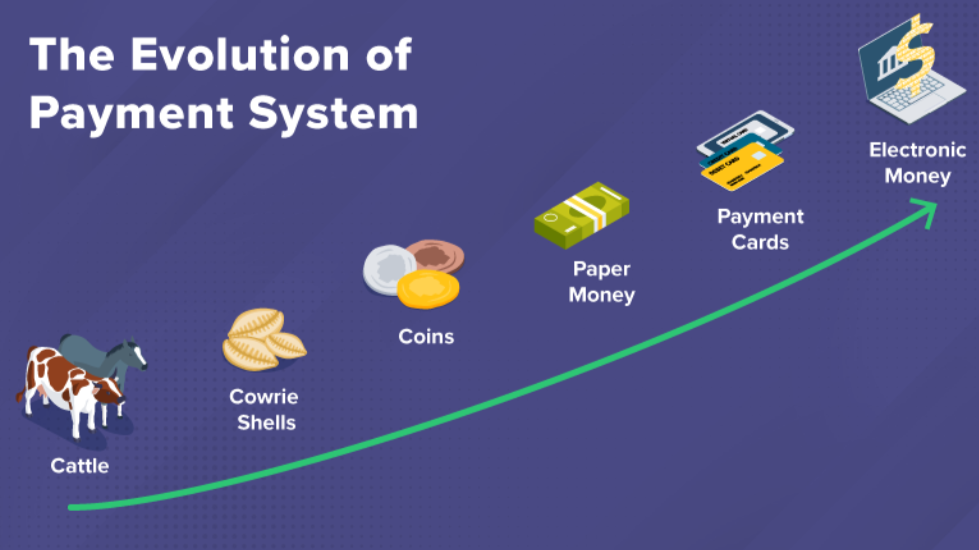

Evolution of Payment Providers in India

India’s journey from traditional payment methods to digital wallets and UPI has been nothing short of revolutionary. The tech-savvy population and government initiatives like Digital India have played a pivotal role in this evolution. Payment providers, once confined to facilitating transactions, now stand as catalysts for economic growth.

Role of Payment Providers in Business Growth

The symbiotic relationship between payment providers and business growth is undeniable. Streamlined payment processes enhance customer satisfaction, leading to increased sales and brand loyalty. Payment Provider: Direct Marketing Analytics in India This mutually beneficial alliance has fueled the growth of e-commerce and brick-and-mortar businesses alike.

Direct Marketing Analytics Defined

Direct marketing Data insights involve the systematic analysis of data generated from marketing campaigns to make informed decisions. In the context of payment providers, it means exploiting transaction data to understand customer behavior, preferences, and trends.

Integration of Payment Providers and Direct Marketing Analytics

Smart businesses are now realizing the potential of integrating payment provider direct marketing data insights. By deciphering patterns in customer spending and identifying target social statistics, companies can tailor their marketing strategies for maximum impact. This integration ensures a personalized approach to customer engagement.

Challenges and Solutions

However, integrating payment data with marketing Data[1] insights aren’t without challenges. Balancing the need for detailed insights with data privacy concerns poses a significant hurdle. Implementing robust encryption and decryption techniques can address these concerns, ensuring compliance with data protection regulations.

Security Measures in Payment Provider Analytics

Security is paramount in the world of payment data insights. Leading providers employ state-of-the-art encryption and authentication protocols to safeguard customer data. Payment Provider[2] trust is the cornerstone of these services, and stringent security measures are non-negotiable.

Impact on Consumer Behavior

The marriage of payment service provider[3] Data insights and marketing strategies have a profound impact on consumer behavior.Payment Provider: Direct Marketing Data insights in India Understanding the psychology behind purchasing decisions allows businesses to tailor their offerings, creating a more personalized and enjoyable shopping experience.

Advantages for Small Businesses

While larger enterprises have been quick to adopt payment provider data insights, small businesses can also reap the rewards. Affordable data analytics[4] tools and cloud-based solutions have leveled the playing field, enabling smaller ventures to compete on data-driven insights.

Future Trends in Payment Provider Analytics

As technology advances so does the landscape of payment provider Data insights Artificial intelligence (AI) and machine learning (ML) are expected to play a more significant role, predicting consumer behavior with unprecedented accuracy. The future holds exciting possibilities for businesses willing to embrace innovation.

Comparison with Global Trends

Benchmarking India’s payment Data insights with global standards reveal areas for improvement and innovation. Collaboration and knowledge-sharing on an international scale can propel India’s payment providers to new heights, fostering a global reputation for distinction.

Case Studies

Real-world examples speak louder than theories. Businesses across sectors have witnessed remarkable success by maximizing payment provider data insights. From personalized marketing campaigns to inventory management, these case studies showcase the tangible benefits of integrating payment and marketing data.

The regulatory landscape in India

The regulatory landscape governing payment providers and data insights is evolving. Striking a balance between fostering innovation and safeguarding consumer interests remains a challenge. Businesses must stay abreast of regulatory changes to ensure compliance and build trust with their customers.

Expert Opinions

Industry experts Unanimously recognize the revolutionary power of payment provider analytics[5]. According to [Expert Name], “the marriage of payment data and marketing analytics is a game-changer, enabling businesses to anticipate customer needs and stay ahead of the competition.”

Conclusion

In conclusion, the convergence of payment providers and direct marketing data insights marks a pivotal moment in India’s business landscape. The seamless integration of transaction data into marketing strategies strengthens businesses ability to connect with their audience on a deeper level. As technology continues to evolve, the synergy between payment providers and data insights will undoubtedly shape the future of commerce in India.

FAQs

- Is payment provider data insight only for large businesses?

- No, improvements in technology have made data-insight tools more accessible, allowing businesses of all sizes to benefit.

- How can small businesses afford payment provider analytics?

- ManyData insights solutions offer affordable plans and scalable options suitable for small businesses.

- Are there any privacy concerns with payment provider data insights?

- Leading payment providers prioritize data security, employing encryption and redaction to protect customer privacy.

- What role does AI play in payment provider data insights?

- AI enhances predictive capabilities, enabling businesses to forecast trends and make data-driven decisions.

- How can businesses stay compliant with changing regulations?

- Regularly updating knowledge on evolving regulations and also partnering with compliant service providers ensures adherence to standards.