AUTHOR : RIVA BLACKLEY

DATE : 13/12/2023

Introduction

In the rapidly evolving landscape of educational software, the role of payment providers has become increasingly crucial. The digital transformation in the education sector has led to a paradigm shift in payment methods, with a focus on efficiency, security, and user experience.

Evolution of Payment Solutions in Education

Historically, educational institutions relied on traditional payment methods, often causing inefficiencies and delays. However, with the advent of digital technologies, there has been a significant transition towards seamless and instantaneous payment solutions in the education sector.

Current Landscape in India

market is witnessing exponential growth, and payment providers play a pivotal role in facilitating financial transactions within the sector. Notable companies are actively contributing to the digitalecosystem, making accessible to a broader audience

Despite the progress, challenges persist in payment processing for security concerns, and ensuring smooth transactions remains top priorities for both educational institutions and payment providers.

Role of Payment Providers in Enhancing User Experience

Payment providers contribute to a positive user experience by streamlining payment processes and integrating seamlessly with educational platforms. This not only reduces administrative burdens but also enhances overall satisfaction among users.

Security Measures in Payment Processing

The paramount importance of security in educational payment transactions[1] cannot be overstated. Robust encryption technologies and secure payment gateways are imperative to safeguard sensitive financial information.

Popular Payment Gateways in the Indian Education Sector

Several payment gateways dominate the Indian education sector[2], each offering unique features and benefits. Understanding the strengths of these providers is crucial forinstitutions seeking reliable payment solutions

Adoption of Mobile Wallets and UPI

The rise of mobile wallets and UPI (Unified Payments Interface) has reshaped the way educational transactions[3] occur. The convenience of these methods has led to increased adoption, but challenges such as connectivity issues must be addressed.

Impact of Digital Payment Trends on Educational Institutions

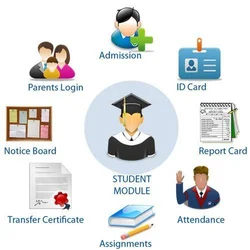

Digital payment trends have significantly impacted how educational institutions manage fee collections. The administrative benefits of integrating digital payment solutions[4] into existing systems are evident in terms of efficiency and accuracy.

Case Studies: Successful Implementations

Real-world examples of educational institutions[5] successfully implementing efficient payment solutions highlight the tangible benefits for both administrators and users. These case studies serve as models for others considering digital payment integration.

User Feedback and Satisfaction

Gathering user feedback is essential for payment providers to refine their services continually. Addressing common concerns and improving user satisfaction fosters trust and long-term partnerships.

Future Trends in Educational Payment Solutions

As technology continues to evolve, so do payment solutions in the education sector. Predicting future trends, such as blockchain-based transactions and advanced biometric authentication, provides insights for educational institutions preparing for the future.

The Importance of Compliance and Regulations

Navigating the regulatory landscape is crucial for both educational institutions and payment providers. Adhering to compliance measures ensures the legality and security of financial transactions within the education sector.

Cost-Effective Payment Solutions for Educational Institutions

Balancing efficiency and cost-effectiveness is a challenge for educational institutions. Choosing the right payment provider requires careful consideration of features, pricing models, and scaleability to meet the institution’s unique needs.

Future Trends in Educational Payment Solutions

As technology continues to evolve, the future of payment solutions in the education sector holds exciting possibilities. One noteworthy trend gaining traction is the exploration of blockchain-based transactions. The decentralized nature of blockchain enhances security and transparency and reduces the risk of fraudulent activities in educational financial transactions.

Conclusion

In conclusion, the symbiotic relationship between providers is transforming the way financial transactions occur within the sector. The emphasis on security, user experience, and compliance will continue to shape the future of payment solutions in India’s education landscape.

FAQS

- Is it safe to use digital payment methods for educational transactions?

- Yes, when using reputable payment providers and following recommended security practices.

- What are the advantages of mobile wallets in educational payments?

- Mobile wallets offer convenience, quick transactions, and seamless integration with educational platforms.

- How can educational institutions ensure compliance with payment regulations?

- Educational institutions can stay compliant by understanding and adhering to relevant financial regulations.

- Are there affordable payment solutions for smaller educational institutions?

- Yes, many payment providers offer scalable and cost-effective solutions tailored to the needs of smaller institutions.

- What future trends can we expect in educational payment solutions?

- Future trends may include blockchain-based transactions, enhanced security measures, and innovative authentication methods.