AUTHOR : SOFI PARK

DATE : 27/12/2023

Introduction

Payment providers, also known as payment gateways[1], are essential components of the e-commerce ecosystem. They act as intermediaries that enable secure online transactions between buyers and sellers. India has witnessed a significant surge in the demand for electronic goods. From smartphones to smart home devices, the electronic goods market is thriving, creating new opportunities for businesses and challenges in payment processing.

Importance of Payment Providers in E-commerce

Facilitating Secure Transactions

One of the primary responsibilities of payment providers[2] is ensuring the security of online transactions. With the rising concerns about cyber threats, consumers rely on these providers to safeguard their

financial information.

Streamlining the Checkout Process

Payment providers contribute to a smooth and efficient checkout experience. By integrating seamlessly with e-commerce platforms[3], they reduce friction in the purchasing process, leading to higher conversion rates.

Key Features of Payment Providers

Multiple Payment Options

Leading payment providers offer a variety of payment options[4], including credit cards, debit cards, digital wallets, and even UPI (Unified Payments Interface). This diversity caters to the preferences of a wide range of consumers.

Integration with Popular E-commerce Platforms

To enhance the user experience, payment providers integrate with popular e-commerce platforms. This integration allows for a unified and cohesive transaction process, benefiting both merchants and customers.

Top Payment Providers in India

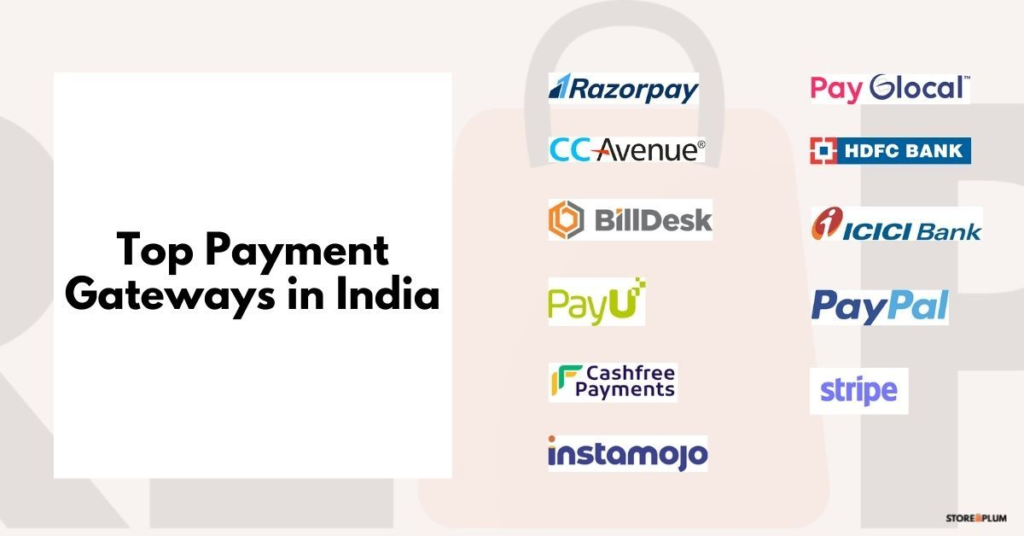

Overview of Leading Companies

Several payment providers dominate the Indian market, each with its own unique features and strengths. Understanding these companies is crucial for businesses looking to optimize their payment processing.

Unique Features and Offerings

Exploring the distinctive features of top payment providers provides insights into how they differentiate themselves. Whether it’s advanced security measures or innovative technologies, these features influence merchant and consumer choices.

Challenges in the Electronic Goods Payment Sector

Security Concerns

As the volume of online transactions[5] increases, so do the security concerns. Addressing these concerns is paramount for payment providers to maintain trust and credibility.

Transaction Failures and Resolutions

Technical glitches and transaction failures can frustrate both consumers and merchants. Analyzing common issues and providing effective resolutions is key to improving the reliability of payment processing.

How Payment Providers are Adapting

Technological Innovations

Payment providers continually adapt to technological advancements. From AI-driven fraud detection to biometric authentication, staying at the forefront of innovation is crucial for meeting evolving consumer expectations.

Partnerships and Collaborations

Collaborations between payment providers and e-commerce platforms or financial institutions can lead to enhanced services. Exploring such partnerships can provide a competitive edge in the market.

Benefits of Electronic Goods Payment Providers

Convenience for Consumers

Efficient payment processing enhances the overall convenience for consumers. Simplified checkout processes and secure transactions contribute to a positive shopping experience.

Boosting Sales for Merchants

For merchants, the right payment provider can significantly impact sales. Faster processing times, reduced cart abandonment, and expanded payment options contribute to increased revenue.

Future Trends in Payment Solutions for Electronic Goods

Emerging Technologies

The future of electronic goods payment processing holds exciting prospects with emerging technologies like blockchain and contactless payments. Understanding these trends is essential for businesses planning for the long term.

Market Predictions

Industry experts and analysts make predictions about the trajectory of payment solutions in the electronic goods sector. These insights can guide businesses in making informed decisions about their choice of payment providers.

Regulatory Environment for Payment Providers

Compliance Standards

Navigating the regulatory landscape is crucial for payment providers. Compliance with standards and regulations ensures legality and builds trust with both consumers and financial institutions.

Legal Implications

Understanding the legal implications of payment processing is essential. From data protection laws to financial regulations, payment providers must stay abreast of legal requirements.

Consumer Education on Secure Transactions

Importance of Awareness

Educating consumers about secure transactions fosters a sense of confidence in online shopping. Payment providers can play a role in promoting awareness about best practices and potential risks.

Best Practices for Consumers

Simple yet effective practices, such as using strong passwords and monitoring financial statements, can empower consumers to play an active role in ensuring the security of their transactions.

Comparison of Payment Provider Fees

Analyzing Cost Structures

Comparing the fees and cost structures of different payment providers helps businesses make informed decisions. Understanding the value of money ensures a positive return on investment.

Value for Money Considerations

While cost is a significant factor, businesses should also consider the value provided by payment providers. Balancing cost considerations with the quality of services is crucial for long-term success.

Conclusion

The article has explored the crucial role of payment providers in the electronic goods sector in India. From ensuring secure transactions to boosting sales, these providers are indispensable for the growth of e-commerce. As technology continues to evolve, the future looks promising for payment solutions in the electronic goods industry. Businesses that stay adaptive and choose their payment providers wisely are poised for success.

FAQs

- Q: How do payment providers ensure the security of online transactions? Payment providers employ advanced encryption technologies and fraud detection measures to safeguard online transactions.

- Q: What factors should businesses consider when choosing a payment provider? Businesses should consider transaction fees, security features, and compatibility with their business model when selecting a payment provider.

- Q: Are there emerging technologies impacting the future of electronic goods payment processing? A: Yes, technologies like blockchain and contactless payments are expected to shape the future of electronic goods payment processing.

- Q: How can consumers contribute to the security of their online transactions? A: Consumers can contribute by using strong passwords, monitoring their financial statements, and staying informed about best practices.

- Q: What role do regulatory compliance and legal considerations play for payment providers? A: Regulatory compliance and legal considerations are crucial for payment providers to ensure legality and build trust with consumers and financial institutions.