AUTHOR : ZOYA SHAH

DATE : 27-12-2023

Electronic media in India has witnessed a remarkable evolution in recent years, with the advent of digital platforms and the increasing reliance on online content consumption. In tandem with this, the role of payment providers[1] has become pivotal in facilitating seamless financial transactions within the digital landscape. Let’s delve into the intricacies of how payment providers are transforming electronic media in India.

Introduction to Payment Providers in India

In the vast expanse of India’s digital landscape, payment providers play a crucial role in enabling secure and swift transactions. From e-commerce platforms to streaming services, these providers ensure that users can conveniently make payments for goods and services.

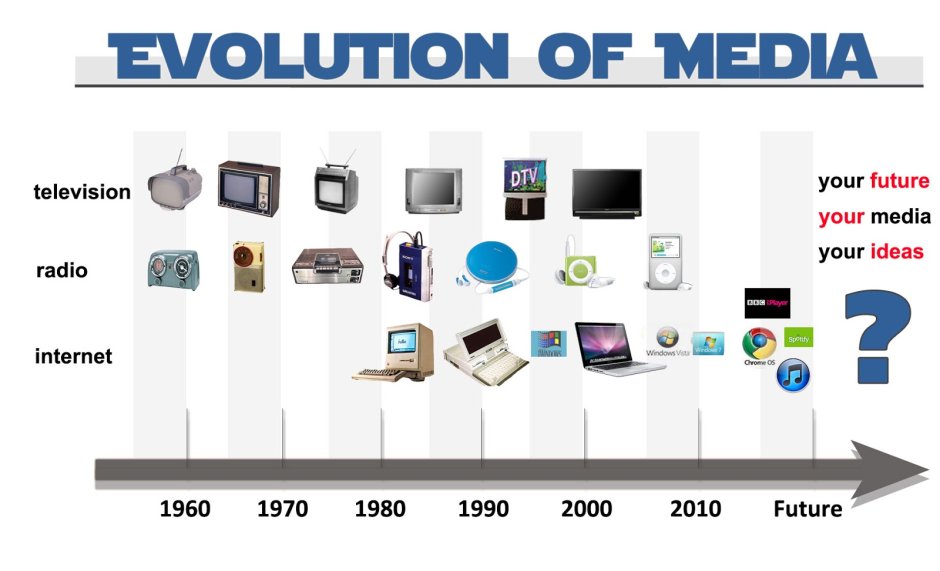

Evolution of Electronic Media in India

The journey of electronic media in India has been nothing short of revolutionary. From traditional television broadcasting to the rise of streaming platforms, the landscape has transformed significantly. This evolution has paved the way for increased reliance on digital payment[2] methods.

The Role of Payment Providers in the Digital Landscape

Payment providers act as the backbone of digital transactions, offering a range of services such as online payment gateways[3], mobile wallets, and UPI transactions. This has not only made transactions more efficient but has also opened up new avenues for monetization for content creators.

Challenges Faced by Electronic Media in India

Despite the progress, electronic media in India faces challenges, including the digital divide, varying internet speeds, and the need for widespread digital literacy. Payment providers address some of these challenges by offering user-friendly interfaces and catering to diverse demographics. Payment Provider Electronic Media In India.

Integration of Payment Solutions in Media Platforms

To enhance user experience and monetization opportunities, electronic media platforms are integrating seamless payment solutions. This allows users to subscribe to premium content, make in-app purchases, and support their favorite content creators effortlessly. Payment Provider Electronic Media In India.

Benefits of Seamless Transactions for Consumers

The integration of payment solutions brings about numerous benefits for consumers. From the convenience of one-click transactions to exclusive offers and discounts, users are incentivized to explore and engage with digital content in a more personalized manner.

Security Measures in Payment Processing

Security remains a top priority in the digital era, and it is paramount that organizations employ robust measures to safeguard user data, thereby ensuring trust and confidence among consumers. Payment providers employ advanced encryption technologies and multi-factor authentication to ensure the confidentiality and integrity of user data, fostering trust among consumers.

Popular Payment Providers in the Indian Market

Several payment providers have made a significant impact on the Indian market, including well-known names like Paytm, Google Pay, PhonePe, and others. Each offers unique features and advantages, contributing to the diversity of choices for users.

Impact of Digital Payments on Revenue Models

For content creators and media platforms, digital payments have revolutionized revenue models. Subscription-based services, pay-per-view models, and innovative monetization strategies have emerged, providing sustainable income streams for digital content[4].

User Experience Enhancement Through Payment Integration

Seamless payment integration enhances the overall user experience. By reducing friction in the payment process, media platforms can retain users and encourage repeat transactions, ultimately contributing to the growth of the digital media industry.

Innovations in Payment Technologies

The dynamic nature of the fintech industry brings forth continuous innovations. From contactless payments to the integration of blockchain technology, payment providers are at the forefront of adopting new technologies to further streamline transactions.

Government Regulations and Compliance

With the increasing influence of digital transactions, governments are keen on regulating the payment industry. Compliance with regulations ensures the security of transactions and the protection of consumer rights, fostering a healthy and transparent digital ecosystem[5].

Future Trends in Electronic Media and Payment Providers

The future holds exciting possibilities for electronic media and payment providers. Augmented reality, virtual reality, and immersive experiences are likely to reshape content consumption, and payment providers will play a pivotal role in facilitating these transformations.

Case Studies:

Successful Integration Stories

Examining successful case studies highlights the positive impact of payment provider integration. Platforms that have seamlessly integrated payment solutions have experienced increased user engagement, revenue growth, and a more robust digital presence.

Conclusion:

Transforming the Digital Media Landscape

In conclusion, the synergy between payment providers and electronic media in India is reshaping the digital landscape. From user convenience to revenue models, the impact is profound. As we navigate this digital era, the collaboration between payment providers and content creators will continue to define the future of electronic media.

FAQs

- Are digital payments secure for online content subscriptions?

- Absolutely. Payment providers use advanced security measures to ensure the safety of digital transactions.

- How do payment providers contribute to the monetization of content creators?

- Payment providers enable various revenue models, including subscriptions and pay-per-view, providing sustainable income for content creators.

- Which payment providers are most popular in India?

- Popular payment providers in India include Paytm, Google Pay, PhonePe, and others.

- What role do government regulations play in the digital payment landscape?

- Government regulations ensure the security and transparency of digital transactions, protecting consumer rights.

- What future trends can we expect in electronic media and payment integration?

- Future trends may include augmented reality, virtual reality, and immersive experiences shaping the future of content consumption.