AUTHOR : FUZZIE

DATE: 28/02/2024

Payment Provider Electronic Software in India

Electronic payment providers have revolutionized the financial landscape in India, offering a seamless and efficient way to conduct transactions in the digital era. As we delve into the intricacies of payment software in the country, it becomes evident that this transformation has not only impacted individuals but has also played a pivotal role in shaping the business landscape.

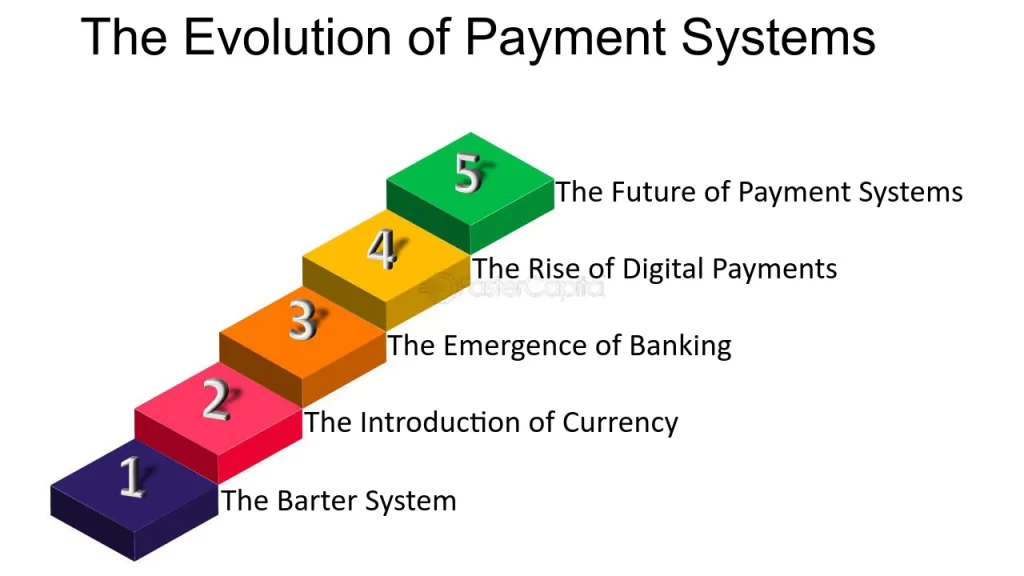

Evolution of Payment Systems

In the not-so-distant past, traditional payment methods were the norm, involving cumbersome processes and delays. However, the advent of electronic payment systems has ushered in a new era of convenience and speed. The evolution from cash-based transactions to digital wallets and online banking has been remarkable.

Key Features of Electronic Software in India

One of the standout features of electronic payment software in India is the robust security measures implemented to safeguard transactions. With advancements in encryption and authentication protocols, users can now engage in financial transactions with confidence. The sheer convenience and speed of electronic payments have further fueled their widespread adoption.

Prominent Payment Providers

India boasts a diverse array of payment providers, each offering unique features to cater to a broad spectrum of users. From established players to innovative startups, the competition in this space has led to continuous improvements in user experience and added functionalities. A comparative analysis [1] can help users choose the provider that best aligns with their needs.

Challenges Faced by Electronic Payment Providers

While electronic payment systems [2] have gained immense popularity, they are not without their challenges. Security concerns remain at the forefront, requiring constant vigilance and technological advancements to stay ahead of potential threats. Additionally, user adoption can be a hurdle in certain demographics, necessitating targeted strategies for wider acceptance.

Regulatory Landscape

The Indian government plays a crucial role in shaping the electronic payment landscape through regulations and policies. The regulatory environment not only ensures the security of transactions but also influences the growth and operation of payment providers. Understanding and adhering to these regulations are paramount for sustained success [3].

Technological Advancements

The future of electronic payments lies in technological advancements, with artificial intelligence (AI) and machine learning (ML) at the forefront. Innovations in these fields contribute to enhanced security, personalized user experiences, and the development of predictive analytics, shaping the trajectory of the payment industry. Payment Provider Electronic [4] Software in India

Benefits for Businesses

Businesses [5], irrespective of their size, stand to gain significantly from embracing electronic payment systems. The advantages include streamlined financial processes, improved cash flow, and enhanced customer satisfaction. The compatibility of electronic payment systems with various industries further strengthens their appeal.

User Experience and Interface Design

The success of any electronic payment software hinges on its user interface design. A user-friendly and intuitive interface ensures a positive experience for users, leading to increased adoption. Case studies highlighting successful designs provide insights into creating platforms that prioritize user needs and preferences.

Future Trends in Electronic Payments

As technology continues to evolve, so do electronic payment systems. Predicting future trends involves considering the rise of contactless payments, the integration of blockchain technology, and the growing importance of cybersecurity. Staying abreast of these trends is crucial for both users and providers.

Consumer Trust and Confidence

Building and maintaining consumer trust is paramount for electronic payment providers. Transparency, proactive communication, and robust security measures contribute to fostering confidence among users. Addressing concerns promptly and effectively is key to sustaining trust in the dynamic digital landscape.

Social and Economic Impact

The shift towards electronic payments has positive implications for the economy. Increased digital transactions contribute to a more transparent financial system and can address concerns related to financial inclusion. Understanding and mitigating potential drawbacks is essential for maximizing the societal benefits.

Global Comparisons

How do India’s electronic payment systems compare globally? Examining successful international models provides valuable insights. Learning from the experiences of other countries helps in adopting best practices and fine-tuning strategies for sustainable growth.

Educational Initiatives

Promoting awareness and education about electronic payments is a collaborative effort. Initiatives to enhance digital literacy among users, coupled with efforts from the government and industry players, can contribute to a more informed and empowered user base.

Conclusion

In conclusion, the landscape of electronic payment providers in India is vibrant and dynamic. The continuous evolution of technology, coupled with regulatory frameworks and user-centric designs, ensures a promising future for digital transactions. As we navigate this transformative journey, the importance of consumer trust, seamless interfaces, and staying ahead of technological trends cannot be overstated.

FAQs

- Are electronic payment systems secure in India?

- Electronic payment systems in India employ robust security measures, including encryption and authentication protocols, to ensure the security of transactions.

- How do businesses benefit from electronic payment systems?

- Businesses benefit from streamlined financial processes, improved cash flow, and enhanced customer satisfaction through the adoption of electronic payment systems.

- What are the challenges faced by electronic payment providers in India?

- Challenges include security concerns, user adoption hurdles in specific demographics, and the need to stay compliant with evolving

- How secure is this payment software?

Highly secure! It uses advanced encryption and complies with global security standards like PCI DSS to protect customer and business data. - Can startups and small businesses use this software?

Absolutely! Many solutions are designed to be scalable, cost-effective, and user-friendly, making them perfect for startups and small businesses in India.