AUTHOR : ISTELLA ISSO

DATE : 13/12/2023

Introduction

In the fast-paced world of financial services in India, payment providers[1] are not just facilitating transactions[2] but are also extending their reach into new realms of consumer protection. One notable feature gaining popularity is the inclusion of extended warranties in their offerings. This article explores the landscape of payment provider[2] extended warranties, providing insights, comparisons, and valuable tips for consumers.

The Landscape of Payment Providers

India boasts a diverse array of payment providers[3], from traditional banks to innovative fintech companies. These entities are not merely handling transactions; they are evolving to meet the varied needs of their users. Integrated extended warranties are becoming a hallmark feature, enhancing the overall value proposition for consumers.

Understanding Extended Warranties

Extended warranties, in general, offer additional coverage beyond the standard warranty period. Payment providers[4] are now integrating this concept into their services, ensuring that users have added protection for their purchases. Key features include prolonged coverage, protection against unexpected breakdowns, and peace of mind for consumers.

Payment Provider Extended Warranty Options

Different payment providers[5] offer varied extended warranty plans. It’s crucial for consumers to explore these options, comparing coverage, costs, and additional benefits. A detailed analysis can help users make informed decisions based on their individual needs.

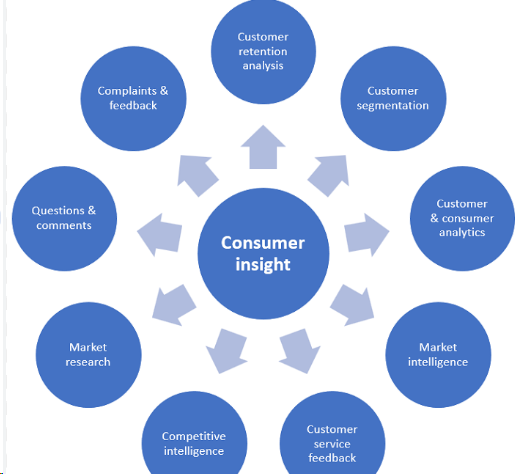

Consumer Insights

Real-life experiences often provide the best understanding of a service. This section delves into consumer reviews and testimonials, offering a glimpse into how payment provider extended warranties have impacted users’ lives.

Navigating Terms and Conditions

Understanding the terms and conditions of an extended warranty is vital. This section provides an in-depth look at what consumers need to know, debunking common misconceptions and ensuring clarity.

Pros and Cons

Every service has its advantages and drawbacks. Here, we weigh the pros and cons of opting for payment[1] provider extended warranties, helping consumers make balanced decisions.

How to Make a Claim

Filing a claim should be a straightforward process. A step-by-step guide, along with practical tips, ensures that users can navigate the claims process smoothly when needed.

Industry Trends

Extended warranties in the payment industry[2] are not static. This section explores the evolution of these offerings, offering predictions on future trends and innovations.

Tips for Choosing the Right Plan

Choosing the right extended warranty[3] plan involves considering various factors. This section provides valuable tips and insights to help users tailor coverage to their specific needs.

Comparing Payment Provider Extended Warranties to Traditional Plans

Traditional extended warranty plans exist alongside payment provider[4] offerings. This section draws comparisons, enabling consumers to assess the value for money offered by both options.

Educating Consumers

Raising awareness about payment provider extended warranties is crucial. This section explores initiatives aimed at educating consumers and making them more informed about the benefits available to them.

Addressing Common Concerns

Skepticism can surround any new offering. This section addresses common concerns, providing information to alleviate doubts and build confidence in payment provider extended warranties.

Industry Regulations

Extended warranties operate within a framework of regulation[5]. This section provides an overview of the regulatory landscape, emphasizing the importance of compliance and consumer protection.

Conclusion

In conclusion, payment provider extended warranties are a valuable addition to the financial landscape in India. As consumers explore these offerings, they gain not only extended coverage for their purchases but also peace of mind. The evolving nature of these services suggests a promising future, where consumers can expect even more tailored and innovative solutions.

FAQs

- Are payment provider extended warranties worth the cost? Extended warranties can provide added peace of mind, but their worth depends on individual preferences and usage patterns.

- How do payment providers determine warranty coverage? Coverage varies between providers, often depending on the type of product and its cost. Detailed terms and conditions outline the specifics.

- Can I purchase an extended warranty after making a purchase? Many payment providers offer the option to add an extended warranty after the initial purchase, providing flexibility to consumers.

- Are there restrictions on the types of products covered by extended warranties? Yes, certain products may be excluded, and coverage details can vary. It’s essential to review the terms for specific information.

- What happens if I switch payment providers? Extended warranties are often tied to the provider. Switching providers may impact coverage, and consumers should be aware of the terms when making changes.