AUTHOR : PUMPKIN KORE

DATE : 21/12/2023

Introduction

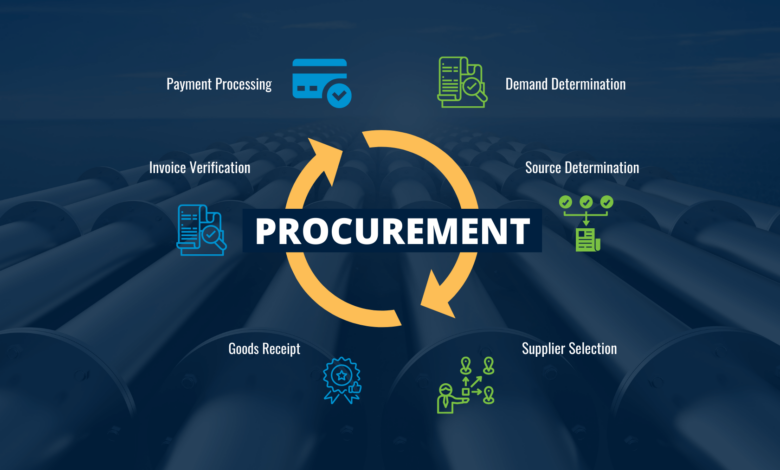

Corporate procurement in India has evolved significantly in recent years, with businesses relying on efficient processes to streamline their operations. One critical aspect of this process is the selection of a reliable payment provider. This article explores the challenges faced in corporate procurement[1], the role of payment providers, key features to consider, popular providers in India, and much more.

In the dynamic landscape of corporate procurement, businesses encounter various challenges related to payment processes[2]. Diverse payment needs, security concerns, and regulatory compliance are among the primary hurdles that organizations need to navigate. payment provider for Corporate procurement in india

Role of Payment Providers

Payment providers[3] play a pivotal role in facilitating seamless transactions for corporate procurement. Beyond transaction facilitation, they are responsible for ensuring the security of sensitive data and complying with the ever-changing regulations governing financial transactions.

When selecting a payment provider for corporate procurement, it’s crucial to consider specific features that can enhance efficiency. Integration capabilities, customization options, and robust reporting and analytics are key elements to look for in a provider.

Popular Payment Providers in India

Several payment providers cater specifically to the corporate sector in India. Each has its unique offerings, ranging from customizable solutions to advanced analytics. Understanding the strengths of these providers is essential for making an informed decision.

Comparison of Payment Providers

To aid in decision-making, a comparative analysis of payment providers is necessary. This section delves into the features of each provider, backed by user reviews and testimonials, providing a comprehensive overview of their strengths and weaknesses.

Real-world examples showcase the positive impact of using payment providers for corporate procurement. These case studies highlight improved efficiency, cost-effectiveness, and overall success stories of companies that have embraced these solutions.

Trends in Corporate Procurement Payments

The article explores the latest trends in payment processing for corporate procurement[4], including emerging technologies and future predictions. Staying abreast of these trends is essential for businesses aiming to remain competitive in the market.

Security is a top priority in any financial transaction[5]. This section discusses the importance of secure transactions and the measures taken by payment providers to safeguard sensitive information.

Regulatory Landscape

Understanding the regulatory landscape is crucial for businesses operating in India. This section provides an overview of payment regulations and the compliance requirements payment provider for corporate procurement.

A user-friendly interface is vital for ensuring smooth transactions. This section explores the significance of a seamless user experience, citing real-life examples of platforms with intuitive interfaces.

Transparent pricing models and the avoidance of hidden fees are paramount when selecting a payment provider. This section delves into the various cost considerations businesses should keep in mind.

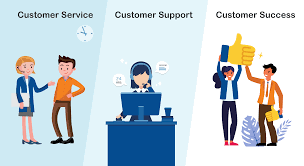

Customer Support

Responsive customer support is a key factor in the overall satisfaction with a payment provider For Corporate. This section discusses how providers handle customer queries and issues, showcasing the importance of excellent customer service.

As businesses grow, their payment needs evolve. This section explores how payment providers offer scalable solutions to adapt to the changing requirements of a growing business.

In the ever-evolving landscape of corporate procurement, businesses are dynamic entities that witness growth over time. As such, payment providers must offer scalable solutions to adapt to the changing needs of a growing enterprise. This section explores how these providers accommodate the expansion of businesses, ensuring that payment processes remain efficient and effective even as transaction volumes increase.

Conclusion

In conclusion, selecting the right payment provider for corporate procurement in India is a strategic decision that requires careful consideration. From understanding the challenges to evaluating key features and comparing popular providers, businesses can make informed choices that positively impact their operations.

FAQs

- How do payment providers ensure data security during transactions?

- Discussion of encryption methods and secure protocols.

- What are the common regulatory compliance requirements for corporate procurement payments?

- Overview of regulations and compliance measures.

- Can small businesses benefit from payment providers designed for corporate procurement?

- Explanation of scalable solutions and benefits for small businesses.

- How do payment providers handle customer queries and issues?

- Insights into customer support mechanisms.

- What emerging technologies are shaping the future of corporate procurement payments in India?

- Discussion of the latest technological trends in the industry.