AUTHOR: AYAKA SHAIKH

DATE: 30/12/2023

Introduction

India, a land of diversity and contrast, has a burgeoning frugal shopping society. People are always on the lookout for the best deals, discounts, and value for money. But what fuels this trend? It’s the need to maximize savings while enjoying quality products and services. Payment Provider for the Frugal Shopping Society in India.

Importance of Efficient Payment Systems

Imagine finding the perfect deal only to be hindered by a complicated payment process. Sounds frustrating, right? Efficient payment systems are the backbone of any frugal shopping society. They ensure seamless transactions, security, and convenience for consumers, Payment Provider For Frugal Shopping Society in India.

Challenges in Payment Systems in India

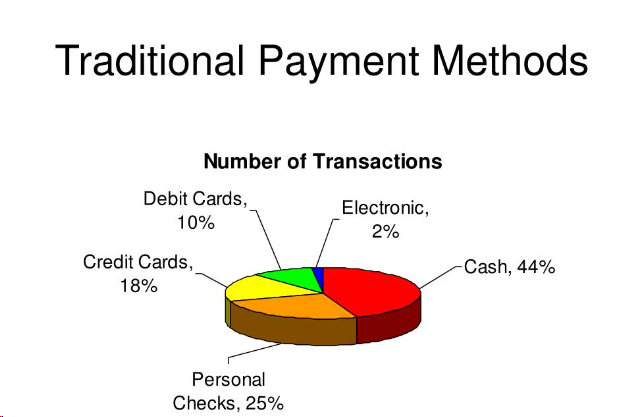

Traditional Payment Systems

Historically, India has relied heavily on cash transactions. While convenient, it poses risks like theft, counterfeit notes, and the hassle of carrying physical money.

Digital Payment Trends

With technological advancements, digital payment methods[1] like UPI, mobile wallets, and online banking have gained momentum. However, not all systems cater to the unique needs of a frugal shopping society.

Emerging Payment Providers

Features and Benefits

Several payment providers[2] are revolutionizing the frugal shopping landscape in India. They offer features like instant transactions, cashback offers, and secure platforms tailored for budget-conscious consumers.

Market Penetration Strategies

To tap into this growing market, these providers employ[3] innovative strategies. They collaborate with retailers, offer exclusive discounts, and enhance the user experience through intuitive interfaces.

Case Studies

Companies like Paytm, PhonePe, and Google Pay have witnessed exponential growth by catering to India’s frugal shoppers. Their success lies in understanding consumer behavior, addressing pain points, and delivering value consistently.

The Future of Frugal Shopping and Payment Providers

Technological Advancements

As technology continues to evolve, payment providers must adapt. Features like AI-driven recommendations. blockchain security, and IoT integration will redefine the frugal shopping experience.

Consumer Behavior Shifts

With increasing internet penetration and digital literacy, consumers are becoming more discerning. They demand transparency, flexibility, and personalized offers from payment providers

Strategies for Sustainable Growth

Diversified Payment Options

To cater to a diverse audience, payment providers need to offer a range of payment method[4] options. Whether it’s credit/debit cards, UPI, mobile wallets, or even cryptocurrencies, flexibility is key. This ensures that every consumer, irrespective of their preference, finds a suitable payment method.

Enhanced Security Measures

In an era where data breaches and cyber-attacks are rampant, security remains a top priority. Payment providers must invest in robust security infrastructure, encryption technologies, and regular audits to safeguard consumer data and build trust.

Collaborative Partnerships

Tie-ups with E-commerce Platforms

Collaborating with e-commerce giants can significantly boost a payment provider’s reach and credibility. Such partnerships can lead to exclusive offers, discounts, and seamless integration, enhancing the overall shopping experience for consumers.

Localized Solutions for Tier II and III Cities

While metropolitan cities offer vast Payment Provider For Frugal Shopping Society[5] in Indiaopportunities, the real growth lies in tier II and III cities. Payment providers must tailor their services to cater to local preferences, languages, and cultural nuances to penetrate these markets effectively.

Community Engagement and Education

Workshops and Webinars

Organizing workshops, webinars, and community events can help payment providers engage directly with consumers. It provides a platform to address queries, gather feedback, and educate users about the benefits of digital payments.

Customer Support and Feedback Mechanisms

Establishing a robust customer support system and feedback mechanism is crucial. It not only resolves issues promptly but also provides insights into consumer preferences, pain points, and areas of improvement.

Conclusion

The frugal shopping society in India presents a vast opportunity for payment providers. By addressing challenges, leveraging technology, and understanding consumer needs, they can carve a niche in this dynamic market.

FAQs

- What is frugal shopping in India? Frugal shopping refers to the practice of seeking the best deals, discounts, and value for money among Indian consumers.

- Why are efficient payment systems crucial for frugal shoppers? Efficient payment systems ensure seamless transactions, security, and convenience, enhancing the overall shopping experience.

- Which payment providers are popular among frugal shoppers in India? Companies like Paytm, PhonePe, and Google Pay are popular among India’s frugal shopping community.

- How are payment providers adapting to technological advancements? Payment providers are leveraging technologies like AI, blockchain, and IoT to enhance security, user experience, and offer personalized services.

- What does the future hold for frugal shopping and payment providers in India? The future looks promising with advancements in technology, shifting consumer behavior, and innovative solutions tailored for frugal shoppers.

.