AUTHOR:HAZEL DSOUZA

DATE:16/12/2023

Introduction

In the ever-evolving landscape of e-commerce in India, the selection of a reliable payment provider is crucial for the success of businesses, particularly for those dealing in headlights. As digital transactions become the norm, the importance of seamles and secure payment solutions cannot be overstated. India’s payment ecosystem is diverse, with a range of options available to consumers. From traditional methods like cash on delivery to digital wallets and UPI, buyers have multiple ways to make transactions.

Challenges Faced by Headlight Sellers

Headlight sellers encounter unique challenges in the payment domain. These challenges include ensuring the security of transactions, addressing the diverse payment preferences of customers, and seamlessly integrating payment solutions into their online platforms.

Benefits of Using Payment Providers

Implementing payment providers brings a multitude of benefits to headlight sellers. The focus is on secure transactions, convenience for buyers, and integration with popular e-commerce platforms. These benefits not only enhance the overall customer experience but also contribute to the efficiency and credibility of the business.

Secure Transactions

One of the primary concerns for any online transaction is security. Payment providers employ robust security measures, including encryption and two-factor authentication, ensuring that both buyers and sellers can trust the platform for secure transactions. This section will explore the specific security features implemented by payment providers in the context of headlight sales.

Convenience for Buyers

The convenience of the buying process is a key factor influencing[1] customer satisfaction. Payment providers streamline the payment process, offering a user-friendly interface and quick, hassle-free transactions. Understanding how these providers enhance the overall buying experience is crucial for headlight sellers looking to attract and retain customers.

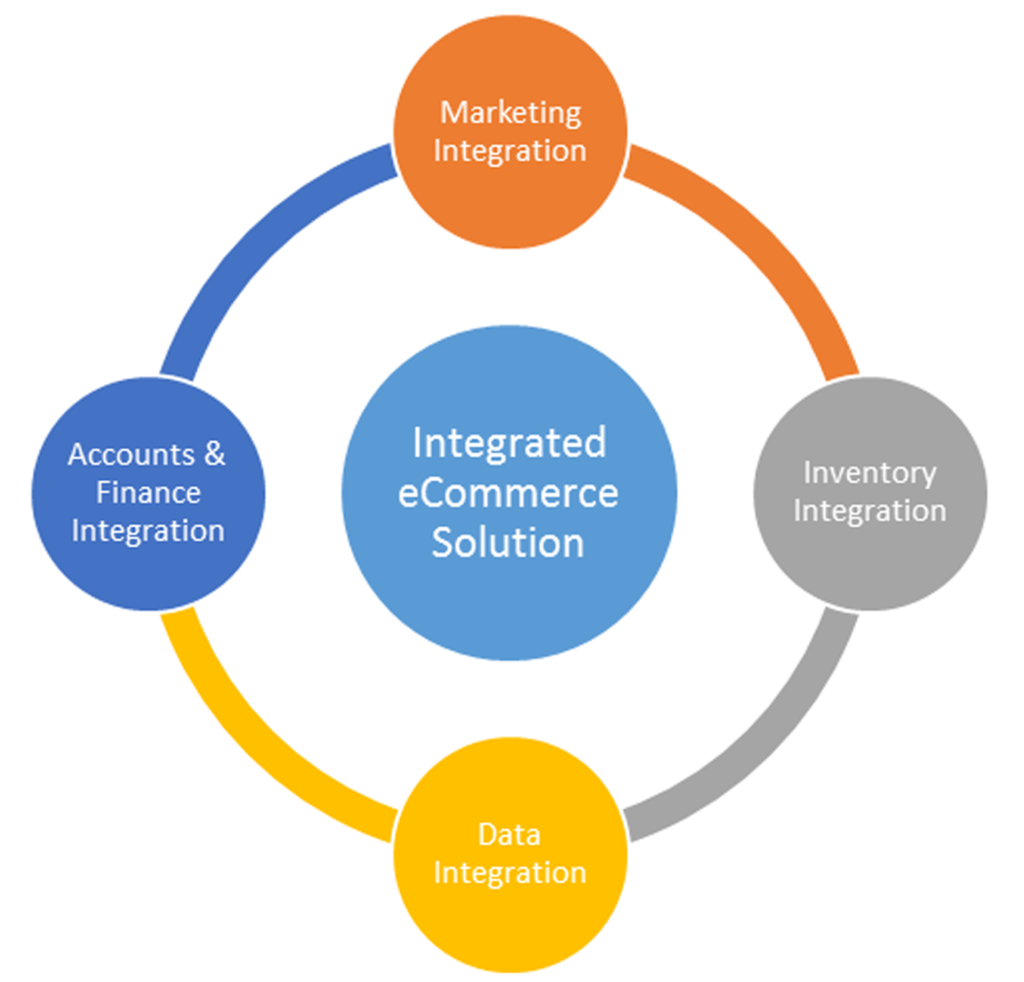

Integration with E-commerce Platforms

For headlight businesses operating through e-commerce platforms, seamless integration with payment solutions is essential. This section will discuss how payment providers can be easily integrated into popular e-commerce platforms, providing a smooth and unified experience for both sellers and buyers.

Popular Payment Providers in India

Two prominent payment providers, Provider A and Provider B, will be compared in detail. Each provider has unique features and advantages tailored[2] to the payment provider for Headlights in India specific needs of headlight sellers in the Indian market.

Provider A: Features and Advantages

Highlighting the key features and advantages that make Provider A a preferred choice for headlight businesses. This includes aspects such as transaction speed, user interface, and compatibility with different devices.

Provider B: Tailored Solutions for Headlight Sellers

Delving into the specialized solutions offered by Provider B, showcasing how their features are specifically designed to address the challenges faced by headlight sellers, including customizable payment options and robust customer support.

How to Choose the Right Payment Provider

Choosing the right payment provider is a critical decision for headlight sellers. This section will guide sellers through the selection process, considering[3] factors such as security measures, transaction fees, and compatibility with their specific business model. payment provider for Headlights in India

Assessing Security Measures

An in-depth look at the security measures implemented by payment providers and how sellers can evaluate and ensure the safety of their transactions and customer data.

Considering Transaction Fees

Examining the financial aspect of choosing a payment provider, including an analysis of transparent transaction fees and potential hidden costs that sellers should be aware of.

Compatibility with Headlight Business

Understanding the importance of selecting a payment provider that aligns with the unique needs and scale of a headlight business. This includes considerations like the volume of transactions, types of payment methods supported, and ease of integration.

Success Stories with Payment Providers

Real-world examples of headlight businesses that have successfully implemented[4] payment providers, resulting in increased sales, improved customer satisfaction, and streamlined operations.

Increased Sales and Customer Satisfaction

Analysing a case where a headlight seller experienced a significant boost in sales and enhanced customer satisfaction after integrating a payment provider. This includes details on the specific strategies employed and the outcomes achieved.

Streamlined Operations

Highlighting a case study showcasing how a headlight business achieved operational efficiency through the integration of a payment provider. This includes insights into the before-and-after scenarios, focusing on aspects like order processing time and inventory management.

Future Trends in Payment Solutions for Headlights

Looking ahead, this section will explore emerging technologies[5] and evolving customer expectations that will shape the future of payment solutions for headlight sellers in India.

Emerging Technologies

An overview of the cutting-edge technologies, such as blockchain and AI, that are poised to revolutionize the payment landscape for headlight businesses.

Customer Expectations

Understanding the evolving expectations of customers in the context of payment solutions. This includes preferences for personalized experiences, seamless transactions, and the role of emerging technologies in meeting these expectations.

Conclusion

Summarizing the key insights from the article and emphasizing the critical role that payment providers play in the success of headlight businesses in India. Encouraging sellers to carefully evaluate and choose providers that align with their specific needs and goals.

FAQs

FAQ 1: How do payment providers enhance security?

Payment providers enhance security through robust encryption, two-factor authentication, and continuous monitoring of transactions. These measures ensure that both buyers and sellers can trust the platform for secure transactions.

FAQ 2: Can I use multiple payment providers for my headlight business?

Yes, it is possible to use multiple payment providers for a headlight business. However, careful consideration should be given to the compatibility of these providers with the business model and the preferences of customers.

FAQ 3: Are there any hidden fees associated with payment providers?

While many payment providers transparently display their transaction fees, it’s essential for sellers to thoroughly review the terms and conditions to identify any potential hidden fees. Transparency is key in establishing a trustworthy relationship with the provider.

FAQ 4: What trends can we expect in payment solutions for headlights?

The future of payment solutions for headlights will likely involve the integration of emerging technologies such as blockchain and AI. Additionally, there will be a continued focus on enhancing user experience and meeting evolving customer expectations.