AUTHOR : ZOYA SHAH

DATE : 21-12-2023

Introduction

In the dynamic landscape of industrial trade in India, the role of payment providers has become increasingly crucial. This article explores the evolution of payment systems, the challenges faced in industrial trade payments, and the significant impact of payment providers[1].

Evolution of Payment Systems in India

Traditional Methods

Historically Payment Provider For industrial trade in India relied on traditional payment methods, including cash transactions and bank transfers. These methods, while prevalent, posed several challenges, such as limited accessibility and delays in processing.

Digital Transformation

With the advent of digitalization, there has been a paradigm shift in payment Provider For Industrial[2] systems. Digital transactions, online banking, and e-wallets have become commonplace. This transformation has streamlined payment processes, making them more efficient and accessible.

Challenges in Industrial Trade Payments

Currency Conversion

One of the primary challenges in industrial trade involves currency conversion. Payment providers play a vital role in facilitating seamless transactions across borders, overcoming currency barriers. Payment Provider For Industrial Trade In India.

Security Concerns

Security is paramount in industrial trade payments. Payment providers[3] implement advanced encryption and authentication measures to ensure secure transactions, safeguarding sensitive financial information.

Transaction Delays

Traditional banking methods often result in transaction delays, impacting the efficiency of industrial trade Payment providers leverage technology to expedite transactions, reducing delays and improving overall workflow.

Role of Payment Providers

Facilitating Cross-Border Transactions

Payment providers specialize in facilitating cross-border transactions. This is particularly beneficial for industrial trade[4], where international transactions are commonplace. The ability to transact globally enhances business opportunities. Payment Provider For Industrial Trade In India.

Ensuring Secure Transactions

Security is a top priority for payment providers. By employing advanced security protocols, they mitigate the risk of fraud and unauthorized access. Businesses can trust these platforms to safeguard their financial transactions.

Popular Payment Providers in India

Analyzing the top payment[5] providers in India provides insights into the market leaders. Companies like Paytm, Razorpay, and Instamojo offer comprehensive solutions tailored to the needs of industrial trade.

Key Features to Look for in an Industrial Trade Payment Provider

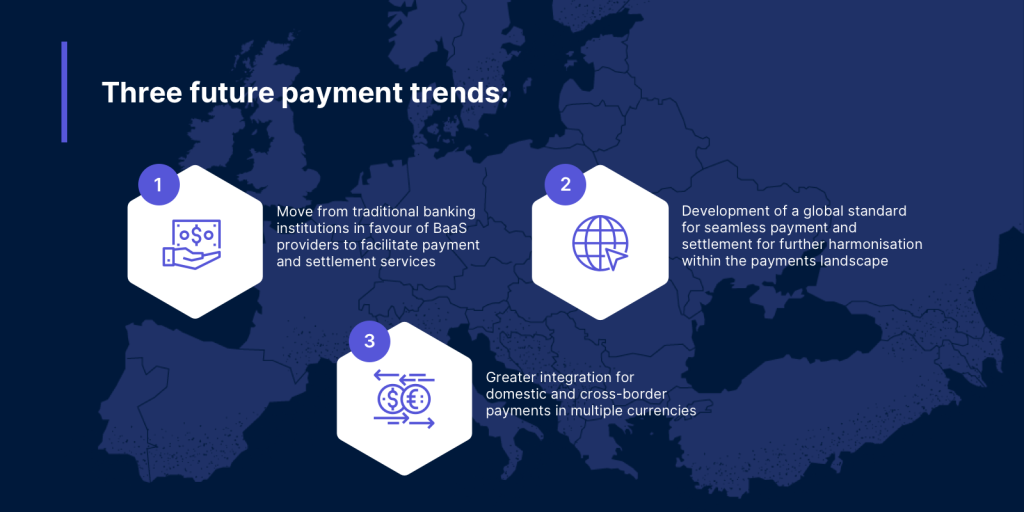

Multi-Currency Support

A crucial feature for industrial trade payment providers is multi-currency support. This capability enables businesses to transact in various currencies, facilitating international trade seamlessly.

Integration with Industrial Platforms

Efficient integration with industrial platforms enhances the overall workflow. Payment providers that seamlessly integrate with existing systems contribute to a smoother payment process for businesses.

Transparent Fee Structure

Transparency in fee structures is essential for businesses. Payment providers that offer clear and transparent pricing models help companies understand and manage their transaction costs effectively.

Case Studies

Examining real-life case studies of successful implementation of payment providers in industrial trade highlights the positive impact on businesses. These stories serve as inspiration for companies seeking reliable payment solutions.

Future Trends in Industrial Trade Payments

Emerging Technologies

The future of industrial trade payments lies in emerging technologies such as blockchain and artificial intelligence. These innovations promise increased efficiency, reduced costs, and enhanced security.

Regulatory Changes

Keeping abreast of regulatory changes is crucial for businesses. Payment providers that stay compliant with evolving regulations ensure a seamless and legally sound payment environment.

Tips for Businesses in Choosing the Right Payment Provider

Selecting the right payment provider is a critical decision for businesses. Consider factors such as reliability, security features, and the provider’s track record in industrial trade.

The Impact of Payment Providers on Business Growth

The adoption of efficient payment providers positively impacts business growth. Streamlined transactions, global accessibility, and enhanced security contribute to a conducive environment for industrial trade expansion.

User Testimonials

Real-world experiences of businesses that have benefited from reliable payment providers add credibility to their effectiveness. Positive testimonials showcase the tangible advantages of choosing the right payment partner.

Common Misconceptions about Payment Providers

Addressing misconceptions about payment providers is essential. Clearing up any misunderstandings fosters trust among businesses, encouraging them to embrace the benefits of these financial solutions.

How to Stay Informed About Payment Industry Updates

Given the dynamic nature of the payment industry, staying informed is key. Subscribing to industry newsletters, attending conferences, and following reputable sources ensure businesses are aware of the latest trends and developments.

Conclusion

In conclusion, the role of payment providers in industrial trade in India is pivotal. Businesses stand to benefit significantly from embracing modern payment solutions that address challenges and contribute to overall growth.

FAQs

- Are payment providers secure for industrial trade transactions?

- Yes, reputable payment providers implement advanced security measures to ensure the safety of industrial trade transactions.

- How do payment providers facilitate cross-border transactions?

- Payment providers leverage technology to overcome currency barriers and enable seamless cross-border transactions.

- What should businesses prioritize when choosing a payment provider?

- Businesses should prioritize factors such as reliability, security features, and transparent fee structures when selecting a payment provider.

- Can payment providers integrate with existing industrial platforms?

- Yes, many payment providers offer seamless integration with industrial platforms, enhancing overall workflow.

- What is the future of industrial trade payments?

- The future involves the adoption of emerging technologies like blockchain and artificial intelligence, promising increased efficiency and security.