AUTHOR : ANGEL ROY

DATE : 28-12-2024

Jewelry inventory management[1] is a crucial aspect of any jewelry business, whether it’s a small boutique or a large enterprise. Managing inventory efficiently not only streamlines operations but also ensures customer satisfaction and financial growth. One of the most significant aspects of modern jewelry business operations is the integration of a reliable payment provider for jewelry[2] inventory management in India. By combining efficient payment solutions with advanced inventory management systems, jewelers can track sales, manage stock, and offer seamless transactions for their customers.

Understanding Jewelry Inventory Management

Before diving into the role of a payment provider for jewelry inventory management[3] in India, it is essential to understand what jewelry inventory management[4] entails. Inventory management in the jewelry sector involves tracking the movement of various products, such as gold, silver, diamonds, and other precious materials. It ensures that jewelers know exactly how much stock is available, its location, and its current value.

A well-organized inventory system allows businesses to reduce overstocking, avoid stockouts, and ensure the smooth flow of products. Managing such precious commodities efficiently is paramount to a jewelry business’s success.

The Role of Payment Providers in Jewelry Inventory Management

In the past, jewelry businesses would rely on traditional methods for inventory tracking and payment processing[5]. However, with the rise of e-commerce and technological advancements, businesses have started integrating payment solutions directly with their inventory management systems. A payment provider for jewelry inventory management in India offers various services to businesses, including:

- Payment Gateways: Secure platforms for processing online transactions, making it easier for jewelry businesses to accept payments for products.

- Payment Integration: Connecting payment methods such as credit/debit cards, mobile wallets, UPI, and net banking with inventory management systems to ensure smooth transactions.

- Fraud Prevention: Providing tools to detect and prevent fraudulent transactions, which is particularly crucial for high-value jewelry transactions.

- Analytics and Reporting: Generating detailed reports about payments, helping business owners track sales and inventory in real-time.

Integrating payment providers with jewelry inventory management systems simplifies the payment process, enhances security, and streamlines operations.

Benefits of Integrating Payment Solutions for Jewelry Inventory Management

1. Real-time Inventory Tracking

With an integrated payment provider for jewelry inventory management in India, businesses can track inventory in real time. When a sale occurs, the inventory management system automatically updates the stock levels. This minimizes human error and ensures accurate stock data, which is crucial for businesses selling expensive items like jewelry.

2. Seamless Transaction Processing

One of the biggest advantages of using a payment provider for jewelry inventory management in India is the ability to process transactions smoothly. Whether a customer is making an in-store purchase or buying jewelry online, payment providers offer secure, swift payment solutions that integrate seamlessly with the business’s existing inventory systems.

3. Enhanced Customer Experience

A smooth and secure payment process improves customer satisfaction. Payment providers offer multiple payment options, allowing customers to choose their preferred method. This increases the likelihood of a successful sale and fosters customer loyalty.

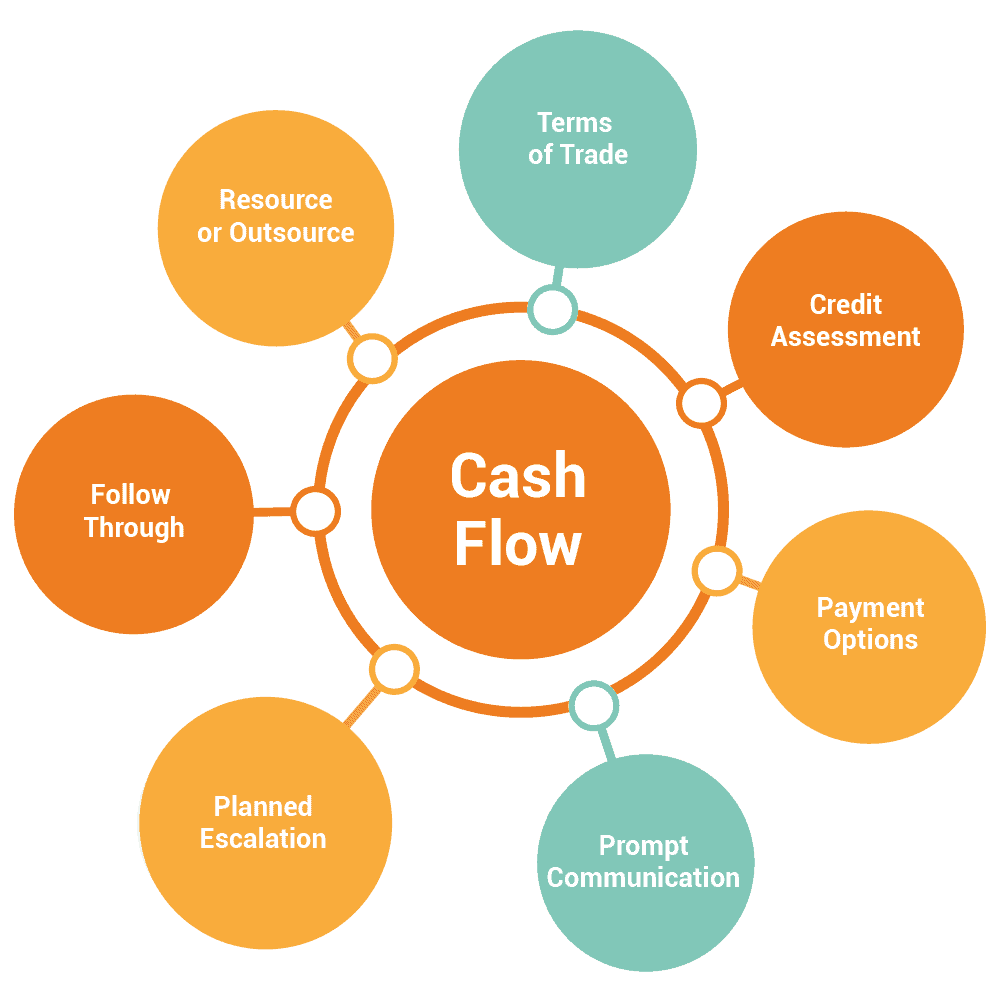

4. Improved Cash Flow

Payment providers offer timely payments, which helps businesses improve their cash flow. Fast payment settlements, especially for online purchases, ensure that the business receives funds quickly, enabling it to reinvest in its inventory or manage operational costs.

5. Accurate Financial Tracking

With integrated payment and inventory systems, businesses can accurately track the financial status of their operations. Payment providers generate reports that include payment receipts, transaction histories, and financial summaries, all of which can be used to assess the business’s overall financial health.

6. Compliance and Security

Jewelry businesses, particularly in India, must adhere to strict regulations regarding the sale of precious metals and gems. Payment providers offer compliance with these regulations, ensuring that the business operates legally. Additionally, they implement security measures like encryption and multi-factor authentication to protect both the business and customers from fraudulent activity.

7. Scalability

As jewelry businesses grow, they may require more advanced payment solutions. The right payment provider for jewelry inventory management in India can scale with the business, allowing for additional payment gateways, multiple currency handling, and the ability to process larger transactions as the business expands.

Must-Have Features in a Payment Provider for Jewelry Management

- Payment Flexibility: Ensure the provider supports various payment methods, including credit cards, debit cards, UPI, wallets, and bank transfers.

- Integration Capabilities: The payment solution should easily integrate with the existing inventory management system and other business tools like CRM software and accounting systems.

- Security: Look for providers that offer strong encryption and security features, such as PCI DSS compliance, to protect sensitive customer data.

- Customer Support: Opt for a provider with robust customer support, available round the clock to resolve any issues.

- Transaction Fees: Understand the fee structure of the payment provider. Choose one with reasonable transaction fees that align with the business’s budget.

How a Payment Provider Enhances Jewelry Business Operations in India

In India, where the jewelry industry is vast and diverse, payment providers are becoming an integral part of managing business operations. With e-commerce platforms, digital payments, and mobile commerce gaining popularity, integrating a payment provider for jewelry inventory management in India helps businesses stay competitive.

By offering various payment methods, including UPI and mobile wallets, payment providers cater to the tech-savvy customer base in India. They also enable jewelers to reach a wider audience by facilitating online transactions, ensuring smooth inventory management, and providing instant payment settlements.

Conclusion

In the fast-paced world of jewelry business management in India, integrating a payment provider for jewelry inventory management in India is an invaluable tool. It simplifies the process of tracking inventory, processing payments, and ensuring security, all while enhancing the overall customer experience. By choosing the right payment provider, jewelry businesses can grow more efficiently, remain competitive, and offer a seamless experience to their customers.

(FAQs)

1. What is a Payment Provider for Jewelry Inventory Management in India?

A payment provider for jewelry inventory management in India is a service that allows jewelry businesses to process payments securely while integrating with their inventory systems. This ensures that every sale is tracked accurately, and inventory levels are updated in real-time.

2. Why do jewelry businesses need a payment provider?

Jewelry businesses need a payment provider to streamline transaction processing, improve cash flow, ensure inventory accuracy, and enhance customer satisfaction. A good payment provider also adds an extra layer of security to protect against fraud.

3. Can a Payment Provider Integrate with My Existing Inventory System?

Yes, most payment providers offer seamless integration with existing inventory management systems, allowing businesses to automate updates, track stock, and process payments efficiently.

4. What Payment Methods Are Supported by Payment Providers in India?

Payment providers in India typically support multiple payment methods such as credit and debit cards, UPI, mobile wallets (like Paytm and Google Pay), and net banking.

5. Is it Safe to Use Payment Providers for Jewelry Transactions?

Yes, reputable payment providers employ strong security protocols like encryption, multi-factor authentication, and PCI DSS compliance to ensure secure transactions.