AUTHOR : Sook

DATE : 21/12/2023

Introduction

The digital landscape in India has witnessed a significant surge in professional Cooperation In India collaborations, necessitating reliable and efficient payment solutions. As businesses seek seamless and secure transactions, the choice of payment provider becomes crucial. This article navigates through the realm of payment providers for professional cooperation in India, highlighting essential features, comparison factors, and the process of selection.

Understanding the Need for Professional Payment Solutions

In today’s interconnected world, businesses engaging in professional cooperation demand secure and efficient payment processing. The necessity arises from the need for timely transactions, seamless integrations, and data security.

Key Features of Ideal Payment Providers

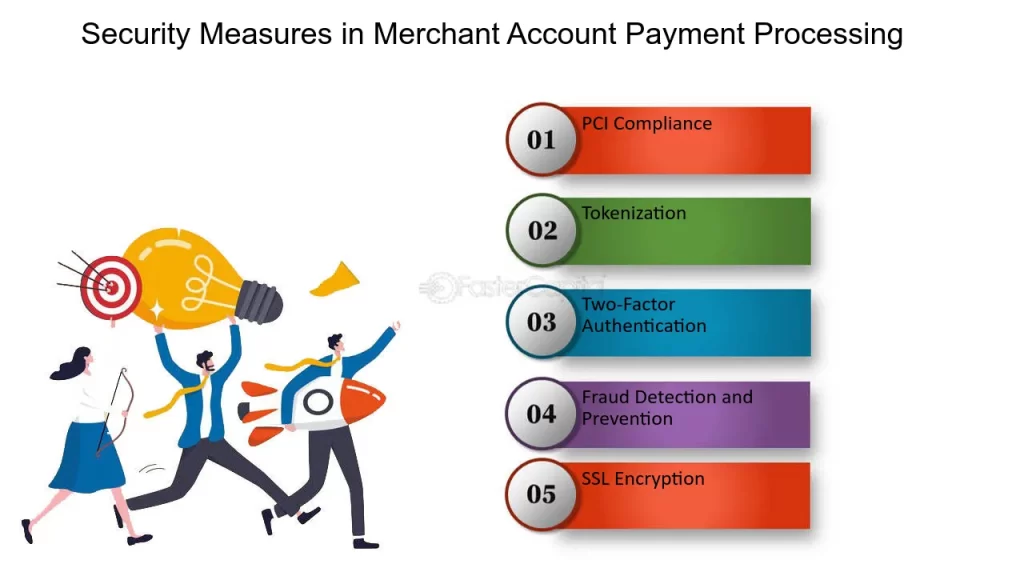

Security Measures

Security stands as the cornerstone of any Payment Provider For Professional. Encryption protocols, compliance with industry standards, and robust fraud prevention mechanisms are vital considerations.

Transaction Fees and Processing Time

Efficiency in transaction processing Payment Cooperation In India coupled with reasonable fees is imperative for businesses engaged in professional collaborations.

Integration Capabilities

The ease of integrating payment solutions with existing platforms or systems is a significant factor for seamless operations.

Top Payment Providers for Professional Cooperation

Several prominent payment providers cater to the needs of businesses in India. Payment Management System[1] Companies such as Company A, with its robust security measures, Company B excelling in user experience, and Company C offering unique advantages, dominate the market.

Features and Benefits

Cross-Border Payments[2] Known for its stringent security measures and reliability, Company A ensures secure transactions and ease of integration.

Services Offered and User Experience

The user-centric approach and diverse service offerings make Company B a favorable choice among professionals seeking seamless payment[3] solutions.

Advantages and Limitations

Company C presents a unique set of advantages but might have limitations concerning integration or service scope.

Comparison of Payment Providers

A comparative analysis of fees, security measures, and services offered by these providers aids in making an informed decision based on specific business requirements.

Selecting the Right Payment Provider

Considering factors such as security, fees, integration, E-commerce payments[4] and customer support becomes pivotal in selecting the most suitable payment provider for professional cooperation.

Steps to Integrate Payment Providers

Understanding the integration process[5] and adhering to best practices ensures a smooth incorporation of payment solutions into existing business frameworks.

Security Measures in Payment Processing

Data protection and encryption methodologies play a critical role in safeguarding sensitive information during payment processing, ensuring trust and reliability.

Future Trends in Payment Solutions

The future of payment providers in professional cooperation foresees innovations such as blockchain integration, AI-driven security enhancements, and faster transaction speeds.

Conclusion

In the evolving landscape of professional collaborations in India, selecting the right payment provider is instrumental. Prioritizing security, integration capabilities, and efficient transaction processing ensures seamless operations and fosters trust among collaborating entities.

FAQs

- How do payment providers ensure data security?

- What factors should businesses consider while selecting a payment provider?

- Can payment providers integrate with different business systems?

- What are the emerging trends in payment solutions for professional cooperation?

- How do payment processing times affect professional collaborations?