AUTHOR : NORA

DATE : 21-12-23

Introduction

Understanding the dynamics of payment providers[1] is essential for professionals in India. These entities serve as intermediaries, ensuring a smooth flow of financial transactions between service providers and their clients. The reliability of these payment solutions is paramount, considering the intricate nature of professional services.

Payment Landscape in India

India has witnessed a remarkable transformation in its payment landscape over the years. From cash transactions to digital wallets and online banking, the options available for professionals have expanded significantly. The shift towards digital payments has not only increased convenience but has also opened doors to innovative solutions

Challenges Faced by Professionals

Despite the advancements, professionals[2] often encounter challenges related to payments. Delayed transactions, unclear payment records, and all-around issues with currency conversion can disrupt the smooth functioning of businesses. It’s crucial to address these challenges to maintain a sustainable and profitable professional practice.

Need for Specialized Payment Providers

Recognizing the unique requirements of of professional payment providers for professional services in India, there is a growing need for specialized payment providers. These entities understand the intricacies of invoicing, billing cycles, and the importance of transparent financial transactions Tailored solutions ensure that professionals can focus on delivering their expertise without worrying about payment complications.

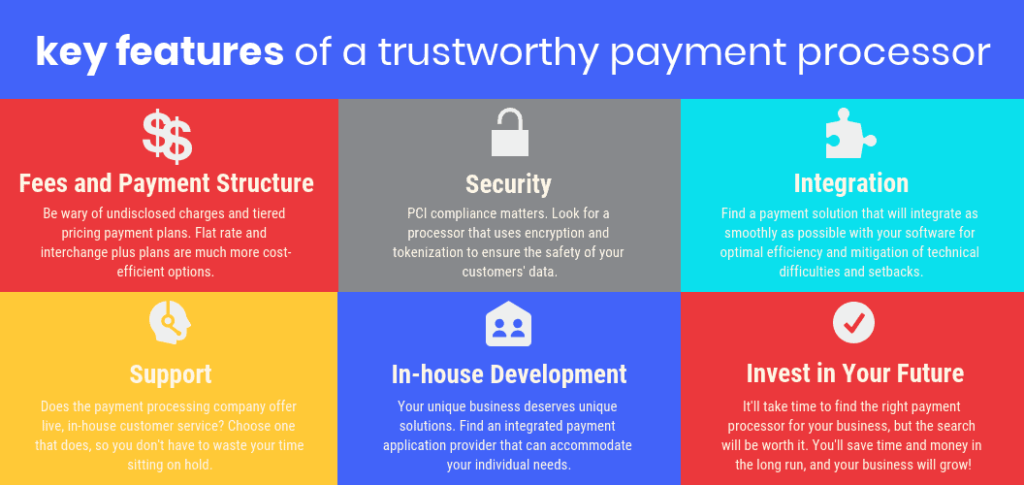

Key Features of Payment Providers for Professionals

Security is paramount when it comes to financial transactions in the professional services[3] sector. Reliable payment providers offer advanced security measures to safeguard sensitive information. Additionally, seamless integration with professional tools ensures a cohesive workflow, making financial management more efficient for service providers.

Popular Payment Providers in India

Several payment providers cater specifically to the needs of professionals in India. A comparative analysis of these providers helps in making informed decisions. Understanding the fees, transaction speed, and user interface is crucial for selecting the most suitable payment solution.

Benefits of Using Professional Payment Solutions

The benefits of adopting a specialized payment provider for professional services in India are manifold. From streamlining financial management to enhancing client trust, professionals stand to gain significantly. Transparent and efficient payment processes contribute to overall client satisfaction, positively impacting the reputation of the service provider[4].

Case Studies

Real-world examples illustrate the effectiveness of professional payment providers for professional services in India. Success stories of professionals who have seamlessly integrated these solutions into their practice provide valuable insights. These case studies serve as testimonials for the reliability and efficiency of specialized payment providers.

How to Choose the Right Payment Provider

Choosing the right payment provider for professional[5] services in India requires careful consideration of various factors. Professionals should assess the provider’s reputation, fees, integration capabilities, and customer support. A comprehensive checklist can guide professionals to make informed decisions that align with their specific needs.

Security Measures for Professional Transactions

The sensitive nature of professional transactions necessitates robust security measures. Professionals must prioritize payment providers that offer secure gateways and comply with industry standards for data protection. Implementing best practices ensures the confidentiality and integrity of financial information.

Future Trends in Professional Payments

From blockchain to artificial intelligence, these innovations are set to revolutionize the payment landscape. Professionals need to stay abreast of these trends to future-proof their financial transactions.

User Reviews and Testimonials

Insights from professionals who have utilized payment providers offer valuable perspectives. User reviews and testimonials provide a glimpse into the user experience, helping others make informed decisions. These first-hand accounts contribute to the credibility of payment providers.

Conclusion

In conclusion, the role of payment providers for professional services in India cannot be overstated. These entities bridge the gap between service providers and clients, ensuring a secure and efficient financial ecosystem. Professionals are encouraged to explore and adopt reliable payment solutions to enhance their practice and provide an optimal experience for their clients.

FAQs about Professional Payment Providers in India

Q1: What are the advantages of using professional payment providers?

A1: Professional payment providers offer streamlined financial management, enhanced security, and increased client satisfaction.

Q2: How do I choose the right payment provider for my professional services?

A2: Consider factors such as reputation, fees, integration capabilities, and customer support. Use a comprehensive checklist to guide your decision.

Q3: Are there specific payment providers catering to professional services in India?

A3: Yes, several payment providers specialize in catering to the unique needs of professionals in India. A comparative analysis can help you choose the most suitable one.

Q4: What security measures should I prioritize for professional transactions?

A4: Prioritize payment providers that offer secure gateways, comply with data protection standards, and implement best practices for secure transactions.

Q5: What are the future trends in professional payments?

A5: Future trends include the adoption of emerging technologies like blockchain and artificial intelligence, revolutionizing the payment landscape for professionals.