AUTHOR : ROSE KELLY

DATE : 30/12/23

INTRODUCTION

Savings clubs, a time-tested method of communal financial planning, have witnessed a significant surge in India. As these clubs evolve to incorporate modern financial tools, the need for an efficient payment provider becomes paramount. This article explores the factors influencing the choice of payment provider, the features of an ideal platform, and the emerging trends shaping the future.

Understanding Savings Club Memberships

Savings clubs, often rooted in community traditions, have transformed into organized entities facilitating collective savings. With the digitization of financial practices, these clubs are becoming an integral part of the financial fabric of India.

The Need for Secure Payment Solutions

While the concept of savings clubs is age-old, the challenges they face in the digital age are novel. Ensuring secure and seamless transactions is crucial for maintaining trust among members. This is where a reliable payment provider steps in as the backbone of the entire operation.

Features of an Ideal Payment Provider

An ideal payment method[1] provider for savings clubs goes beyond just facilitating transactions. It encompasses robust security measures, a user-friendly interface, and seamless integration capabilities. In this section, we dissect these features and their significance in detail.

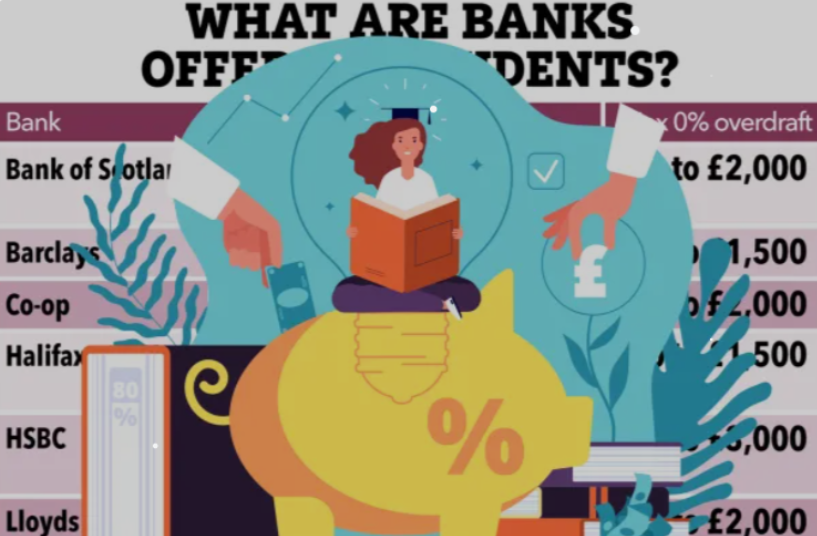

Popular Payment Providers in India

India boasts a diverse array of payment services providers[2], each with its own unique features and advantages. From traditional banking solutions to fintech startups, savings clubs have a plethora of options. A comparative analysis is essential to making an informed decision.

Case Studies

Real-world examples add depth to the understanding of how a reliable international payment gateway[3] can transform the operations of savings clubs. We explore success stories, learning from clubs that have embraced efficient payment solutions and reaped the rewards.

When selecting payment processor[4] it’s imperative to consider various factors, including transaction processing speed, reliability, and compatibility with the savings club’s operational framework, to ensure seamless and expedited financial transactions.

The decision-making process intricately involves the meticulous evaluation of various transaction-related factors, encompassing security measures, cost-effectiveness, and the overall efficiency of the chosen payment provider to guarantee optimal transactional outcomes for the savings club.

From cost-effectiveness to customer support and customization options, this section provides a comprehensive guide for clubs in the selection process.

Tips for Seamless Integration

Integrating a payment provider into the existing framework of a savings club can be a delicate process. Here, we offer a step-by-step guide, highlighting common pitfalls to avoid for a smooth transition.

The Future of Payment Providers in Savings Clubs

As technology advances at a rapid pace, payment solutions[5] also undergo constant transformation, adapting to emerging trends and incorporating innovative features to facilitate secure and efficient transactions for savings clubs. We discuss emerging trends and innovations that are set to shape the future of payment providers for savings clubs in India.

User Testimonials

Direct experiences from individuals using payment providers for savings club memberships provide valuable insights. Members share their experiences, shedding light on the practical impact of these solutions.

The Role of Technology

Technological advancements play a pivotal role in enhancing payment solutions. From mobile applications to blockchain, we explore how technology is driving positive changes in savings club operations.

Addressing Security Concerns

In an era where data breaches are a constant threat, this section emphasizes the importance of stringent data protection measures. Strategies for maintaining trust and security are discussed in detail.

Regulation and Compliance

Navigating the legal landscape is crucial for any financial entity. Here, we delve into the regulatory aspects of payment providers for savings clubs, ensuring adherence to guidelines.

Overcoming Challenges

No system is without its challenges. We identify potential obstacles and offer practical solutions, emphasizing the importance of industry collaborations and support networks.

Conclusion

In conclusion, the choice of a payment provider significantly impacts the efficiency and trustworthiness of savings clubs in India. By considering the outlined factors, clubs can make informed decisions, paving the way for a robust financial future.

FAQs

- Q: Are traditional banks better than fintech startups for savings club transactions?

- A: The choice depends on the specific needs and preferences of the savings club. Traditional banks offer stability, while fintech startups provide innovative solutions.

- Q: How can savings clubs ensure the security of member data during transactions?

- A: Implementing encryption protocols, regular security audits, and partnering with trusted payment providers are crucial steps.

- Q: What role does government regulation play in the selection of payment providers for savings clubs?

- A: Adherence to government regulations ensures legal compliance and builds trust among members.

- Q: Can savings clubs benefit from integrating blockchain technology into their payment systems?

- A: Blockchain can enhance transparency and security but requires careful consideration of implementation costs and technical expertise.

- Q: Is it necessary for savings clubs to have a dedicated IT team for managing payment integrations?

- A: While not mandatory, having a skilled IT team can streamline integration processes and address any technical issues promptly.