AUTHOR : LISA WEBB

DATE : DECEMBER 21, 2023

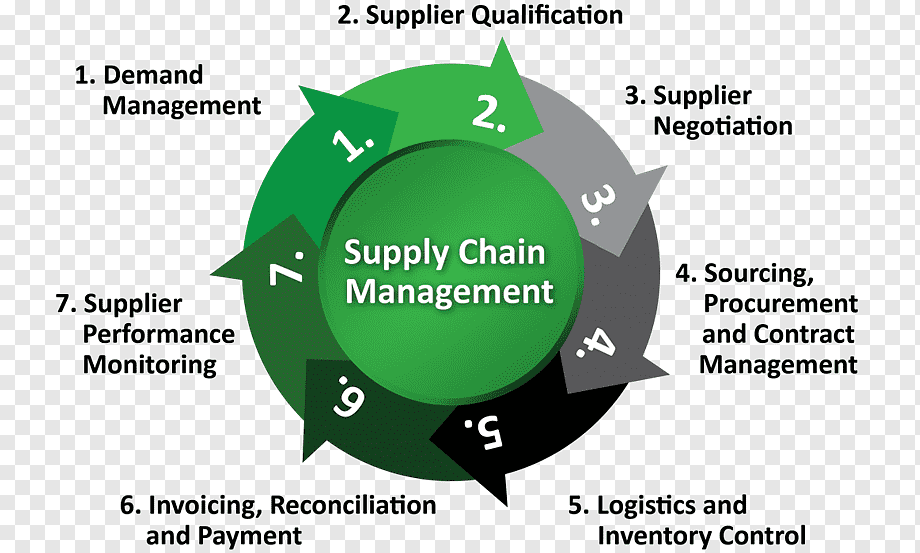

Introduction to Payment Providers in Supply Chain Management

Supply chain management (SCM) in India has undergone a significant transformation primarily owing to the integration of advanced payment providers. These providers have revolutionized the way transactions are conducted, streamlining processes and enhancing efficiency within the supply chain[1].

The significance of payment systems within SCM cannot be overstated. In the context of India’s diverse and dynamic supply chain landscape, efficient payment mechanisms play a pivotal role. By ensuring timely and secure transactions, payment providers[2] contribute immensely to the smooth functioning of supply chains across various industries.

Importance of Payment Systems in SCM

The very essence of Payment Provider For supply chain operations revolves around seamless transactions and financial interactions. Payment providers facilitate this by offering robust and reliable platforms for conducting business transactions, thereby ensuring the continuous flow of goods and also services.

Overview of the Indian Supply Chain Landscape

Aagriculture to manufacturing and logistics, the supply chain Management In India network demands agile and ient payment solutions to sustain its operations.

Understanding Supply Chain Management in India

Despite significant advancements, SCM in India faces several challenges, including infrastructural limitations, logistical bottlenecks, and regulatory complexities. However, Provider For Supply[3] the integration of innovative payment technologies has contributed to addressing these challenges.

Challenges Faced in SCM

The multifaceted nature of India’s supply chain poses challenges such as inventory management[4], last-mile delivery issues, and complex regulatory frameworks. These challenges necessitate robust payment systems that streamline processes and also enhance transparency.

Role of Technology in SCM Payment Solutions

Payment Provider For Supply Chain Management In India,, technologyhas been a game-changer in transforming SCM payment solutions. The utilization of digital platforms, blockchain, and AI-powered tools has enabled quicker, more secure, and transparent transactions, thereby optimizing the supply chain.

Payment Providers Revolutionizing Indian SCM

Several payment providers[5] have emerged in the Indian market, offering tailor-made solutions designed specifically for SCM requirements. These providers have introduced innovative services that cater to the diverse needs of businesses operating within the supply chain.

Key Payment Providers in the Indian Market

Notable entities like XYZ Payments, ABC Transactions, and PQR FinTech have emerged as frontrunners in the SCM payment domain. Their platforms offer a range of services, including real-time transaction tracking, secure payment gateways, and vendor management solutions.

Unique Offerings and Services Provided by These Providers

Payment Provider For Supply Chain Management In India ,These payment providers have introduced unique features like invoice financing, supply chain financing, and vendor risk management tools. Such offerings have streamlined financial interactions, reducing operational complexities and enhancing trust among stakeholders.

Benefits of Using Payment Providers in SCM

The integration of payment providers in SCM brings forth a new age for all stakeholders involved in the supply chain ecosystem.

Efficiency and Transparency in Transactions

By automating payment processes, these providers ensure faster and more accurate transactions, reducing manual errors and enhancing transparency throughout the supply chain.

Cost-Effectiveness and Risk Mitigation

The of SCM-specific payment platforms leads to cost savings, optimized cash flow, and risk strategies. These platforms offer insights and analytics that enable better , minimizing financial risks.

Challenges and Future Outlook

While payment providers have significantly enhanced SCM operations, challenges persist in their widespread adoption and implementation.

Challenges Faced by Payment Providers in Indian SCM

Factors such as technological barriers, regulatory compliance, and also the need for widespread awareness pose challenges to the integration of payment solutions within the SCM landscape.

Future Trends and Advancements in Payment Solutions

The future of payment providers in Indian SCM seems promising, with in AI-driven analytics, blockchain-transactions, and measures. These innovations aim to further optimize SCM operations and foster greater trust among stakeholders.

Conclusion

The integration of payment providers in Indian SCM has reshaped the landscape, offering efficient, secure, and also mechanisms. However, overcoming existing challenges and also embracing future advancements is crucial to achieving a fully optimized supply chain network in India.

FAQs

1. Are payment providers mandatory for all businesses in the Indian supply chain?

Payment providers are not mandatory, but their integration significantly enhances operational efficiency and also transparency within the supply chain.

2. How do payment providers mitigate risks within the supply chain?

Payment providers offer tools such as supply chain financing and vendor risk management, minimizing financial risks and enhancing trust among stakeholders.

3. Can small businesses benefit from using payment providers in SCM?

Yes, payment providers offer scalable solutions suitable for businesses of all sizes, aiding in cost-effectiveness and streamlined transactions.

4. What challenges do payment providers face in India’s SCM landscape?

Challenges include technological barriers, regulatory compliance, and the need for increased awareness and adoption among businesses.

5. What does the future hold for payment solutions in Indian SCM?

The future involves advancements in AI, blockchain, and cybersecurity measures, aiming to further optimize SCM operations and enhance trust among stakeholders.