AUTHOR : JAYOKI

DATE : 25/12/2023

Introduction

Late payments, defined as delays in settling invoices beyond agreed-upon terms, pose a significant challenge to businesses worldwide. Timely payment are the lifeblood of any enterprise, ensuring smooth operations and fostering positive relationships with suppliers. In India, this issue takes on a unique dimension, influenced by economic factors, internal business challenges, and the lack of automation in payment processes.

Impact on Businesses

Cash Flow Disruptions

One of the primary consequences of late payments is the disruption of cash flow. payment provider Late payments in india Businesses rely on a steady stream of income to cover operational costs, and delays in payments can lead to financial strain and hinder day-to-day operations.

Strained Supplier Relationships

Late payments can strain relationships with suppliers, leading to a breakdown in communication and cooperation. Trust, payment provider Late payments in india once eroded, is challenging to rebuild, and businesses may find it difficult to secure favorable terms in the future.

Legal Implications

Reasons for Late Payments

Beyond financial repercussions, late payments can have legal consequences. Businesses may face penalties for breaching payment terms, leading to costly litigation and potential damage to their reputation.

Economic downturns and fluctuations can impact a business’s ability to make timely payments. Understanding and navigating these External payment methods[1] Late payments in india factors is crucial for businesses seeking to maintain financial stability.

Internal Business Issues

Inefficient internal processes, such as disorganized invoicing and payment workflows, contribute to late payments[2]. Streamlining these processes is essential for ensuring prompt payment.

The absence of automated payment systems can result in delays. Implementing technology solutions to automate invoicing and payment processes can significantly reduce the risk of late payments.

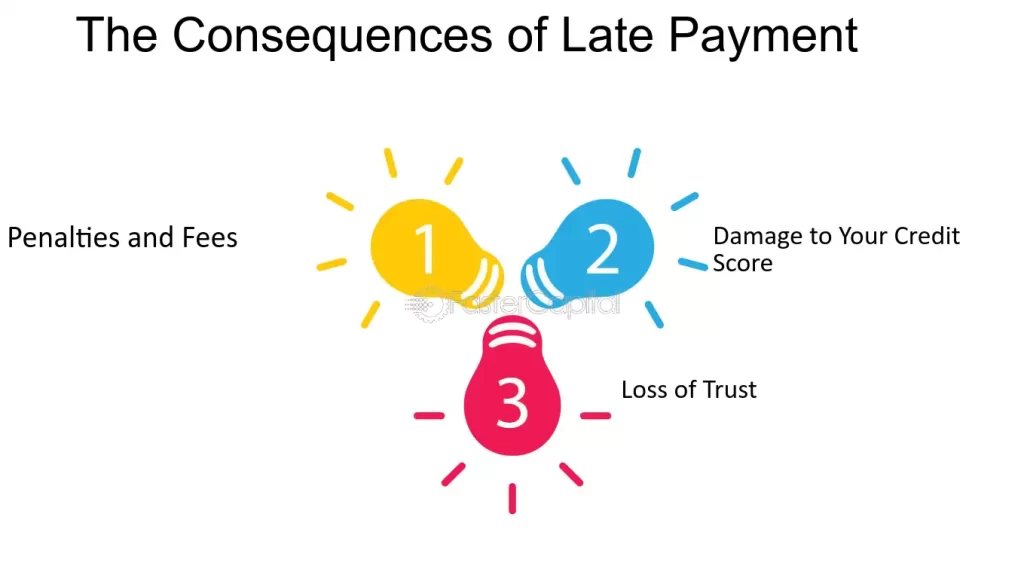

Consequences of Late Payments

Damage to Business Reputation

Late payments often incur financial penalties, compounding the financial burden on businesses. These penalties can escalate quickly, further affecting the bottom line.

Repeated instances of Late payments tarnish report[3] a business’s reputation. Suppliers and partners may become wary of engaging with a company known for its payment delays.

In extreme cases, persistent late payments can lead to business closure. The cumulative impact of financial strain, damaged relationships, and legal challenges may become insurmountable.

Addressing Late Payments

Establishing Clear Payment Terms

Clearly defined payment terms in contracts can set expectations and reduce the likelihood of disputes. Clarity promotes transparency and helps build trust between parties. Payment system[4],

Automation of invoicing and payment processes minimizes the risk of human error and ensures efficiency. Businesses should invest in modern technology to streamline their financial workflows.

Building Stronger Supplier Relationships

Late Payments in the Indian Context

Cultivating strong relationships with suppliers involves effective communication and collaboration. Regularly engaging with suppliers can foster mutual understanding and cooperation.

In India, diverse payment practices contribute to the challenge of late payments. Cultural nuances, varying business practices, and a complex regulatory landscape require businesses to navigate carefully.

Challenges Faced by Businesses

Businesses in India face challenges such as delayed invoice processing, slow payment cycles, and cultural differences in understanding payment priorities. These factors exacerbate the issue of late payments.

The Indian government has initiated measures to address the late payment issue, including the introduction of digital payment platforms[5] and campaigns promoting timely payments. However, the effectiveness of these measures varies across industries.

Success Stories in Overcoming Late Payments

Lessons Learned from Failures

Examining success stories provides insights into effective strategies for overcoming late payment challenges. Businesses that have successfully navigated these issues offer valuable lessons for others.

Analyzing failures in managing late payments can also offer valuable lessons. Understanding where others went wrong helps businesses avoid similar pitfalls.

Technology Solutions

Role of Payment Providers

Payment providers play a crucial role in facilitating timely payments. Choosing the right payment provider with features tailored to the business’s needs can make a significant difference.

Features to Look for in Payment Solutions

Tailoring Payment Plans

Businesses should consider payment solutions with features like automated invoicing, reminders, and easy integration with existing systems. These features enhance efficiency and reduce the risk of late payments.

Small and medium-sized enterprises (SMEs) can benefit from tailoring payment plans to suit their unique needs and the preferences of their clients. Flexibility can foster positive relationships.

Leveraging Technology

Emerging Trends in Payment Practices

SMEs, often more vulnerable to late payments, can leverage technology to level the playing field. Implementing cost-effective automation tools can streamline processes and enhance financial stability.

As technology evolves, so do payment practices. Emerging trends such as blockchain, instant payments, and artificial intelligence are likely to shape the future of financial transactions.

Predictions for the Future

Predicting the future of late payments involves anticipating how businesses will adapt to changing technologies and economic landscapes. Proactive measures and continuous improvement will be key.

Conclusion

In conclusion, addressing late payments requires a multifaceted approach, including clear communication, automation, and strategic partnerships. In India, businesses face unique challenges, but proactive measures and learning from both successes and failures can pave the way for a more secure financial future.

FAQs

- 1Q: How can businesses in India overcome cultural differences affecting payment practices?

- A: Building strong relationships through effective communication and understanding cultural nuances is essential.

- 2Q: Are there government initiatives specifically targeting late payments in India?

- A: Yes, the Indian government has introduced measures, including digital payment platforms, to encourage timely payments.

- 3Q: What role do payment providers play in addressing late payment issues?

- A: Payment providers can streamline processes, offer automated solutions, and facilitate timely transactions.

- 4Q: How can SMEs leverage technology to prevent late payments?

- A: SMEs can implement cost-effective automation tools for invoicing and payment processes.

- 5Q: What are the emerging trends in payment practices globally?

- A: Emerging trends include blockchain, instant payments, and the integration of artificial intelligence in financial transactions.