AUTHOR: HEZAL DSOUZA

DATE:22/12/2023

In the dynamic landscape of India’s payment industry, leadership plays a pivotal role in shaping the success and trajectory of payment providers. As the digital payment ecosystem continues to evolve, the need for strong, innovative, and adaptable leaders becomes more critical than ever.

Evolution of Payment Providers in India

India’s journey in the payment space has been nothing short of remarkable. From traditional cash transactions to the digital revolution, payment providers have played a key role in facilitating this transition. Technological advancements, especially the widespread adoption of smartphones, have further fueled this evolution.

Key Attributes of Effective Leadership

Successful leaders in the payment sector possess a clear vision and strategy. They understand the importance of adaptability in an ever-changing market and prioritize a customer-centric approach. As the industry continues to grow, leaders need to be agile and forward-thinking to stay ahead.

Challenges Faced by Payment Providers in India

While the opportunities are vast, challenges are inevitable. Regulatory hurdles, fierce competition, and rapid technological disruptions are some of the obstacles that payment service providers[1] face. Effective leadership involves navigating these challenges with resilience and strategic decision-making.

Successful Leadership Stories

Examining successful leaders in the payment industry[2] provides valuable insights. Leaders who have overcome obstacles and achieved success offer lessons for others. Whether it’s navigating regulatory complexities or making bold decisions, these case studies shed light on effective leadership strategies.

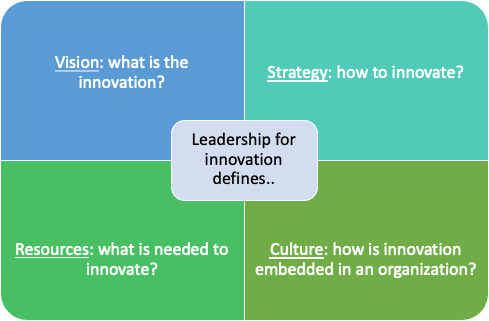

The Role of Innovation in Payment Leadership

Innovation is at the heart of the payment industry. Leaders must embrace new technologies and trends to stay competitive. Those who lead in innovation often set the pace for the entire sector. The ability to foresee market shifts and introduce ground-breaking solutions is a hallmark of effective leadership[3].

Building a Strong Team

Behind every successful payment provider[4] is a skilled and motivated team. Leaders must prioritize team building, fostering a work environment that encourages collaboration and creativity. Investing in the professional development of employees ensures a sustainable and successful future.

Navigating Regulatory Landscapes

Understanding and navigating the complex guidance landscape in India is crucial for payment leaders[5]. Compliance with regulations is non-negotiable, and leaders must engage effectively with regulators to influence policies positively.

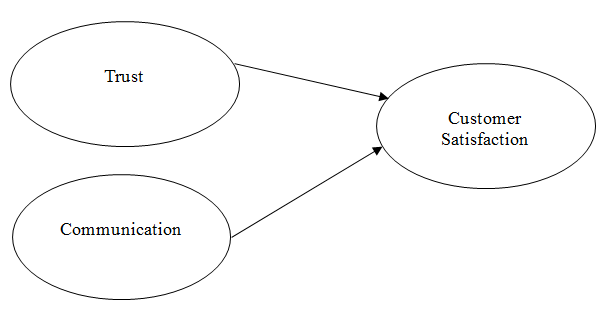

Customer Trust and Communication

Building and maintaining trust is paramount in the payment sector. Leaders must communicate transparently with customers, addressing concerns and ensuring the security of transactions. Trust is the foundation of a successful payment provider-customer relationship.

Balancing Profitability and Social Responsibility

While profitability is essential, effective leaders also recognize the importance of social responsibility. Striking a balance between financial success and contributing to societal well-being is a key aspect of leadership in the payment industry.

Future Trends in Payment Leadership

Looking ahead, leaders must anticipate future trends and position their organizations accordingly. Embracing emerging technologies, such as blockchain and artificial intelligence, will be crucial. Staying ahead of market shifts ensures sustained success.

Global Comparisons: Learning from International Leaders

Drawing insights from global payment leaders provides a broader perspective. Comparative analysis allows Indian leaders to learn from international successes and adapt strategies that align with the unique challenges and opportunities in the Indian context.

Training and Development for Payment Professionals

Continuous learning is imperative in the fast-paced payment industry. Leaders should invest in the training and development of their teams to ensure Payment Provider Leadership Guidance In India they stay updated on the latest trends and technologies. A skilled workforce is an asset for any payment provider.

Measuring Success: Key Performance Indicators for Payment Leaders

Identifying and tracking key performance indicators (KPIs) is essential for assessing leadership success. Metrics related to customer satisfaction, Payment Provider Leadership Guidance In India transaction security, and market share provide valuable insights into the effectiveness of leadership strategies.

Conclusion

effective leadership is the linchpin of success for payment providers in India. As the industry continues to evolve, leaders must be visionary, adaptable, and customer-focused. Navigating challenges, embracing innovation, and building strong teams are essential elements of leadership that can make the difference between mediocrity and excellence.

FAQs

- Q: What are the key challenges faced by payment providers in India?

- A: Payment providers in India face challenges such as regulatory hurdles, intense competition, and rapid technological disruptions.

- Q: How important is customer trust in the payment sector?

- A: Customer trust is paramount in the payment sector. It forms the foundation of a successful provider-customer relationship.

- Q: What role does innovation play in payment leadership?

- A: Innovation is at the core of payment leadership, driving the adoption of new technologies and setting the pace for the industry.

- Q: How can payment leaders balance profitability and social responsibility?

- A: Effective leaders strike a balance between financial success and contributing to societal well-being, recognizing the importance of both.

- Q: What are the future trends in payment leadership in India?

- A: Future trends include embracing emerging technologies like blockchain and artificial intelligence, anticipating market shifts, and staying ahead of the curve.