AUTHOR : ANGEL ROY

DATE : 19-12-2024

Introduction

In a country like India, where income disparity is prevalent, access to basic services like education, healthcare, and essential goods is often a major concern for many. Need-based financial[1] aid plays a crucial role in addressing this issue, ensuring that individuals from low-income backgrounds can access these services without facing financial barriers. Payment provider[2] need-based financial aid planning in India is central to the efficient disbursement of such aid, utilizing modern payment solutions to support and streamline the process.

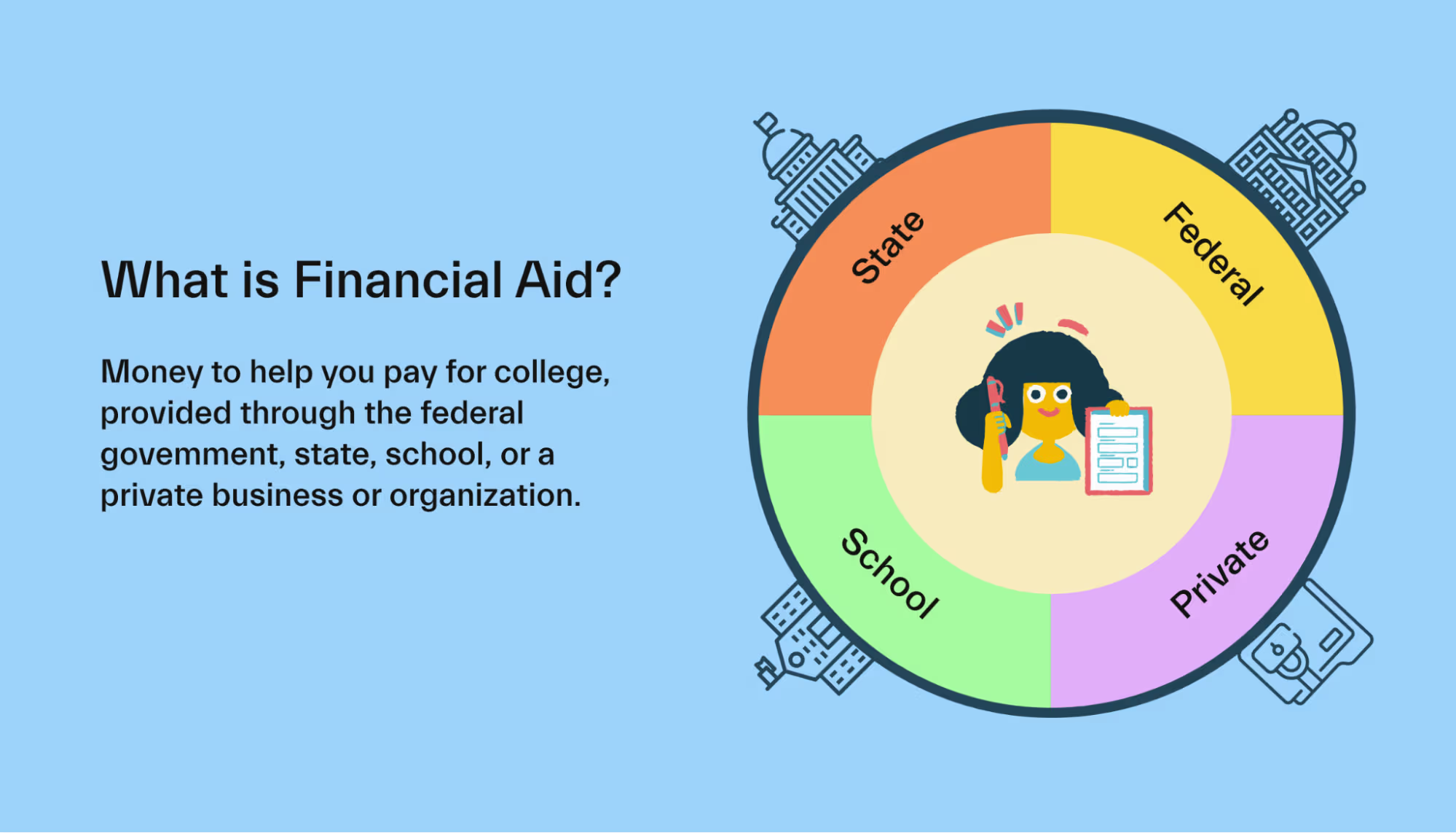

Need-based financial[3] aid is an assistance program designed to support individuals whose financial resources are insufficient to cover the cost of essential services. Whether it’s scholarships for students, subsidized healthcare, or welfare programs, such aid helps bridge the gap between the cost of services and what individuals can afford.

What is Need-Based Financial Aid?

Need-based financial aid refers to funds provided to individuals based on their Financial crisis[4] rather than their academic performance or other achievements. The aid is designed to support those who are financially disadvantaged, helping them access essential services such as education, healthcare, and more.

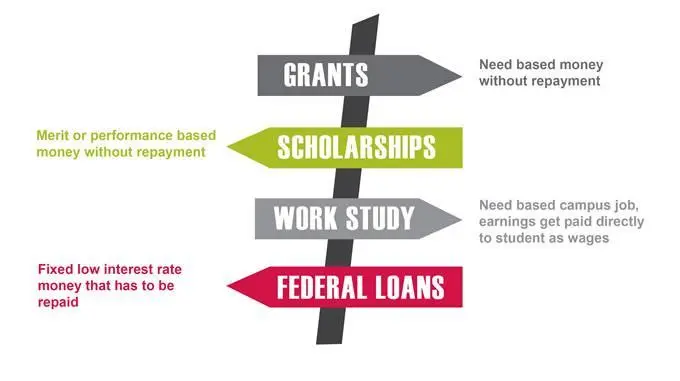

- Scholarships and Grants: For students who cannot afford the cost of tuition, textbooks, and other academic expenses.

- Subsidies: For low-income households in need of essential goods and services, such as food, housing, and healthcare.

- Loans with Favorable Terms: To help individuals pay for education or business-related needs, often with low interest rates or deferred payment options[5].

The primary goal of need-based financial aid is to ensure that financial constraints do not hinder deserving individuals from accessing opportunities or essential services.

Role of Payment Providers in Need-Based Financial Aid

Payment providers play a critical role in the efficient management and distribution of need-based financial aid. Their involvement ensures that the aid reaches its intended beneficiaries quickly, securely, and without unnecessary administrative delays. Here’s how payment providers contribute to the process:

1. Efficient Fund Disbursement

Payment providers manage the disbursement of funds by facilitating transactions between the financial institutions offering the aid and the recipients. In a country like India, where a large population may not have access to traditional banking services, payment providers ensure that funds are delivered via digital payment platforms, mobile wallets, or bank transfers. These methods are faster, more reliable, and reach individuals in remote areas, ensuring that help is provided to those who need it most.

2. Transaction Security

For financial aid to be effective, it must be securely transferred to the right individuals. Payment providers utilize secure payment gateways, encryption methods, and fraud prevention systems to ensure that funds are delivered safely and that there is no misuse of resources. This helps in building trust in the system, ensuring that the recipients receive the full amount of aid intended for them.

3. Cost Reduction

Payment providers help reduce the overall costs involved in distributing financial aid. Traditional methods of disbursement, such as checks or physical transfers, can be costly and time-consuming. Digital payment solutions, on the other hand, are more affordable and efficient, making it possible for both aid providers and recipients to save on transaction costs.

4. Increased Accessibility

The use of digital payment systems has significantly increased the accessibility of need-based financial aid in India. Mobile wallets, UPI (Unified Payments Interface), and bank transfers have made it easier for individuals, especially in rural or underserved areas, to receive financial support.

Challenges in Need-Based Financial Aid Planning in India

1. Lack of Awareness

One of the primary barriers to accessing need-based financial aid is the lack of awareness about available programs. Many individuals in rural areas or from economically disadvantaged communities do not know about the financial assistance opportunities available to them.

2. Bureaucratic Barriers

This creates barriers for individuals who may not have the time, resources, or knowledge to navigate such processes. In many cases, the complicated procedures discourage people from applying for aid altogether.

3. Delayed Disbursement

While the need for aid is immediate, the disbursement process is often slow. Delays in fund transfers or administrative inefficiencies can result in recipients not receiving the aid on time, causing further hardship. Payment providers are crucial in solving this issue by offering digital platforms that speed up the disbursement process, ensuring that aid reaches the recipients when they need it most.

4. Corruption and Mismanagement

In some cases, mismanagement or corruption can hinder the effective distribution of financial aid. Payment providers, by ensuring transparency through secure digital transactions, can help mitigate such risks and ensure that the funds are used for their intended purpose.

Opportunities for Improvement in Need-Based Financial Aid

1. Leveraging Technology

The rise of digital payments in India provides a unique opportunity to streamline need-based financial aid. This eliminates the need for intermediaries and ensures that the recipients can access the funds easily.

2. Public-Private Partnerships

Collaboration between the government and private payment providers can enhance the reach and efficiency of need-based financial aid. Payment providers can offer their technological infrastructure to facilitate the disbursement of government subsidies, grants, and welfare payments. Public-private partnerships can also help improve the transparency and accountability of the process.

3. Targeted Aid Programs

Payment providers can help create targeted financial aid programs that are personalized based on the specific needs of the beneficiaries. Using data analytics and AI, payment providers can ensure accurate and efficient aid distribution to the right individuals.

Conclusion

Payment provider need-based financial aid planning in India is integral to ensuring that financial assistance reaches those who need it most. By leveraging modern digital payment solutions, payment providers are making the process of distributing financial aid faster, more secure, and more accessible. Despite challenges, opportunities for improvement are vast, and with collaboration between the government, financial institutions, and payment providers, need-based financial aid can greatly impact millions in India.

FAQs

1. Exploring Need-Based Financial Assistance: A Crucial Support System?

Need-based financial aid is assistance provided to individuals based on their financial needs rather than their academic achievements or other criteria.

2. How do payment providers need-based financial aid planning in India?

Payment providers streamline fund disbursement, ensure security, cut costs, and improve accessibility, enhancing efficiency.

3. What are the main challenges in need-based financial aid distribution in India?

The key challenges include lack of awareness, bureaucratic barriers, delayed disbursements, and corruption.

4. How can technology improve financial aid distribution in India?

Digital payment platforms, such as mobile wallets and UPI, can streamline the disbursement process, ensuring quicker and more secure transfers of funds to the recipients.

5. What role does the government play in need-based financial aid in India?

The Indian government offers several financial aid programs, including subsidies and scholarships, to support individuals in need, often in collaboration with payment providers to ensure efficient distribution.