AUTHOR : SOFI PARK

DATE : 28/12/2023

Introduction

In the dynamic landscape of digital content creation, the role of payment providers[1] cannot be overstated. As India embraces the digital revolution, the need for efficient and secure online payment solutions has become paramount. This article explores the evolution, features, challenges, and future trends of payment providers in the context of online content creation in India.

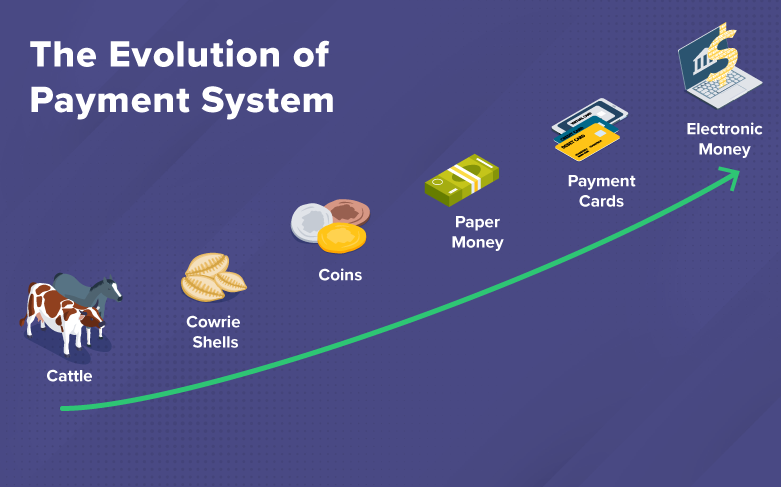

Evolution of Payment Providers in India

India’s journey towards a cashless economy has witnessed a significant evolution in payment providers. From traditional methods to cutting-edge technologies, the landscape has transformed, offering content creators more options than ever before. Technological advancements and increased internet penetration have played a pivotal role in this evolution.

Key Features of Leading Payment Providers

Leading payment providers offer a range of features crucial for online content[2] creators. Security measures, user-friendly interfaces, and seamless integration options are among the key considerations when choosing a payment partner. These features ensure a smooth transaction process and build trust among users.

Popular Payment Methods

In India, the popularity of various payment methods has soared. UPI transactions, digital wallets, and credit/debit cards have become ubiquitous. Content creators need to understand the advantages and limitations of each method to cater to the diverse preferences of their audience.

Benefits for Online Content Creators

For content creators, utilizing online payment providers comes with several advantages. Streamlined transactions, global accessibility, and real-time analytics empower creators to focus on their content while efficiently managing their revenue streams.

Challenges Faced by Content Creators

However, it’s not all smooth sailing. Content creators face challenges such as transaction fees,

security concerns, and regulatory issues. Navigating these challenges requires a careful assessment of the chosen payment provider and proactive measures to address potential issues.

Comparison of Major Payment Providers

Choosing the right payment provider is a crucial decision for content creators. A detailed comparison of fee structure, customer support, and market share can help in making an informed choice aligned with business goals.

Payment providers are companies or platforms that facilitate online financial transactions. They act as intermediaries, ensuring that money moves securely and efficiently between buyers and sellers. Whether through apps, websites, or POS systems, payment providers simplify and streamline payments.

Importance of Payment Providers in E-commerce

For e-commerce businesses, payment providers are the backbone. They enable smooth online transactions, reduce cart abandonment, and boost customer trust. Without reliable payment gateways[3], the convenience of online shopping would be unimaginable.

Tips for Choosing the Right Payment Provider

Understanding the unique needs of one’s business, scalability, and considering customer reviews are essential factors when selecting a payment provider. A well-suited provider can contribute significantly to the success of online content creators.

Future Trends in Online Payments

The future of online payments in India holds exciting possibilities. Emerging technologies, regulatory changes, and shifts in consumer behavior are expected to shape the landscape. Content creators need to stay informed and adapt to these trends for sustained success.

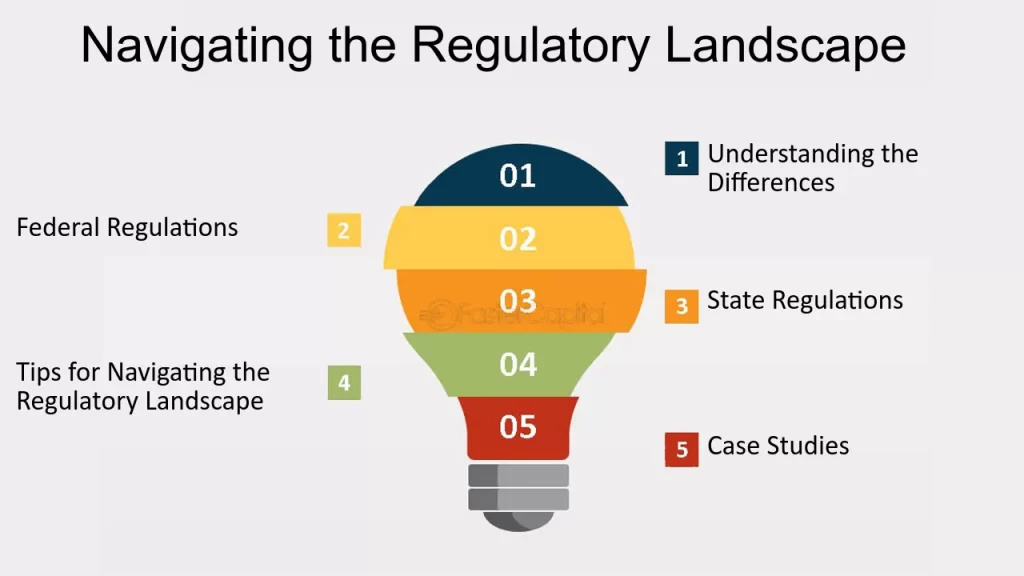

Navigating Regulatory Landscape

As the digital payment[4] ecosystem matures, navigating the regulatory landscape becomes crucial. Compliance requirements and legal considerations for content creators ensure a secure and sustainable business environment.

Security Measures for Online Transactions

Ensuring the security of online transactions[5] is paramount. Two-factor authentication and robust encryption protocols safeguard the financial transactions of both content creators and consumers.

Maximizing Revenue through Strategic Payment Integration

Diversifying payment methods and building trust with users are essential strategies for maximizing revenue. A strategic approach to payment integration aligns with the dynamic nature of online content creation.

User Experience and Interface Design

The user experience and interface design of payment providers play a pivotal role. A seamless and user-friendly experience enhances trust and encourages users to engage more frequently, benefiting content creators.

Conclusion

The intertwining of online content creation and payment providers in India reflects the broader shift towards a digital-first economy. Content creators must navigate the diverse landscape of payment options, leveraging the features and benefits offered by leading providers. As technology continues to advance and consumer behaviors evolve, staying informed and adaptable is key for sustained success in the dynamic world of online content creation.

FAQs

- Is it necessary to use multiple payment methods for online content creation?

- Diversifying payment methods can cater to a broader audience, but it depends on the specific goals and preferences of the content creator.

- How do regulatory changes impact online payment providers?

- Regulatory changes can influence fees, security measures, and the overall operations of payment providers, affecting both creators and consumers.

- What role does user experience play in the success of online payment transactions?

- A seamless and user-friendly experience enhances trust and encourages users to engage more frequently, benefiting content creators.

- How can content creators address security concerns related to online transactions?

- Implementing two-factor authentication and utilizing robust encryption protocols are crucial steps in addressing security concerns.

- What trends can we expect in the future of online payments in India?

- Emerging technologies, regulatory changes, and shifts in consumer behavior are expected to shape the future landscape of online payments in India.