AUTHOR NAME : JASMIN

DATE : 14 / 12 /2023

Introduction

In the bustling landscape of India’s financial technology sector, payment processing companies play a pivotal role in shaping the way transactions are conducted. As the nation undergoes a digital revolution, the demand for efficient and secure payment solutions has never been higher.

Evolution of Payment Processing in India

The evolution of payment processing in India is a fascinating journey through time. From traditional cash transactions to the advent of electronic payments, the landscape has undergone a remarkable transformation. The rise of payment processing companies has been a key driver of this change, providing innovative solutions to meet the evolving needs of businesses and consumers

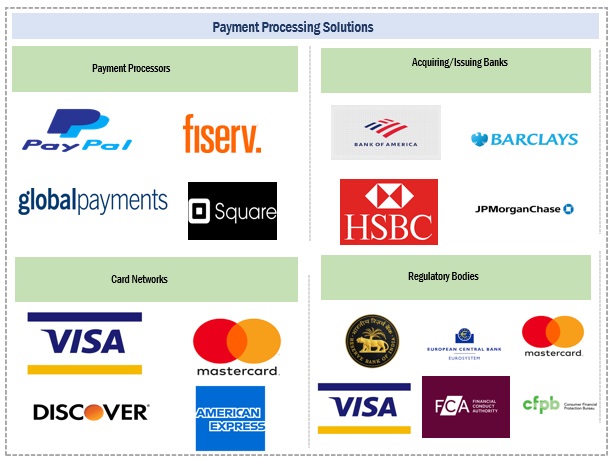

Key Players in the Indian Payment Processing Industry

In this dynamic environment, several key players stand out in the Indian payment processing industry. Giants such as XYZ Payments and ABC Finance have not only captured significant market share but have also been instrumental in shaping industry standards. Their influence extends across various sectors, driving the adoption of digital payment solutions

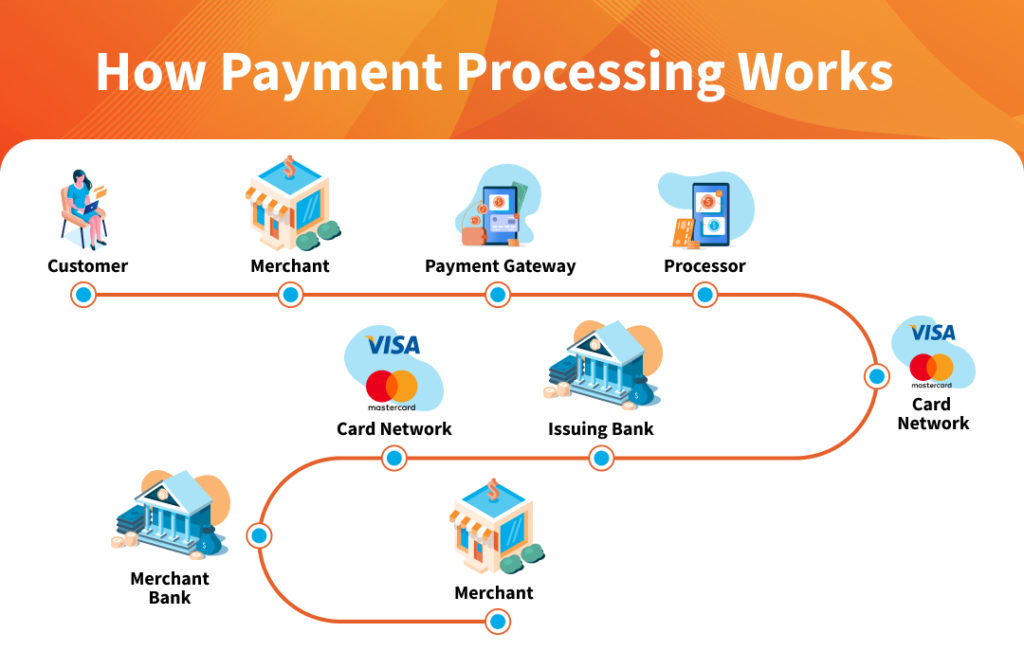

Technological Advancements in Payment Processing

Technological advancements have been a driving force behind the growth of payment processing companies in India. The integration of cutting-edge technologies such as blockchain, artificial intelligence, and biometrics has not only enhanced the security of transactions but has also significantly improved the overall user experience.

Challenges Faced by Payment Processing Companies in India

However, the journey has not been without its challenges. Regulatory hurdles and the constant battle against security threats and fraud have been persistent challenges for payment processing companies. Despite these obstacles, the industry has demonstrated resilience and adaptability, constantly evolving to address emerging risks. Payment Provider Payment Processing Companies in India.

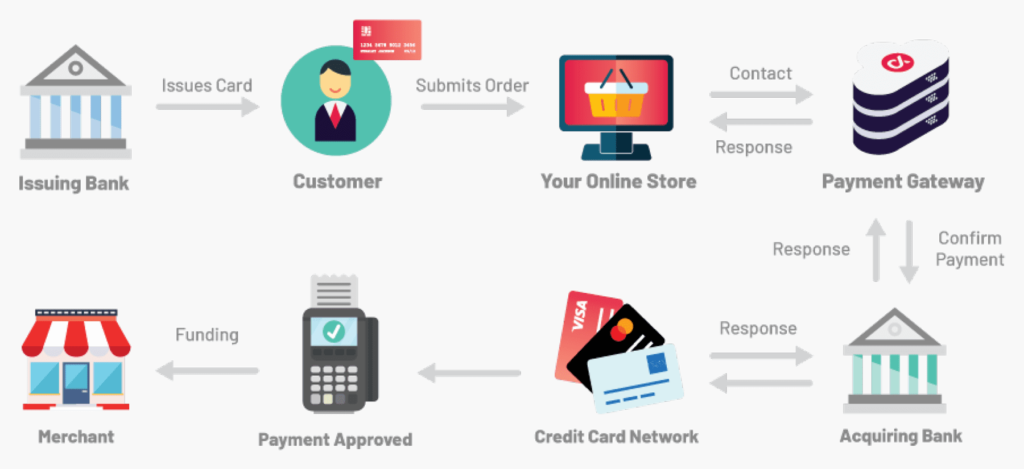

Role of Payment Providers in Facilitating E-commerce

Payment processors play a crucial role in facilitating the growth of e-commerce in India[1]. Their seamless integration with online platforms has not only simplified transactions but has also instilled confidence in consumers to engage in online shopping. The symbiotic relationship between payment providers and e-commerce businesses has become a cornerstone of the digital economy.

Mobile Wallets and Digital Payment Trends

The proliferation of mobile wallets and the surge in digital payment[2] usage have redefined the landscape of financial transactions in India. The convenience and accessibility offered by mobile payment solutions have made them increasingly popular among a diverse demographic. The current trends suggest a continued shift towards a cashless society, with digital payments becoming the norm.

Government Initiatives and Policies

Recognizing the significance of a digital economy, the Indian government[3] has introduced various initiatives and policies to promote digital payments. From demonetization to the implementation of the Unified Payments Interface (UPI), these measures have not only accelerated the adoption of digital transactions but have also created a conducive environment for payment processing companies to thrive.

Security Measures Implemented by Payment Processing Companies

In response to the growing concerns about cybersecurity, payment processing[4] companies have implemented robust security measures. Encryption technologies, two-factor authentication, and constant monitoring for suspicious activities are among the strategies employed to safeguard user data and ensure the integrity of financial transactions.

User Experience in Payment Processing

Apart from security, the user experience is a critical factor in the success of payment processing solutions. Investment company[5] heavily in developing intuitive interfaces and streamlining the payment process to make it seamless and user-friendly. The goal is to create an experience that not only meets but exceeds user expectations.

Future Trends in Payment Processing

Looking ahead, the future of payment processing in India is poised for exciting developments. The convergence of technologies like the Internet of Things (IoT) and 5G is expected to open new possibilities, offering faster and more efficient payment solutions. Additionally, the rise of contactless payments and innovations in biometric authentication are likely to shape the industry’s trajectory.

Comparison of Indian Payment Processing with Global Standards

How does India’s payment processing industry measure up on the global stage? While the nation has made significant strides, there are areas for improvement. The comparison with global standards provides valuable insights into where the industry stands and highlights areas that require attention for continued growth and competitiveness.

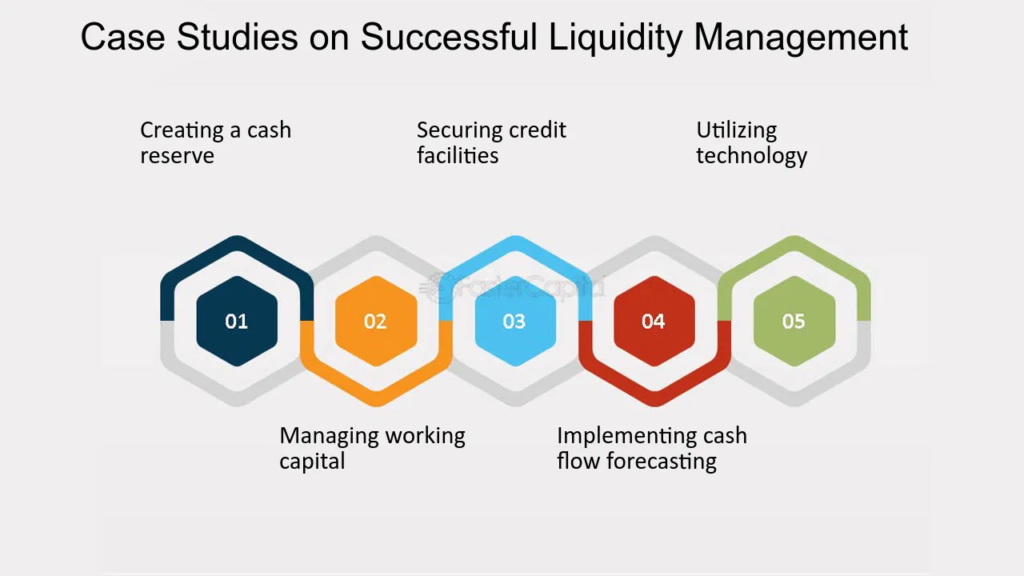

Case Studies of Successful Payment Processing Implementations

Examining real-world examples of successful payment processing implementations provides valuable lessons for industry stakeholders. Case studies showcasing how companies overcame challenges and achieved positive outcomes offer a roadmap for others looking to enhance their payment processing capabilities.

Customer Testimonials

The true litmus test for any payment processing company lies in the experiences of its users. Positive testimonials from businesses and individuals using these services provide a glimpse into the tangible benefits offered. From the speed of transactions to the reliability of services, these testimonials paint a picture of the impact payment processing companies have on daily financial activities.

Conclusion

In conclusion, the journey of payment processing companies in India reflects a narrative of innovation, challenges, and triumphs. Payment Provider Payment Processing Companies in India. As the nation continues its digital evolution, these companies will play a crucial role in shaping the future of financial transactions. The collaboration between technology, regulation, and consumer behavior will determine the trajectory of the payment processing industry in India.

FAQs

- Are digital payments secure in India?

- Yes, payment processing companies implement robust security measures to ensure the safety of digital transactions.

- How have government initiatives impacted the payment processing industry?

- Government initiatives, such as demonetization and UPI, have accelerated the adoption of digital payments, positively influencing the industry.

- What role do mobile wallets play in reshaping payment habits?

- Mobile wallets offer convenient and secure alternatives, reshaping consumer payment habits and driving the shift towards digital transactions.

- How do payment processors contribute to the growth of e-commerce?

- Payment processors facilitate seamless transactions, instilling confidence in consumers and contributing to the growth of e-commerce platforms.

- What are the key future trends expected in payment processing in India?

- Future trends include the integration of IoT and 5G, contactless payments, and advancements in biometric authentication, reshaping the payment processing landscape.