AUTHOR : JAYOKI

DATE : 22/12/2023

Introduction

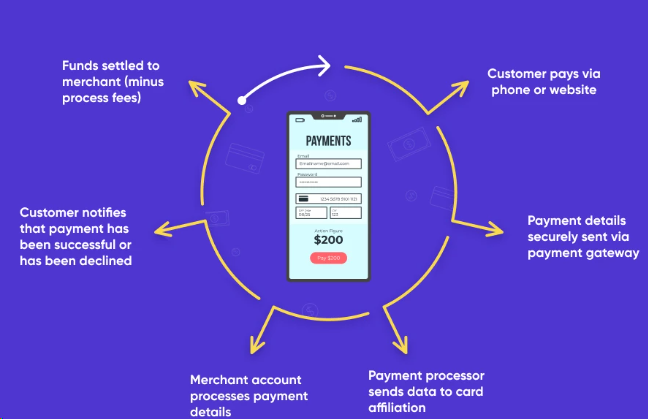

The payment landscape in India has witnessed a remarkable transformation, with businesses recognizing the need for efficient and profitable payment solutions. In today’s dynamic market, the choice of a payment provider gnificantly impact a company’s success. Let’s explore the evolution of payment providers in India and understand why selecting a profitable one is paramount.

Evolution of Payment Providers in India

In the early days, businesses relied heavily on traditional banking for their financial transactions. However, with the advent of digital technologies, the payment landscape underwent a paradigm shift. The emergence of digital payment solutions revolutionized the way businesses conducted transactions, offering speed, convenience, and security.

Key Features to Look for in a Payment Provider

Choosing the right payment provider involves considering various factors. Security and fraud prevention, a user-friendly interface, integration capabilities, and cost-effective solutions are key features that businesses should prioritize. In the next sections, we’ll delve deeper into each of these aspects.

Popular Payment Providers in India

The Indian market boasts several prominent payment providers, each with its unique offerings. payment provider Profitable ventures in india A comparative analysis of these providers will help businesses make informed decisions based on their specific needs. From traditional banking channels to modern digital wallets, we’ll explore the diverse options available.

Successful Ventures

Real-world examples often provide valuable insights. We’ll showcase businesses that have successfully navigated the payment landscape in India. By understanding their strategies and the role of payment providers in their success, readers can glean actionable takeaways for their ventures.

Challenges and Solutions

While payment providers offer numerous benefits, businesses may encounter challenges. payment provider Profitable ventures in india From technical issues to regulatory hurdles, we’ll discuss common challenges and provide practical solutions to overcome them.

Future Trends in Payment Solutions

The payment industry ecosystem[1] industry is dynamic, with technological advancements shaping its future. By exploring upcoming trends, businesses can position themselves strategically to capitalize on new opportunities and stay ahead of the curve.

Tips for Choosing the Right Payment Provider

Selecting a payment provider tailored to business needs is crucial. We’ll offer practical tips on researching Payment service provider[2] reviews, understanding reputation, and aligning the chosen provider with specific business requirements.

Importance of a Seamless Payment Experience

A Instant payment[3] experience contributes significantly to customer satisfaction and retention. Through real-life examples, we’ll highlight the positive impact of a streamlined payment process on businesses.

Regulatory Compliance in India

Navigating the regulatory landscape is vital for businesses using payment providers Venture capital[4]. We’ll provide an overview of regulations affecting the industry and emphasize the importance of compliance.

The Role of Payment Providers in E-commerce

For online businesses, the role of payment providers extends beyond facilitating transactions. Profitable Ventures[5] We’ll explore how payment solutions enhance the overall e-commerce experience for both businesses and customers.

Navigating International Payments

Innovations in Payment Technologies

Global transactions bring unique challenges. We’ll discuss the challenges businesses face when dealing with international payments and provide tips for minimizing currency conversion costs.

As technology continues to evolve, new payment methods emerge. We’ll explore innovative payment technologies and their potential impact on businesses in India.

Growing Your Business with the Right Payment Partner

Strategic partnerships with the right payment provider can fuel business growth. We’ll share success stories of businesses that have scaled by leveraging the capabilities of their payment partners.

Conclusion

In conclusion, the article has provided a comprehensive overview of payment providers in India, covering their evolution, key features, popular players, case studies, challenges, future trends, and tips for choosing the right provider. Businesses must navigate the dynamic payment landscape strategically to ensure profitability and growth.

FAQs

- Q: How do I choose the right payment provider for my business?

- A: Consider your business needs, research provider reviews, and ensure alignment with specific requirements.

- Q: What role do payment providers play in e-commerce?

- A: Payment providers facilitate transactions and enhance the overall e-commerce experience for businesses and customers.

- Q: What challenges do businesses face with international payments?

- A: Challenges include currency conversion costs and navigating the complexities of global transactions.

- Q: How can businesses ensure regulatory compliance with payment providers in India?

- A: Stay informed about regulations affecting the industry and prioritize compliance in all transactions.

- Q: Can a seamless payment experience impact customer satisfaction?

- A: Yes, a seamless payment experience contributes significantly to customer satisfaction and retention.