AUTHOR:AYAKA SHAIKH

DATE:25/12/2023

Introduction

In today’s digital era, the world of payments is vast and intricate. Payment provider recovery services have emerged as a beacon of hope, especially in countries like India, where the financial ecosystem is burgeoning.

Challenges Faced by Payment Providers in India

India, with its vast consumer base, presents unique challenges. From technological glitches to regulatory hurdles, payment providers[1] often find themselves navigating a maze.

The Need for Recovery Services

Ever wondered what happens when transactions go awry? Without recovery services[2], the financial implications can be colossal, both in terms of money and reputation.

Several recovery services have carved a niche for themselves. Their expertise ranges from data recovery to transaction reconciliation, ensuring seamless operations.

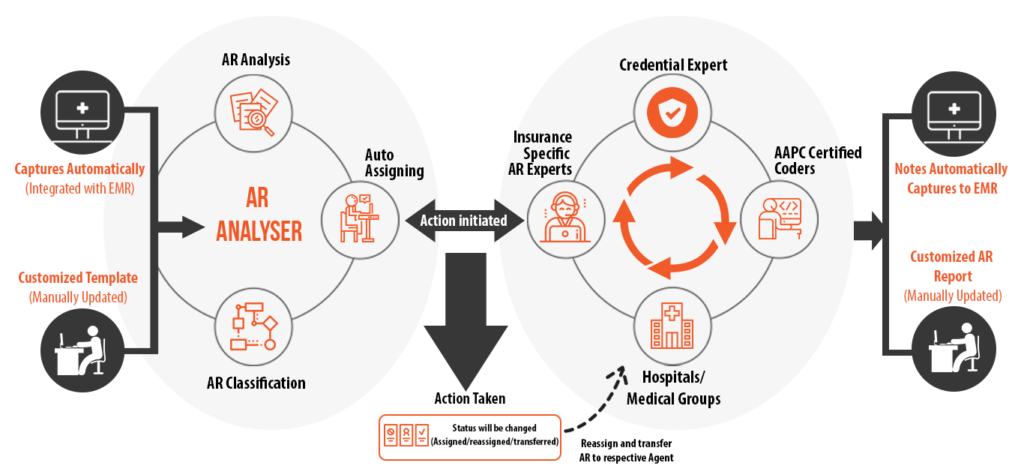

How These Services Operate

Imagine losing critical transaction data! These recovery services work diligently, employing state-of-the-art technologies and methodologies to restore order.

Benefits of Utilizing Recovery Services

Why should payment providers invest in recovery services? Simply put, it’s about safeguarding assets, ensuring customer trust, and maintaining operational efficiency.

Regulatory Compliance and Security Measures

In a world rife with cyber threats, ensuring regulatory compliance and robust security measures isn’t just essential—it’s paramount.

Customer Support and Service Excellence

Ever felt stranded during a transaction glitch? That’s where top-notch customer support comes into play, ensuring minimal downtime and an optimal user experience.

Future Trends in Payment Provider Recovery Services

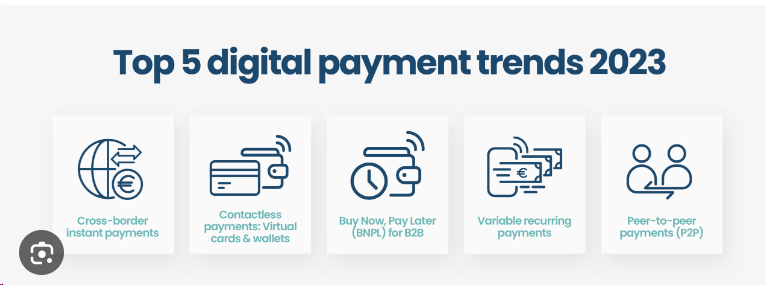

As technology evolves, so do recovery services. From AI-driven solutions to blockchain integration, the future looks promising.

Case Studies:

Let’s delve into some real-life examples, highlighting success stories and the lessons they offer.

Comparative Analysis

With a plethora of provider recovery services[3] available, how does one choose? A comparative analysis offers insights, helping providers make informed decisions.

How to Choose the Right Service

Selecting the right recovery service isn’t rocket science. However, it requires due diligence, asking the right questions, and understanding one’s needs.

Risks and Precautions

Like any service, recovery services come with their own set of risks. Being aware of potential pitfalls and taking preventive measures is crucial

The Evolving Landscape of Payment Provider Recovery Services

In recent years, the digital payment ecosystem[4] in India has experienced exponential growth. With the surge in online transactions, the importance of robust recovery services has become increasingly evident. Think of it this way: as more people flock to online platforms for their financial needs, the likelihood of glitches or data losses also escalates. That’s where these recovery services step in, acting as the unsung heroes behind the scenes.

Navigating the Intricacies of the Indian Market

The Indian market, known for its diversity and vastness, poses unique challenges. From language barriers to varying regulatory landscapes across states, payment providers Recovery services in india often find themselves in uncharted waters. Here, recovery services act as the compass, guiding providers through potential pitfalls and ensuring smooth sailing.

Technological Advancements and Innovations

Gone are the days when Service recovery[5] solely on manual interventions. Today, with advancements in technology, we witness a paradigm shift. Machine learning algorithms, predictive analytics, and blockchain technologies are revolutionizing the recovery landscape, making processes faster, more efficient, and increasingly accurate.

Building Trust Through Transparency

In the world of finance, trust is paramount. Payment providers need assurance, not just in terms of recovering lost data but also in understanding the processes involved. Transparent communication, regular updates, and collaborative approaches foster trust, forging lasting partnerships between providers and recovery services.

The Role of Data Analytics

Data is frequently described as the modern gold mine, and with valid justification.

. Recovery services harness the power of data analytics, analyzing patterns, identifying anomalies, and predicting potential issues. This proactive approach minimizes risks, ensuring uninterrupted service and enhancing customer satisfaction.

The Human Element: Expertise and Experience

While technology is crucial, the essence of human touch remains unmatched.

Seasoned professionals with expertise in finance, technology, and regulatory compliance form the backbone of recovery services. Their insights, coupled with technological tools, create a harmonious blend, offering comprehensive solutions tailored to individual needs.

Conclusion

In wrapping up, payment provider recovery services are more than just a safety net; they’re a lifeline. As India’s fintech landscape evolves, so does the need for robust recovery mechanisms.

FAQs

They involve restoring lost or corrupted transaction data and ensuring seamless payment operations.

How do these services differ from traditional IT support?

While IT support focuses on general technical issues, recovery services specialize in restoring financial transaction data and ensuring compliance.

Are these services cost-effective for small payment providers?

Absolutely! Many services offer scalable solutions tailored to individual needs.

How can one ensure the security of sensitive financial data?

Choosing a service that prioritizes regulatory compliance and employs advanced security measures is paramount.

What does the future hold for payment provider recovery services in India?

With technological advancements, the landscape is poised for growth, offering innovative solutions and enhanced security measures.