AUTHOR :HAANA TINE

DATE :27/02/2024

Introduction

In today’s digital era, payment provider software plays a pivotal role in facilitating seamless transactions for businesses in India. Whether it’s a small start-up or a large enterprise, having efficient payment processing solutions [3] is essential for success in the competitive market.

Understanding the Indian Market

India has witnessed a significant shift towards digital payments in recent years, fueled by factors such as government initiatives, increased smartphone penetration, and changing consumer preferences. With the rise of e-commerce platforms and online transactions, the demand for reliable payment provider software has surged.

Features of Payment Provider Software

Payment provider software offers a wide range of features to meet the diverse needs of businesses. From robust security measures to seamless integration with multiple payment gateways, these solutions are designed to enhance efficiency and streamline operations. Additionally, features like customization options and advanced reporting capabilities empower businesses to tailor their payment processes according to their specific requirements.

Popular Payment Provider Software in India

In the Indian market, several payment provider software options are available, each offering unique features and functionalities. Some of the top choices include XYZ Payment Solutions [1], ABC Pay, and DEF Payment Gateway. Businesses can compare these options based on factors such as pricing, ease of use, and customer reviews to find the best fit for their needs.

Factors to Consider When Choosing Payment Provider Software

When selecting payment provider software, businesses [2] should consider various factors to ensure they make the right choice. Compatibility with existing systems, cost-effectiveness, reliable customer support, and scalability are among the key considerations that can influence the decision-making process.

Steps to Download and Install Payment Provider Software

Downloading and installing payment provider software is a straightforward process. Most providers offer easy-to-follow instructions and also support resources [3] to assist users throughout the installation process. By following these steps diligently, businesses can set up their payment systems quickly and efficiently.

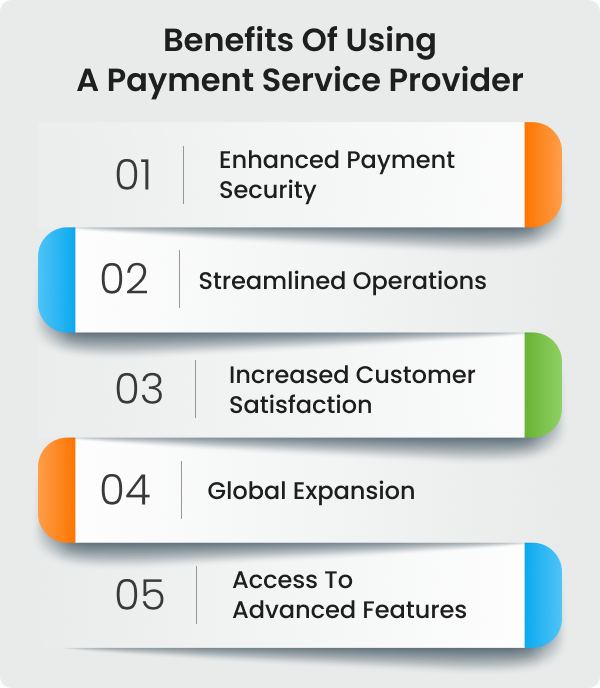

Benefits of Using Payment Provider Software

The benefits of using payment provider software are manifold. Not only does it streamline payment processing and enhance security, but it also improves the overall customer experience. Payment Provider Software Downloads for PC in India Additionally, payment provider software provides valuable insights through detailed reporting and analytics, enabling businesses to make informed decisions and optimize [4] their operations.

Case Studies: Success Stories of Businesses Using Payment Provider Software

Numerous businesses in India have experienced remarkable success by leveraging payment provider software. Whether it’s a small retailer or a multinational corporation, these solutions have helped businesses of all sizes streamline their payment processes, reduce costs, and drive growth [5].

Challenges and Solutions

While payment provider software offers numerous benefits, businesses may encounter challenges such as technical issues, security concerns, or compatibility issues with existing systems. However, with proactive strategies and effective solutions, these challenges can be overcome, allowing businesses to maximize the potential of their payment systems.

Future Trends in Payment Provider Software

Looking ahead, the future of payment provider software looks promising, with continued innovation and advancements in technology. From AI-powered fraud detection to blockchain-based transactions, new trends are emerging that promise to revolutionize the payment industry and shape the future of digital payments in India.

Conclusion

In conclusion, payment provider software plays a crucial role in enabling businesses to thrive in today’s digital economy. By choosing the right software solution and leveraging its features effectively, businesses can streamline their payment processes, enhance security, and deliver exceptional customer experiences.

FAQs

- What are the advantages of using payment provider software? Payment provider software offers benefits such as streamlined payment processing, enhanced security, and access to valuable insights through reporting and analytics.

- How do I choose the right payment provider software for my business? When choosing payment provider software, consider factors such as compatibility with existing systems, cost-effectiveness, reliable customer support, and scalability.

- Is payment provider software suitable for small businesses? Yes, payment provider software is suitable for businesses of all sizes, including small businesses. Many providers offer solutions tailored to the needs and budgets of small enterprises.

- Can payment provider software help prevent fraud? Yes, many payment provider software solutions include advanced fraud detection features powered by AI and machine learning algorithms to help prevent fraudulent transactions.

- What are the costs associated with payment provider software? The costs of payment provider software vary depending on factors such as the provider, the features included, and the scale of the business. Some providers offer pricing plans based on transaction volume, while others may charge a monthly subscription fee.