AUTHOR : BELLA

DATE : FEBRUARY 28, 2024

Introduction

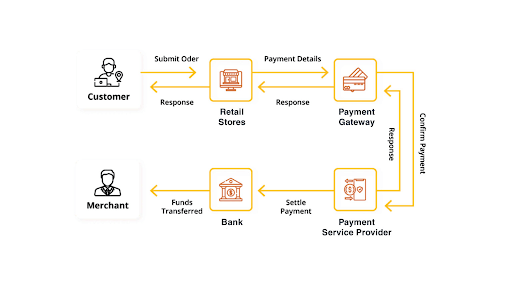

Payment provider software, also known as payment gateway software, is a technology,platform that enables businesses to accept payments from customers electronically. It acts as a bridge between merchants, customers, and financial institutions, securely processing transactions in real-time.

Importance of Payment Provider Software in India

In recent years, India has witnessed a significant surge in digital transactions, driven by factors such as government initiatives like Digital India and demonetization, as well as the widespread adoption of smartphones and the internet. Payment provider software plays a vital role in this ecosystem by facilitating online payments, enabling e-commerce businesses to thrive, and promoting financial inclusion.

Types of Payment Provider Software

Point of Sale (POS) Systems

POS systems are hardware and software solutions that allow merchants to accept payments at physical retail locations. They typically include features such as inventory management, sales analytics, and customer relationship management.

Online Payment Gateways

Online payment gateways [1] enable businesses to accept payments through websites and mobile apps securely. They encrypt sensitive data during transactions, providing a safe and convenient payment experience for customers.

Mobile Payment Apps

Mobile payment apps, also known as digital wallets, allow users to store payment information securely on their smartphones and make transactions with a simple tap or scan. These apps often offer additional features such as loyalty programs and peer-to-peer transfers [2].

Key Features to Look for in Payment Provider Software

Security

Security is paramount [3] when choosing payment provider software. Look for solutions that comply with industry standards and offer features such as encryption, tokenization, and fraud detection to protect sensitive information.

Integration Capabilities

Choose payment provider software [4] that integrates seamlessly with your existing systems and software applications. This ensures smooth operations and enables you to leverage data from various sources for better insights.

User-Friendly Interface

A user-friendly interface is essential for both merchants and customers. Opt for software that offers intuitive navigation, clear instructions, and responsive customer support to minimize friction during transactions.

Popular Payment Provider Software in India

Razorpay

Razorpay is one of the leading payment gateway providers in India, offering a wide range of services including online payments, recurring billing, and international payments. It is known for its robust security features and easy integration with popular e-commerce [5] platforms.

PayU

PayU is another prominent player in the Indian payment provider space, offering solutions for online payments, POS systems, and mobile wallets. It boasts a large merchant network and provides customizable payment solutions to suit diverse business needs.

Instamojo

Instamojo caters primarily to small and medium-sized businesses, offering a user-friendly platform for accepting online payments, creating invoices, and managing orders. It is known for its simple pricing structure and extensive integration options.

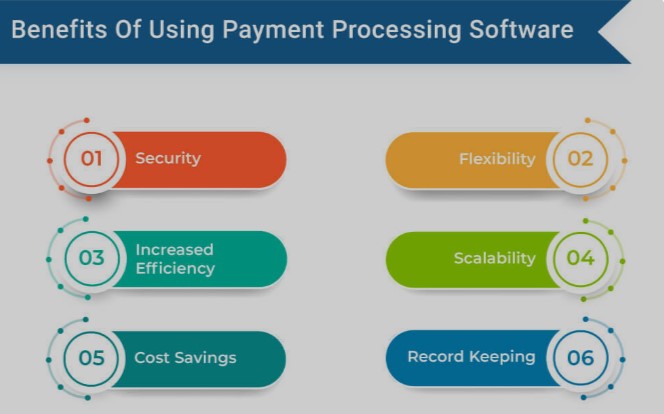

Advantages of Using Payment Provider Software

Enhanced Security

Payment provider software employs advanced security measures such as encryption and tokenization to protect sensitive data from unauthorized access and fraud.

Streamlined Transactions

By automating payment processes and reducing manual intervention, payment provider software helps businesses save time and resources while ensuring faster and more efficient transactions.

Increased Customer Satisfaction

Offering multiple payment options and a seamless checkout experience can enhance customer satisfaction and encourage repeat business. Payment provider software enables businesses to cater to diverse customer preferences and needs.

Challenges and Considerations

Regulatory Compliance

Compliance with regulatory requirements such as the Payment Card Industry Data Security Standard (PCI DSS) and the Reserve Bank of India (RBI) guidelines is crucial for businesses handling sensitive financial data.

Transaction Fees

While payment provider software offers convenience and security, businesses must be mindful of transaction fees and other associated costs, which can impact profitability, especially for small businesses.

Technical Support

Having access to reliable technical support is essential for resolving issues promptly and minimizing downtime. Choose payment provider software that offers responsive customer support and comprehensive troubleshooting resources.

How to Choose the Right Payment Provider Software

Assessing Business Needs

Evaluate your business requirements, including transaction volume, industry-specific regulations, and integration preferences, to identify the most suitable payment provider software for your needs.

Reading Reviews and Comparisons

Research and compare different payment provider software options based on factors such as features, pricing, user reviews, and industry reputation to make an informed decision.

Trial Periods and Demos

Take advantage of free trials, demos, and pilot programs offered by payment provider software vendors to test the platform’s capabilities and evaluate its suitability for your business before making a commitment.

Conclusion

Payment provider software plays a crucial role in facilitating secure and efficient transactions in India’s rapidly evolving digital payment landscape. By choosing the right software solution and prioritizing features such as security, integration capabilities, and user experience, businesses can streamline their payment processes, enhance customer satisfaction, and drive growth in the digital era.

FAQs

1. What is payment provider software?

Payment provider software, also known as payment gateway software, enables businesses to accept electronic payments from customers securely.

2. How does payment provider software work?

Payment provider software acts as a bridge between merchants, customers, and financial institutions, facilitating the authorization and processing of transactions in real-time.

3. What are some popular payment provider software options in India?

Popular payment provider software options in India include Razorpay, PayU, and Instamojo, each offering a range of features and services to suit diverse business needs.

4. What factors should businesses consider when choosing payment provider software?

Businesses should consider factors such as security features, integration capabilities, transaction fees, and technical support when choosing payment provider software.

5. How can businesses ensure regulatory compliance when using payment provider software?

Businesses can ensure regulatory compliance by choosing payment provider software that adheres to industry standards such as PCI DSS and RBI guidelines and implementing best practices for data security and privacy.