AUTHOR:HAZEL DSOUZA

DATE:28/12/2023

In today’s dynamic business environment, the use of payment provider software is ubiquitous, revolutionizing the way transactions are conducted. However, operating such software in India requires compliance with specific licensing requirements to ensure legality and security. Let’s delve into the intricacies of payment provider software licenses in India and explore the crucial aspects businesses need to consider.

Introduction

Definition of Payment Provider Software Licenses

Payment provider software licenses refer to legal permissions granted by regulatory bodies to operate and offer payment services in India. These licenses are essential for ensuring the legitimacy and security of financial transactions.

Importance of Payment Provider Software Licenses in India

The regulatory framework in India emphasizes the significance of licensed payment provider[1] software to safeguard consumers and maintain the integrity of financial systems.

Types of Payment Provider Software Licenses

Overview of Different Licenses

There are various types of licenses, including Prepaid Payment Instruments (PPI), Mobile Wallets, and Payment Aggregator licenses[2], each with distinct requirements and purposes.

Specific Requirements for Each License Type

Businesses must adhere to specific criteria for obtaining each license type, such as minimum capital requirements, security measures, and operational guidelines.

Licensing Process in India

Regulatory Bodies Involved

Multiple regulatory bodies, including the Reserve Bank of India (RBI) and the National Payments Corporation of India (NPCI), play a pivotal role in overseeing and granting payment provider software licenses.

Step-by-Step Guide for Obtaining Licenses

Navigating the licensing process involves comprehensive documentation, adherence to regulatory guidelines, and engaging with regulatory authorities. A step-by-step guide is crucial for businesses aiming to secure licenses[3] efficiently.

Compliance and Legal Considerations

Key Compliance Requirements

Meeting compliance standards is paramount, encompassing data security, customer protection, and adherence to anti-money laundering (AML) regulations.

Penalties for Non-Compliance

Failure to comply with licensing regulations can result in severe penalties, including fines and suspension of operations, emphasizing the need for strict adherence to legal requirements.

Benefits of Using Licensed Payment Provider Software

Increased Security

Licensed payment provider software ensures robust security measures, protecting both businesses and consumers from fraudulent activities.

Enhanced Consumer Trust

Consumers are more likely to trust businesses that operate with licensed payment[4] provider software, contributing to a positive brand image and customer loyalty.

Challenges in Obtaining Licenses

Common Challenges Faced by Businesses

Businesses may encounter challenges during the licensing process, such as complex documentation requirements and lengthy approval timelines.

Strategies to Overcome Challenges

Implementing strategies such as engaging legal experts and leveraging technology solutions can help businesses overcome licensing challenges efficiently.

Future Trends in Payment Provider Software Licensing

Emerging Technologies

Advancements in technology, such as blockchain and artificial intelligence, are anticipated to shape the future of payment provider software licensing[5].

Anticipated Regulatory Changes

Businesses need to stay informed about potential changes in regulations to adapt their strategies and remain compliant in the evolving landscape.

Case Studies

Success Stories of Businesses with Licensed Payment Provider Software

Examining success stories provides insights into how businesses thrive with licensed payment provider software, showcasing the tangible benefits of compliance.

Lessons Learned from Compliance Failures

Analysing cases of non-compliance underscores the importance of understanding and adhering to licensing regulations.

Comparison with Unlicensed Payment Provider Software

Risks Associated with Unlicensed Software

Using unlicensed payment provider software poses risks such as legal consequences, data breaches, and damage to reputation.

Impact on Business Operations

Unlicensed software can disrupt business operations, leading to financial losses and erosion of customer trust.

Tips for Choosing the Right Payment Provider Software License

Factors to Consider

Businesses must evaluate factors such as scalability, security features, and regulatory alignment when selecting a payment provider software license.

Best Practices for Decision-Making

Implementing best practices in decision-making ensures that businesses make informed choices aligned with their long-term goals and compliance requirements.

Industry Insights

Expert Opinions on Payment Provider Software Licensing

Industry experts share insights into the evolving landscape of payment provider software licensing, offering valuable perspectives for businesses.

Current Market Trends

Staying abreast of current market trends helps businesses remain competitive and make informed decisions regarding payment provider software licensing.

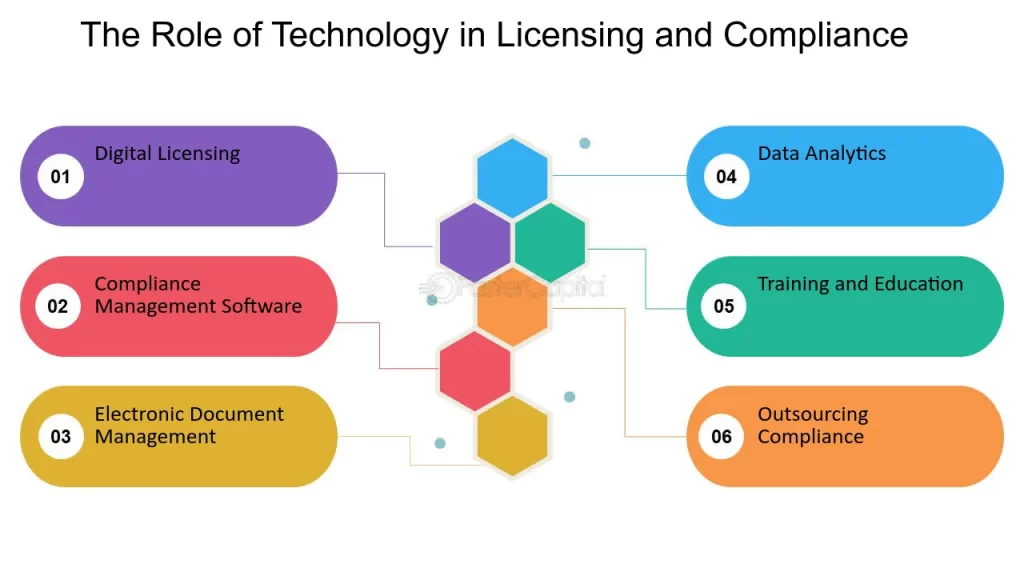

The Role of Technology in Licensing

Innovations Shaping the Licensing Landscape

Technological innovations, such as automation and artificial intelligence, are streamlining the licensing process, making it more efficient and user-friendly.

Automation and Streamlining Processes

The adoption of automated systems facilitates smoother interactions with regulatory bodies, reducing the burden on businesses seeking licenses.

Success Stories and Testimonials

Businesses Thriving with Licensed Payment Provider Software

Real-world success stories and testimonials highlight the positive impact of licensed payment provider software on businesses and customer experiences.

Customer Experiences

Understanding the experiences of customers using licensed payment provider software provides valuable insights for businesses aiming to enhance user satisfaction.

Conclusion

The journey through payment provider software licensing in India emphasizes the critical role of compliance, security, and strategic decision-making.

FAQs

A. What are the primary types of payment provider software licenses?

There are various types, including Prepaid Payment Instruments (PPI), Mobile Wallets, and Payment Aggregator licenses, each serving different purposes.

B. How long does it take to obtain a license in India?

The timeline varies, but businesses should expect a comprehensive process that may take several weeks to months.

C. Are there any exemptions from licensing requirements?

Exemptions are rare and typically depend on specific criteria outlined by regulatory authorities.

D. What steps can businesses take to ensure ongoing compliance?

Regular audits, staying updated on regulatory changes, and engaging legal counsel are crucial steps to maintain ongoing compliance.

E. How can businesses stay informed about regulatory changes?

Subscribing to regulatory updates, participating in industry forums, and collaborating with legal experts can help businesses stay informed about regulatory changes.