AUTHOR = DORA

DATE = 19/12/24

In India, education is highly valued[1], and many students aspire to pursue higher education at prestigious institutions, both domestically and internationally. However, the rising cost of education[2] has made it increasingly difficult for students to fund their dreams[3]. This is where student loans become essential. But with the complexity of various loan options, interest rates, eligibility criteria, and repayment plans, students often find themselves overwhelmed. To address these challenges, payment provider student loan[5] consulting services[4] have emerged as a vital resource to help students navigate the financial maze and make informed decisions.

The Growing Need for Student Loan Consulting Services

Education in India has seen a dramatic shift over the years, with more students seeking to study in both traditional universities and specialized courses. However, the rise in educational expenses, coupled with the growing gap in affordable financing options, has made student loans a necessity for many.

Key Services Provided by Student Loan Consultants

1. Loan Product Selection and Comparison

The initial step in securing a student loan is choosing the appropriate loan option. In India, various banks, non-banking financial companies (NBFCs), and government programs offer student loans. Each loan has different interest rates, repayment terms, and eligibility criteria. Consultants help students compare these options to identify the most affordable and suitable loan product for their needs.

They evaluate several factors such as:

- Loan Amount: The cost of education and additional expenses such as living costs, books, and travel

- Interest Rate: Fixed vs. floating interest rates and their impact on the total repayment

- Repayment Terms: Moratorium period, grace period, and post-graduation repayment options

- Eligibility Criteria: Academic requirements, income thresholds, co-applicant needs, etc.

By working with a consultant, students can be sure they are getting the best loan deal tailored to their specific circumstances.

2. Application Guidance and Documentation Support

Securing a student loan requires a considerable amount of paperwork and documentation. This can often be a confusing and tedious process, especially for first-time borrowers. Consultants guide students through the entire loan application process, helping them gather the necessary documents and ensuring that they meet all the eligibility criteria.

Common documents required for a student loan include:

- Admission letter from the educational institution

- Identity proof, address proof, and passport-size photographs

- Academic transcripts and certificates

By leveraging their expertise, consultants help students avoid common errors, reduce delays, and increase the chances of loan approval.

3. Financial Planning and Loan Repayment Strategy

Student loan consulting services not only help students secure a loan but also play a crucial role in financial planning. Once the loan is secured, consultants can assist students in developing a clear repayment strategy. This involves calculating the total cost of the loan over its tenure and understanding how monthly repayments will impact the student’s post-graduation financial stability.

Consultants help create a loan repayment schedule that considers the student’s potential salary post-graduation, career prospects, and possible deferment options. They also guide students on the best time to begin repayment, including options for prepayment or loan restructuring if necessary.

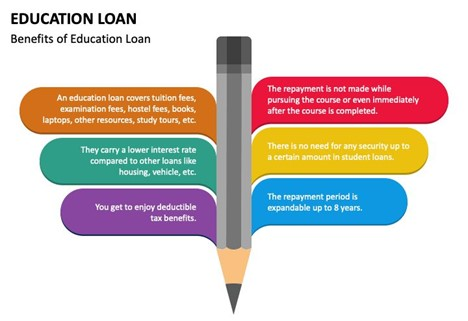

Benefits of Using Payment Provider Student Loan Consulting Services

1. Expert Guidance and Personalization

Consultants bring years of expertise to the table and offer personalized recommendations based on the student’s unique circumstances. They understand the nuances of student loans and offer customized solutions that address not only the immediate financial needs but also future career aspirations.

2. Faster Loan Approval Process

With their in-depth understanding of the loan application process, consultants can streamline the documentation and application procedure, ensuring that students meet all requirements. This leads to quicker approval times, helping students secure funding for their education without unnecessary delays.

3. Reduced Stress and Confusion

Navigating through the complexities of loan options, repayment structures, and eligibility criteria can be overwhelming for students and their families. By opting for consulting services, students can eliminate confusion and focus on their education rather than on financial worries.

Conclusion

In India, the growing demand for higher education and the escalating cost of tuition fees have made student loans an essential tool for many students. However, securing a student loan can be a daunting and complex process. This is where payment provider student loan consulting services play a pivotal role. These services offer expert guidance, streamline the application process, and ensure that students choose the most suitable loan for their needs. With personalized solutions, financial planning advice, and post-loan support, consultants help students achieve their educational goals without the stress of financial uncertainty. For students seeking a smooth and successful education journey, student loan consulting services have become an invaluable resource.

FAQs:

1. What are student loan consulting services?

Student loan consulting services help students navigate the entire process of securing a student loan. These services include assessing the student’s financial needs, comparing loan options, guiding them through the application process, assisting with documentation, and helping in loan repayment planning.

2. Why should I use a student loan consultant?

Using a student loan consultant provides several benefits:

- Expert Advice: Consultants offer professional advice on selecting the best loan option suited to your needs.

- Simplified Process: They streamline the application and documentation process, reducing the chances of errors and delays.

3. How do I choose the right student loan consultant?

When choosing a student loan consultant, consider the following factors:

- Experience and Expertise: Ensure the consultant has experience in handling student loans for both domestic and international education.

- Reputation: Look for reviews or testimonials from previous clients to gauge their reliability and trustworthiness.

4. What services do student loan consultants provide?

Student loan consultants offer a wide range of services, including:

- Loan Product Selection: Help you compare different student loan products based on interest rates, repayment terms, and eligibility.

- Application Assistance: Guide you through the loan application process, ensuring that all required documents are submitted correctly.

5. Are student loan consultants in India trustworthy?

Most student loan consultants in India are reliable and trustworthy, but like any service, it’s essential to do your research before hiring one. Look for consultants with a proven track record and positive customer reviews.

GET IN TOUCH ____