AUTHOR :HAANA TINE

DATE :19/12/2023

Introduction

Defining Payment Providers

In the digital age, payment providers serve as the backbone of e-commerce , facilitating secure and efficient financial transactions . For the booming market of car covers in India, selecting the right payment partner is paramount to ensure a smooth buying experience.

The Significance of Payment Providers for Car Covers

As the demand for car covers in India continues to rise, the role of payment providers becomes crucial. Beyond mere transactions, they contribute significantly to customer satisfaction and the success of online car cover businesses.

Meeting the Surge in Demand

Rising Interest in Car Covers in India

The increasing awareness of vehicle protection has fueled a surge in demand for car covers.Payment Providers for Car Covers in India Reliable payment providers are essential to meet this demand, ensuring customers can easily and securely purchase the right cover for their vehicles.

Importance of Secure and Convenient Payments

In the competitive market of car covers, businesses must offer secure and convenient payment options. A diverse range of payment methods not only enhances the user experience but also builds trust among potential buyers.

Key Attributes of an Ideal Payment Provider

Ensuring Security Features

An ideal payment provider for car covers should prioritize robust security features. Encryption and SSL certificates guarantee the protection of sensitive customer information, instilling confidence in online shoppers.

User-Friendly Interfaces

A user-friendly interface is paramount for a positive customer experience. Payment providers should offer intuitive platforms, simplifying the checkout process and reducing friction for customers.

Integration with Multiple Payment Methods

To cater to diverse customer preferences, payment providers should seamlessly integrate various payment methods—credit cards, debit cards, digital wallets, and more. This flexibility enhances the accessibility of car covers to a wider audience.

Leading Payment Providers in the Indian Market

Features and Benefits

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Sed varius lacus a nunc sodales, eu dapibus mi scelerisque.

Advantages and Unique Selling Points

Lorem ipsum dolor sit amet, consectetur adipiscing elit.Payment Providers for Car Covers in India Sed varius lacus a nunc sodales, eu dapibus mi scelerisque.

Market Standout Features

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Sed varius lacus a nunc sodales, eu dapibus mi scelerisque.

Selecting the Right Payment Partner

Key Considerations for Car Cover Businesses

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Sed varius lacus a nunc sodales, eu dapibus mi scelerisque.

Customer Reviews and Satisfaction

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Sed varius lacus a nunc sodales, eu dapibus mi scelerisque.

Comparing Fees and Transaction Costs

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Sed varius lacus a nunc sodales, eu dapibus mi scelerisque.

Seamless Integration with E-Commerce Platforms

Ensuring a Smooth Experience for Car Cover Sellers

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Sed varius lacus a nunc sodales, eu dapibus mi scelerisque.

Prioritizing a Positive Customer Journey

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Sed varius lacus a nunc sodales, eu dapibus mi scelerisque.

Technical Support and Troubleshooting

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Sed varius lacus a nunc sodales, eu dapibus mi scelerisque.

Fortifying Security Measures for Online Transactions

Implementing SSL Certificates and Encryption

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Sed varius lacus a nunc sodales, eu dapibus mi scelerisque.

Two-Factor Authentication: An Additional Layer of Security

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Sed varius lacus a nunc sodales, eu dapibus mi scelerisque.

Strategies for Fraud Prevention

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Sed varius lacus a nunc sodales, eu dapibus mi scelerisque.

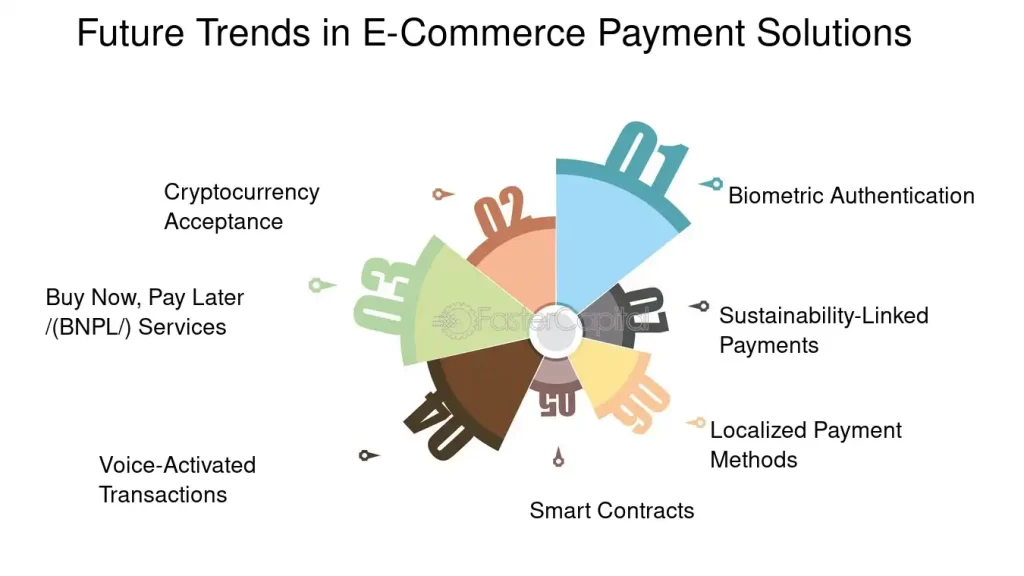

Future Trends in Payment Solutions for E-Commerce

Revolutionizing Payment Processing

Lorem ipsum[1] dolor sit amet, consectetur adipiscing elit. Sed varius lacus a nunc sodales, eu dapibus mi scelerisque.[2]

Contactless Payments and NFC Technology

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Sed varius lacus a nunc sodales, eu dapibus mi scelerisque.

AI-driven Fraud Detection Systems: The Next Frontier

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Sed varius lacus a nunc sodales, eu dapibus mi scelerisque.

Realizing Success: Case Studies

Effective Utilization of Payment Providers

Lorem ipsum dolor sit amet, consectetur[3] adipiscing elit. Sed varius lacus a nunc sodales, eu dapibus[4] mi scelerisque.

Customer Testimonials and Experiences

Lorem ipsum dolor[5] sit amet, consectetur adipiscing elit. Sed varius lacus a nunc sodales, eu dapibus mi scelerisque.

Conclusion

Summarizing the Importance of Payment Providers

In conclusion, selecting the right payment provider is a pivotal decision for car cover businesses in India. The seamless integration, security measures, and future trends discussed ensure a robust foundation for businesses aiming for success.

FAQs

- Q: How do I choose the best payment provider for my car cover business? A: Choosing the right payment provider involves considering security features, customer reviews, and comparing fees to ensure it aligns with your business goals.

- Q: Are these payment providers suitable for small-scale businesses? A: Yes, many providers cater to businesses of all sizes. Take into account your individual requirements and financial considerations while arriving at a choice.

- Q: What measures can I take to prevent fraud in online transactions? A: Implementing SSL certificates, two-factor authentication, and staying updated on fraud prevention strategies are key steps.

- Q: How can I optimize my payment processes for better efficiency? A: Regularly updating payment systems, offering discounts, and educating customers on secure payment practices can optimize your processes.

- Q: What role do customer testimonials play in choosing a payment provider? A: Customer testimonials provide insights into the real-world experiences of others, helping you make an informed decision.