HIMARI JONSON

DATE : 29 DEC, 2024

In the competitive world of jewelry[1] sales, both online and in physical stores, security is paramount. Consumers expect a smooth and safe transaction process, especially when dealing with high-value items such as diamonds, gold, or precious gemstones. Jewelry merchants must ensure that their payment systems[2] are not only efficient but also secure. In this guide, we will explore some of the best secure payment processors for jewelry transactions, helping businesses[3] protect both their profits and their customers’ data.

Understanding the Importance of Payment Security in Jewelry Transactions

The Rise of Online Jewelry Sales

With the increasing number of consumers shopping[4] online, the jewelry industry has experienced a boom in digital transactions. However, this has also led to an uptick in cybercrime. Jewelry merchants, therefore, must ensure their payment processing systems are fortified against fraud, data breaches, and unauthorized transactions. Customers expect nothing less than the highest standards of security, especially when purchasing[5] high-ticket items.

The Threats Faced by Jewelry Merchants

Jewelry businesses are often targeted by cybercriminals due to the high value of their products and transactions. Common threats include:

- Credit Card Fraud: Fraudulent transactions using stolen credit card information.

- Data Breaches: Theft of sensitive customer data, including personal details and payment information.

- Chargebacks: A situation where a customer disputes a payment, potentially resulting in lost revenue.

Given these risks, securing payment processes should be a top priority for jewelry retailers, both online and offline.

Features to Look for in a Secure Payment Processor

PCI DSS Compliance

The Payment Card Industry Data Security Standard is a global standard designed to secure payment card transactions and protect cardholders’ information. A PCI DSS-compliant payment processor is essential for any jewelry business to ensure that they meet the necessary security measures. These standards require encryption, secure data storage, and rigorous access controls.

Fraud Protection Tools

A secure payment processor should come with built-in fraud detection and prevention features. These include:

- Real-time transaction monitoring: Detecting suspicious activity instantly.

- Address Verification System (AVS): Checking the billing address provided by the cardholder against the one on file with the bank.

- CVV Verification: Verifying the card’s CVV (Card Verification Value) to ensure the transaction is legitimate.

Tokenization

Tokenization is the process of converting sensitive payment data into a non-sensitive token that can be used for transactions without exposing real account details. This helps to protect customer data from theft during transactions, adding an extra layer of security.

Encryption

Encryption ensures that sensitive payment details, such as credit card numbers and personal information, are protected during transmission. A secure payment processor should use SSL (Secure Sockets Layer) or TLS Transport Layer Security encryption to protect data.

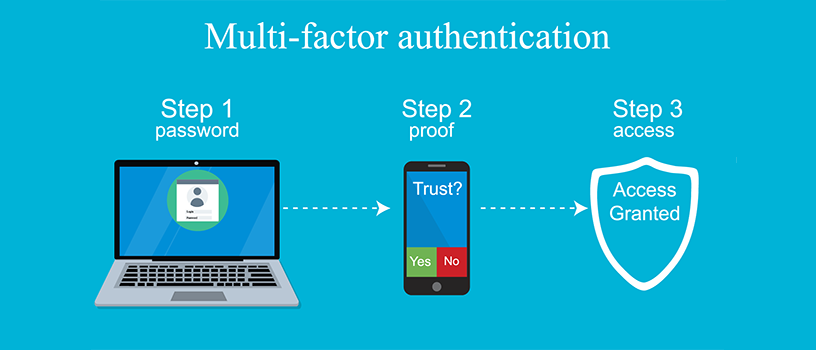

Multi-Factor Authentication (MFA)

MFA adds an extra layer of security by requiring users to provide more than one form of verification. This can include something they know (password), something they have (a phone or card), or something they are (fingerprint or facial recognition).

Top Secure Payment Processors for Jewelry Transactions

PayPal

PayPal is one of the most trusted payment processors worldwide, offering a high level of security. It provides:

- Buyer and Seller Protection: PayPal protects both buyers and sellers from fraud, chargebacks, and disputes.

- PCI DSS Compliance: PayPal adheres to the highest security standards for data protection.

- Fraud Prevention Tools: Includes features like 2FA, fraud detection algorithms, and encryption.

PayPal’s familiarity and ease of use make it a popular choice for both online and brick-and-mortar jewelry retailers.

Stripe

Stripe is another popular payment processor that offers robust security features tailored for high-value transactions, such as jewelry purchases. Its features include:

- PCI DSS Level 1 Compliance: Stripe provides one of the highest levels of payment security.

- Advanced Fraud Detection: Stripe uses machine learning models to analyze transaction patterns and detect fraudulent behavior.

- Tokenization & Encryption: Sensitive customer data is never stored in plaintext; it is tokenized and encrypted to reduce the risk of data breaches.

Stripe’s user-friendly integration and transparent fee structure make it a great option for jewelry businesses looking to scale.

Square

known for its ease of use, particularly for small jewelry businesses that may also operate in-person stores. Square offers:

- End-to-End Encryption: encrypts payment details to protect sensitive customer data.

- EMV Chip Card Support: allows businesses to accept EMV chip cards, which are more secure than traditional magnetic stripe cards.

- Integrated Fraud Prevention: includes tools to detect and block fraudulent activity, providing merchants with peace of mind.

Authorize.Net

Authorize.Net is a trusted payment processor used by businesses of all sizes, including jewelry retailers. Key security features include:

- Tokenization: Payment information is tokenized to prevent unauthorized access.

- Advanced Fraud Detection Suite: Includes tools like IP filtering, velocity filters, and the ability to block high-risk transactions.

- PCI DSS Compliance: Authorize.Net meets PCI DSS standards, ensuring that merchants adhere to industry best practices for data security.

Authorize.Net is particularly beneficial for businesses that need a highly customizable payment processing solution.

Braintree

Braintree, a subsidiary of PayPal, is a secure payment processor that supports global transactions. Its features include:

- Full Compliance with PCI DSS: Braintree ensures that all transactions are processed securely.

- Tokenization & Encryption: Payment information is encrypted and tokenized, reducing the risk of exposure.

- Mobile Payment Integration: Braintree supports mobile wallets like Apple Pay and Google Pay, ensuring a seamless and secure shopping experience for customers.

Braintree is ideal for businesses that wish to cater to a global audience and offer a variety of payment options.

Conclusion

For jewelry businesses, whether online or offline, ensuring that payment transactions are secure is non-negotiable. Consumers trust merchants who prioritize the safety of their personal and financial information, and a secure payment processor can help businesses meet this expectation. Key features like PCI DSS compliance, fraud prevention tools, encryption, and tokenization are essential in protecting both businesses and customers from potential threats.

FAQ

PayPal

- Pros:

- Widely recognized and trusted by customers.

- Offers buyer protection, which can enhance trust.

- Easy integration with websites and eCommerce platforms.

- Secure encryption for both buyers and sellers.

- Cons:

- Fees can be high for international transactions or currency conversions.

- Chargebacks can be problematic, especially for high-value items like jewelry.

Stripe

- Pros:

- Seamless integration with most eCommerce platforms.

- Supports one-time payments, subscriptions, and invoicing.

- Strong fraud protection mechanisms, including machine learning-based detection.

- No setup fees or monthly fees.

- Cons:

- Requires technical setup (ideal for businesses with developers).

- Chargebacks can still occur, though Stripe has mechanisms for handling disputes.

Square

- Pros:

- Excellent for both online and in-person payments (via card readers).

- No monthly fee, only transaction fees.

- Built-in fraud prevention tools and strong security features.

- Detailed reporting and inventory management, ideal for small businesses.

- Cons:

- International payment options are limited.

- Not as many advanced features as PayPal or Stripe for large-scale operations.

Shopify Payments

- Pros:

- Seamless integration if you’re using Shopify for your online store.

- Competitive transaction fees, especially if using Shopify’s own payment gateway.

- Built-in security measures, including PCI-DSS compliance.

- Supports multiple currencies and international transactions.

- Cons:

- Only available to Shopify merchants (i.e., not a standalone option).

- Limited control over the payment gateway (less flexibility).

Authorize.Net

- Pros:

- Highly trusted processor for jewelry businesses.

- Advanced fraud prevention tools, including the Address Verification System (AVS) and real-time fraud detection.

- Works with most shopping carts and payment gateways.

- Cons:

- Setup and transaction fees may be higher compared to some other processors.

- Requires technical knowledge for setup and customization.