AUTHOR : RIVA BLACKLEY

DATE : 08/12/2023

Introduction

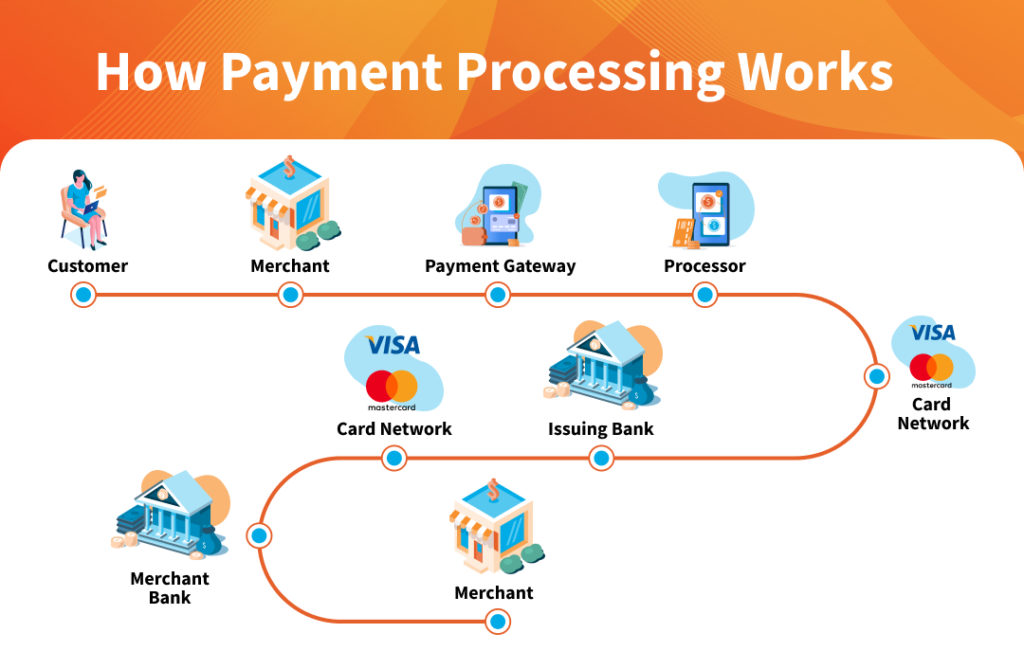

In the dynamic landscape of commerce[1], subscription billing has emerged as a game-changer, transforming the way businesses operate and customers consume services. As the demand for subscription-based models continues to soar in India, the role of payment processors[2] in facilitating seamless transactions[3] becomes paramount.

The Rise of Subscription Models in India

inesses adopting subscription models, spanning industries such as streaming services, software[4]as a service (SaaS), and e-commerce. This shift has not only revolutionized revenue streams but has also led to a paradigm shift in the payment processing[5] industry, necessitating robust solutions tailored for subscription billing.Payment Processor Subscription Billing in India.

Key Features of Payment Processors for Subscription Billing

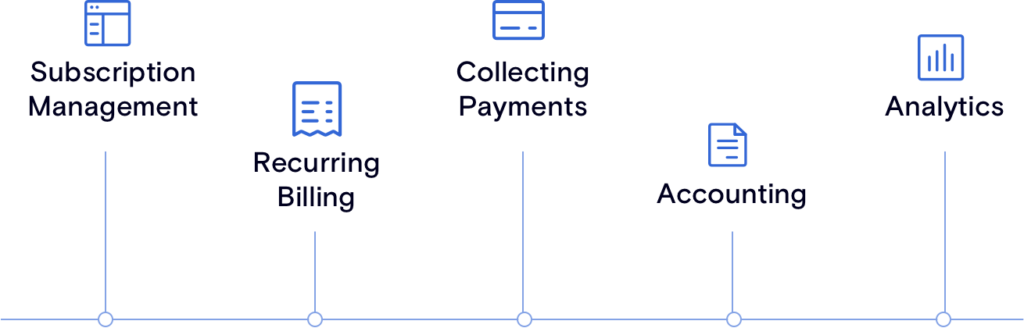

Ensuring the success of subscription billing requires payment processors equipped with advanced security measures, seamless integration capabilities, and customization options to accommodate diverse business needs. These features collectively contribute to a frictionless payment experience for both businesses and their customers.

Popular Payment Processors in India

In the vast landscape of payment processors, several players have emerged as leaders in the Indian market. From industry giants to innovative startups, each brings a unique set of offerings specifically designed to cater to the complexities of subscription billing.Payment Processor Subscription Billing in India.

Challenges and Solutions

While subscription billing presents lucrative opportunities, it comes with its set of challenges. Addressing security concerns, managing recurring payments effectively, and ensuring regulatory compliance are key hurdles that businesses and payment processors must navigate. Innovative solutions and proactive measures are crucial to overcoming these challenges.

Benefits of Using Payment Processors for Subscription Billing

The integration of robust payment processors brings forth a myriad of benefits. From streamlining payment processes and enhancing customer experience to improving overall business efficiency, the advantages are tangible and contribute to the long-term success of subscription-based businesses.

How to Choose the Right Payment Processor

Choosing the right payment processor[1] is a critical decision for businesses venturing into subscription billing. Factors such as security features, integration capabilities, and a proven track record should be carefully considered. Real-world[2] case studies of successful implementations can provide valuable insights.

Case Studies: Successful Subscription Businesses in India

Examining successful subscription businesses in India sheds light on effective payment processor utilization. These case studies not only showcase the diversity of subscription models but also highlight the pivotal [3]role payment processors play in their sustained success.

Future Trends in Payment Processing for Subscription Billing

As technology[4] evolves and consumer preferences shift, the future of payment processing in subscription billing is poised for significant advancements. Predictions include enhanced automation, increased personalization, and the integration of emerging technologies to meet evolving market demands.

The Importance of Seamless User Experience

A seamless user experience is paramount in subscription billing. User-friendly interfaces, mobile compatibility, and the assurance of speed and reliability contribute to customer satisfaction and retention, emphasizing the role of payment processors in fostering positive interactions.

Ensuring Security in Subscription Transactions

Security is a non-negotiable aspect of subscription transactions. Implementing SSL certificates, two-factor authentication, and robust fraud prevention measures are essential in safeguarding sensitive information and building trust among consumers.

The Role of Digital Wallets in Subscription Billing

The integration of digital wallet[5]s adds another layer of convenience to subscription billing. Exploring the benefits for both consumers and businesses, digital wallets provide a secure and efficient payment method, contributing to the overall success of subscription-based models.

Comparing Subscription Billing Models

Choosing between one-time payments and recurring subscriptions involves a nuanced evaluation of pros and cons. Examining the advantages and challenges of each model helps businesses tailor their subscription billing strategy to align with their specific goals and target audience.

Tips for Successful Implementation

Successful implementation of subscription billing requires meticulous planning, thorough testing, and proactive monitoring. Additionally, robust customer support strategies play a crucial role in addressing inquiries and concerns promptly, fostering positive customer relationships.

Conclusion

In conclusion, the landscape of for subscription billing in India is evolving rapidly, mirroring the growth of subscription-based businesses. The integration of advanced features, coupled with a focus on user experience and security, positions payment processors as integral partners in the success of these models.

FAQS

- Are payment processors necessary for subscription billing?

- Yes, payment processors play a crucial role in facilitating secure and seamless transactions for subscription-based businesses.

- What security measures should businesses prioritize in subscription transactions?

- SSL certificates, two-factor authentication, and robust fraud prevention measures are essential for ensuring the security of subscription transactions.

- How can businesses choose the right payment processor for their subscription model?

- Consider factors such as security features, integration capabilities, and review real-world case studies of successful implementations.

- What role do digital wallets play in subscription billing?

- Digital wallets provide a secure and efficient payment method, adding convenience for both consumers and businesses engaged in subscription billing.

- How can businesses overcome challenges in subscription billing, such as regulatory compliance?

- Proactive measures, staying informed about regulations, and implementing compliant practices are key to overcoming challenges in subscription billing.