AUTHOR : RIVA BLACKLEY

DATE : 13/12/2023

Introduction

In the dynamic landscape of India’s travel industry, the role of payment providers[1] has become increasingly pivotal. As the nation embraces digital transformation[2], the payment methods[3] for travel have evolved significantly. This article[4] delves into the nuances of payment provider travel in India, exploring its evolution, significance, challenges, and future trends.

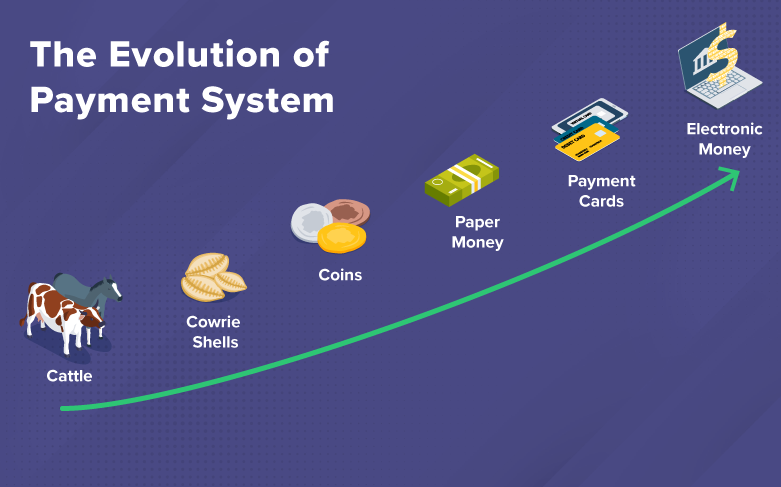

Evolution of Payment Methods in India

India, known for its diverse culture, has witnessed a transformative shift in payment methods. From traditional cash transactions[5] to the rise of digital solutions, the journey has been remarkable. In recent years, the convenience of digital payments has reshaped how individuals book and pay for their travel expenses.

Significance of Payment Providers in the Travel Sector

The integration of payment providers into the travel sector has redefined the customer experience. Travelers now expect seamless booking processes, and payment providers play a crucial role in meeting these expectations. Beyond convenience, these providers ensure the security and prevention of fraud, instilling trust in users.

Popular Payment Providers in India

Several payment providers have established themselves as leaders in the Indian travel market. Analyzing the features and benefits they offer can help travelers make informed choices. From efficient transaction processing to exclusive discounts, these providers cater to diverse customer needs.

Challenges Faced by Payment Providers

Despite their pivotal role, payment providers encounter challenges such as security concerns and building user trust. Addressing these challenges is crucial for the sustained growth of digital payment solutions in the travel industry.

Innovations in Payment Technologies

Technological advancements have given rise to innovations like mobile wallets and contactless payments. These solutions not only enhance user convenience but also contribute to the overall efficiency of travel transactions.

Impact of Payment Providers on Travel Businesses

The collaboration between payment providers and travel businesses has resulted in increased customer satisfaction and improved operational efficiency. Seamless transactions contribute to a positive overall travel experience.

User-Friendly Interfaces and Accessibility

The importance of user-friendly interfaces cannot be overstated. Payment providers need to cater to diverse demographics, ensuring that their services are accessible and easy to navigate for all users.

Collaborations between Payment Providers and Travel Companies

Successful collaborations between payment[1] providers and travel companies create a win-win situation. Examining case studies sheds light on how partnerships contribute to mutual benefits and growth.

Future Trends in Payment Provider Travel in India

The future holds exciting possibilities for payment provider travel[2] in India. Predictions for evolving technologies and market trends are essential for both providers and consumers to stay ahead in the dynamic landscape.

Regulatory Landscape

Compliance with regulations is a critical aspect of the payment provider travel industry[3]. Navigating the regulatory landscape[4] poses challenges, but it also fosters adaptability and innovation.

Customer Reviews and Testimonials

Positive feedback from customers builds trust in the travel-payment ecosystem. Examining customer reviews and testimonials highlights the importance of user satisfaction and can guide improvements in services.

Global Perspectives on Payment Provider Travel

Comparisons with international markets provide valuable insights. Understanding global trends and innovations allows stakeholders in the Indian travel industry to adapt and innovate effectively.

Educational Initiatives by Payment Providers

Promoting financial literacy and user awareness programs are initiatives that contribute to the growth of the payment provider travel ecosystem. Educated users are more likely to embrace digital [5]payment solutions.

Conclusion

In conclusion, the intertwining of payment providers and the travel industry in India is a fascinating journey. From overcoming challenges to embracing innovations, the partnership between these two sectors has redefined how individuals experience and pay for travel.

FAQS

- Are digital payment methods secure for travel transactions?

- Yes, digital payment methods incorporate advanced security measures to ensure safe transactions.

- How do payment providers contribute to the efficiency of travel businesses?

- Payment providers streamline transactions, reducing processing times and improving operational efficiency.

- What future technologies are expected to impact payment provider travel in India?

- Emerging technologies like blockchain and artificial intelligence are expected to shape the future of payment provider travel.

- Do payment providers collaborate with international travel companies?

- Yes, many payment providers form strategic partnerships with international travel companies to enhance their global reach.

- How can users contribute to the improvement of payment provider services?

- Providing feedback and reviews can help users contribute to the continuous improvement of payment provider services.