AUTHOR : RIVA BLACKLEY

DATE : 09/12/2023

Introduction

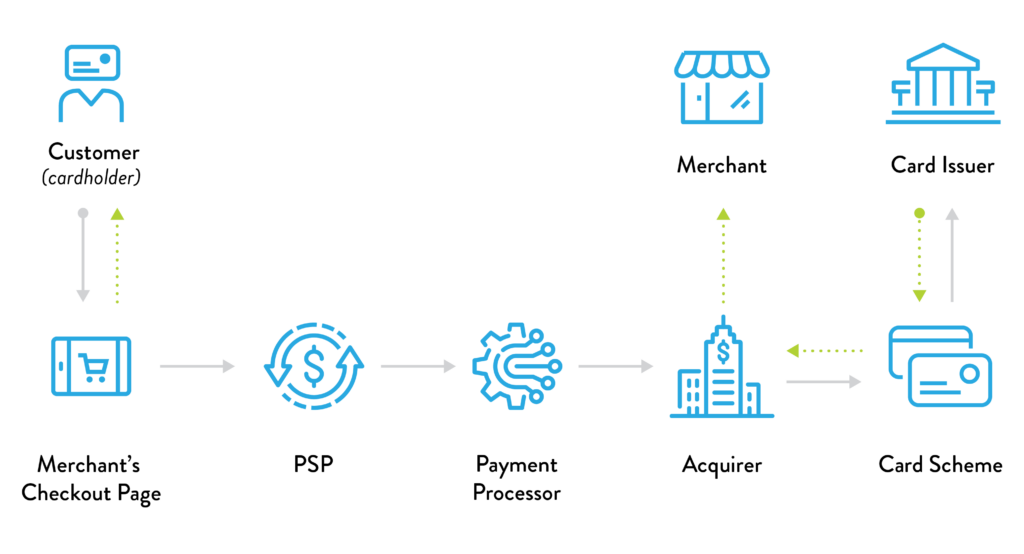

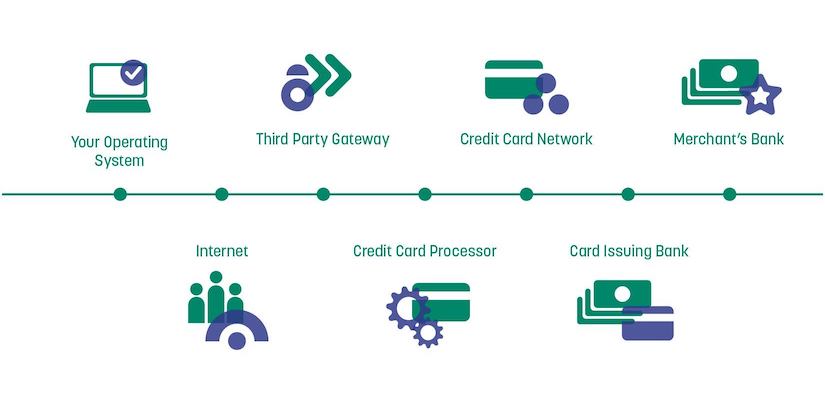

In the fast-paced landscape of business[1] operations, choosing the right payment processor[2] is akin to laying a robust foundation. Payment processors streamline transactions[3], manage financial data[4], and contribute to the overall efficiency of a business[5]. With the myriad of options available, businesses in India are increasingly turning to trial offers as a strategic approach to finding the perfect fit.

Why Payment Processor Trials Matter

Cost Considerations for Businesses

Implementing a new payment processor involves costs, and businesses are often wary of committing without a thorough evaluation. Trial offers provide a risk-free window for businesses to test the waters without a significant financial.

Evaluating Features and Compatibility

Different businesses have unique needs. Payment processor trials allow businesses to assess the features and compatibility of a platform with their operations, ensuring a seamless fit.

Popular Payment Processors in India

India boasts a diverse market of payment processors, each with its own set of features and advantages. Understanding the key players and their offerings is essential for businesses seeking the right fit.

Overview of Key Players

From industry giants to innovative startups, the payment processing market in India includes players like Razorpay, Paytm, and Instamojo. Each brings something distinctive to the table, catering to different business requirements.Payment Processor Trial Offers in India

Unique Features of Each Processor

While some processors specialize in catering to small businesses, others focus on enterprise solutions. Exploring the unique features of each processor helps businesses align their needs with the available offerings.Payment Processor Trial Offers in India

Benefits of Payment Processor Trials

Cost Savings During the Trial Period

One of the primary advantages of payment processor trials is the cost-saving aspect. Businesses can utilize the trial period to assess the impact on their finances and determine if the processor is a sound investment.

Customization and Scalability Advantages

Trial periods also provide businesses the opportunity to test customization options and scalability features. This is crucial for businesses anticipating growth and expansion in the future.

How to Choose the Right Payment Processor

Understanding Business Needs

Before embarking on a trial, businesses must clearly understand their unique requirements. Whether it’s high transaction volumes or specific security features, aligning these needs with a processor’s offerings is paramount.

Researching Trial Offerings

Not all trial offers are created equal. Businesses should conduct thorough research on the trial periods offered by different processors, considering factors like duration, features, and support.

Navigating Trial Periods Successfully

Utilizing Customer Support

During the trial, businesses may encounter challenges or have queries. Optimal utilization of customer support channels can provide valuable insights and ensure a smooth trial experience.

Testing Integration with Existing Systems

Compatibility with existing systems is a critical aspect of a payment processor’s effectiveness. Testing integration during the trial helps identify potential issues and allows for seamless adoption.

Case Studies: Successful Implementations

Real-World Examples of Businesses Benefiting from Trials

Several businesses in India have successfully leveraged payment processor[1] trials to enhance their operations. Case studies shed light on how these businesses navigated the trial period and achieved positive outcomes.

Lessons Learned from These Experiences

Analyzing the experiences of businesses that have gone through payment processor trials offers valuable lessons for others considering a similar path.

Potential Challenges and Solutions

Technical Issues During the Trial

No trial is without its challenges. Businesses may face technical[2] issues that could disrupt operations. Having contingency plans and quick solutions in place is crucial.

Addressing Concerns About Security

Security concerns often deter businesses from fully embracing payment processor trials. Addressing these concerns transparently and implementing robust security[3] measures can instill confidence.

Future Trends in Payment Processing

Emerging Technologies and Their Impact

The payment processing landscape [4]is dynamic, with constant technological advancements. Exploring future trends provides businesses with insights into potential developments that may influence their choice of a payment processor.

How Trial Offers May Evolve

As technology[5] evolves, so do trial offers. Understanding how trial offers may evolve in the future helps businesses stay ahead of the curve and make informed decisions.

Conclusion

In the ever-evolving landscape of payment processing in India, trial offers emerge as a strategic pathway for businesses to find the perfect fit. The benefits, lessons learned from case studies, and insights from industry experts collectively underscore the significance of leveraging trial periods for optimal results. As businesses continue to grow and adapt, payment processor trials remain a valuable tool in their arsenal.

FAQS

- What should I look for in a payment processor trial?

- Consider the specific needs of your business, trial duration, features offered, and the level of customer support.

- How long do payment processor trials typically last?

- The duration varies, but common trial periods range from 14 to 30 days. It’s essential to choose a duration that allows thorough testing.

- Are there any hidden costs during the trial period?

- Transparency is key. Ensure you understand all terms and conditions to avoid unexpected costs.

- Can I switch payment processors after the trial?

- Yes, many businesses choose to switch if the trial reveals a better fit elsewhere. Ensure a smooth transition plan.

- How can I ensure a smooth transition post-trial?

- Plan ahead, communicate with your team, and leverage customer support for a seamless transition to full implementation.