AUTHOR NAME : JASMINE

DATE : 20/12/2023

Introduction

In the dynamic landscape of payment processing corporate transactions, efficient stands as a cornerstone for the seamless functioning of businesses in India. The ability to manage financial transactions swiftly and securely is pivotal processing for corporate success. This article delves into the nuances of payment processing for corporate clientele in India, addressing challenges, exploring solutions, and envisioning the future.

Payment processing is the lifeline of corporate transactions clientele in India ,encompassing a series of steps to authorize, complete, and record financial transactions. For businesses in India, this process holds particular significance, given the diverse and expansive nature of the corporate sector.

Importance of Efficient Payment Processing

Efficient payment processing clientele in India is more than just moving money from one account to another; it’s about streamlining financial transactions to enhance overall business operations. Corporates rely on timely payments for smooth cash flow, vendor relationships, and maintaining a positive market reputation. A robust payment system also builds trust and credibility among stakeholders, fostering long-term business relationships.

Challenges in Payment Processing for Corporates in India

The Indian corporate landscape faces several challenges in payment for Corporate Regulatory complexities, diverse payment methods, and security concerns pose hurdles that require strategic solutions. Navigating these challenges is crucial for corporations aiming for a competitive edge in the market payment automation[1].

Popular Payment Solutions for Corporate Clients

Corporates in India utilize a variety of payment solutions to meet their diverse needs. Corporate Payments Solutions[2]

From traditional methods like NEFT and RTGS to modern approaches like UPI and mobile wallets, the payment landscape is vast. Corporate credit cards also play a significant role in facilitating business transactions. Understanding the suitability of each option is key for corporations aiming for efficiency.

Role of Fintech Companies

Fintech companies have emerged as game-changers in the realm of corporate payment processing. Their innovative solutions, Enterprise Payment Processing[3]

customized payment platforms, and focus on improving efficiency and speed align with the dynamic needs of corporate clients. Embracing Fintech solutions has become a strategic move for companies seeking to stay ahead in the digital age.

Adopting Digital Transformation in Payment Processing

Digital transformation is more than a buzzword; it’s a necessity for corporations in India. Integrating ERP systems, automating invoicing and reconciliation, and enhancing financial visibility are critical components of this transformation. Corporates that embrace digitization find themselves better equipped to navigate the complexities of modern payment[4] processing.

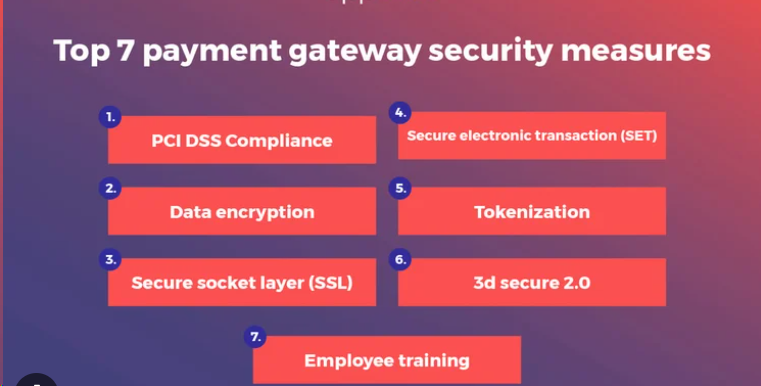

Security Measures in Corporate Payment Processing

With the rise of digital transactions, security is a paramount concern. Encryption and tokenization, multi-factor authentication, and robust fraud detection and prevention mechanisms are essential for safeguarding corporate transactions. This section explores the measures corporations can adopt to ensure the integrity and confidentiality of their financial data.

Case Studies

Real-world examples provide insights into the practical benefits of improving payment processes. Success stories of companies that have streamlined their payment workflows showcase the positive impact on their operations. These case studies serve as inspiration for other corporates looking to enhance their payment processing capabilities.

The Future of Corporate Payment Processing

As technology continues to evolve, so does the landscape of corporate payment processing. This section explores the upcoming Digital Payments Trends[5] anticipated regulatory changes, and the impact of globalization on corporate transactions. Staying abreast of these developments is crucial for corporations aiming for sustained success.

Selecting the Right Payment Processor

Choosing the right payment processor is a decision that can significantly impact a corporation’s efficiency and cost-effectiveness. This section provides insights into the factors corporations should consider when selecting a payment processor, tips for evaluating service providers, and the importance of scalability.

Customer Testimonials

Understanding the experiences of other corporate clients is invaluable. This section features testimonials from businesses that have improved their payment processing with positive outcomes. Real-world feedback provides prospective clients with a practical understanding of the benefits they can expect.

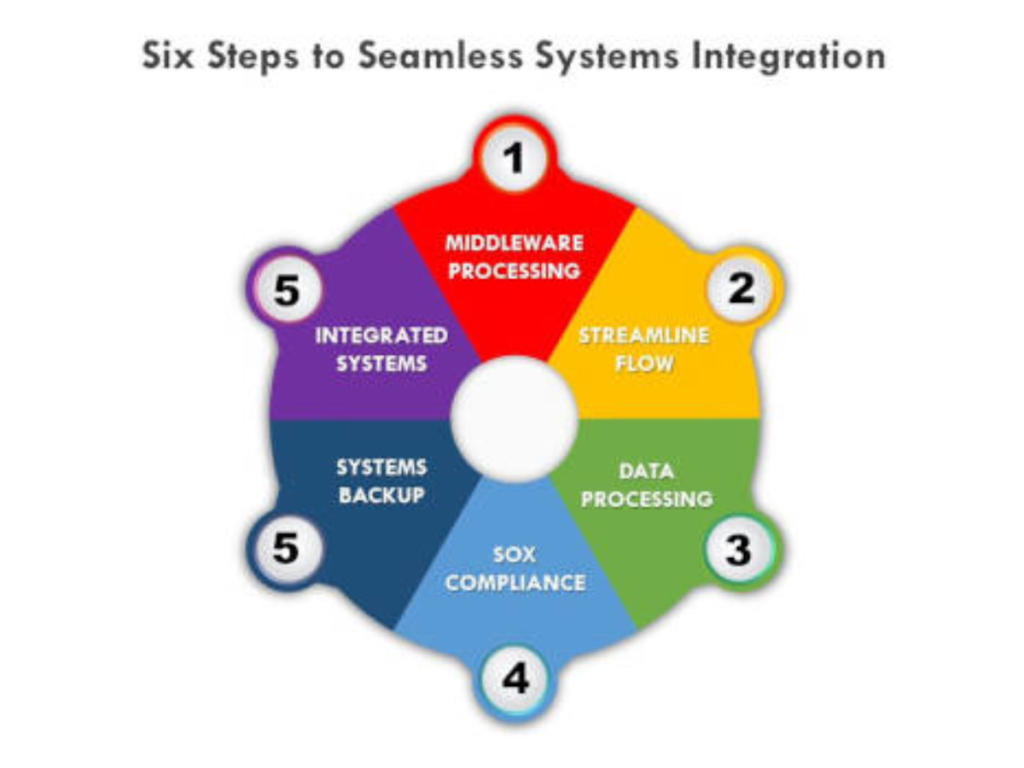

Tips for Seamless Integration

Implementing a new payment processing system requires careful planning and execution. This section offers practical tips for corporates to seamlessly integrate new payment solutions into their existing workflows. From strategic planning to ongoing support, these tips ensure a smooth transition.

Ensuring Compliance with Indian Regulations

Navigating the regulatory landscape is a critical aspect of corporate payment processing. Staying updated with RBI guidelines, understanding tax implications, and addressing legal considerations are paramount for ensuring compliance. This section provides a roadmap for corporates to navigate the regulatory maze successfully.

Conclusion

In conclusion, payment processing for corporate clientele in India is a multifaceted challenge that requires strategic planning and innovative solutions. By understanding the importance of efficient payment processing, navigating challenges, embracing digital transformation, and prioritizing security, corporates can position themselves for sustained success in the evolving business landscape.

FAQs

- What are the common challenges in corporate payment processing?

- Addressing regulatory complexities, diverse payment methods, and security concerns are common challenges in corporate payment processing.

- How can Fintech companies benefit corporate clients?

- Fintech companies offer innovative solutions, customized payment platforms, and improved efficiency, benefiting corporate clients in the digital age.

- What security measures should corporates prioritize?

- Corporates should prioritize encryption, tokenization, multi-factor authentication, and robust fraud detection to ensure the security of their financial transactions.

- How does digital transformation impact payment processing?

- Digital transformation impacts payment processing by integrating ERP systems, automating processes, and enhancing overall financial visibility.

- What are the future trends in corporate payment technology?

- Future trends in corporate payment technology include advancements in digital solutions, anticipated regulatory changes, and the impact of globalization on transactions.