Author : Sweetie

Date : 26/12/2023

Introduction

Understanding High-Risk PSP and Bad Credit in India

In a financial landscape where creditworthiness holds the key to various opportunities, the concept of high-risk PSP and bad credit[1] has gained prominence, especially in a diverse country like India. Let’s delve into the intricacies of these terms and explore how individuals facing credit challenges[2] can navigate their financial journey.

Definition of High-Risk PSP

High-Risk PSP, short for High-Risk[3] Payment Service Provider, is a financial entity that specializes in serving individuals with low credit scores or a history of financial challenges. These institutions play a crucial role in providing financial services to a segment often overlooked by traditional banking systems.

Significance of Credit Score in India

In the Indian financial[4] landscape, your credit score is more than just a number; it’s a gateway to various financial opportunities. Whether it’s securing a loan, applying for a credit card[5], or even renting a house, a good credit score opens doors that might otherwise remain closed.

Understanding Bad Credit in India

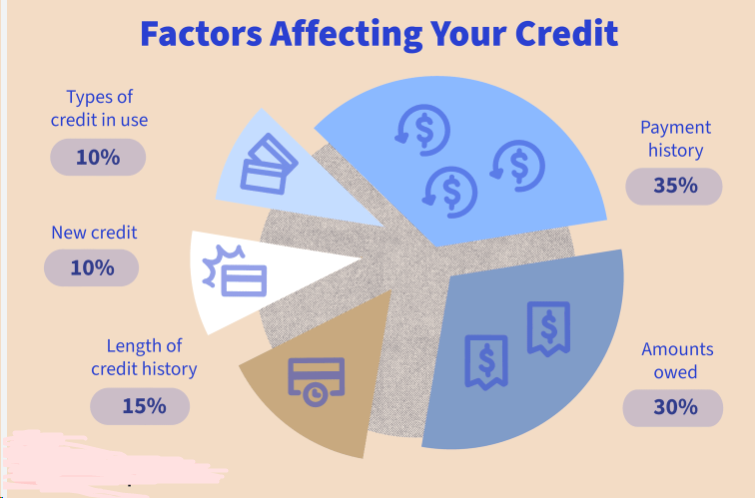

Factors Affecting Credit Score

Numerous factors contribute to an individual’s credit score, including timely payment of bills, outstanding debts, and the length of their credit history. Understanding these elements is crucial to comprehending the reasons behind a low credit score.

Impact of Bad Credit on Financial Opportunities

Bad credit can significantly hinder an individual’s ability to access financial services on favorable terms. From higher interest rates to difficulty in loan approvals, the consequences of a poor credit score are far-reaching.

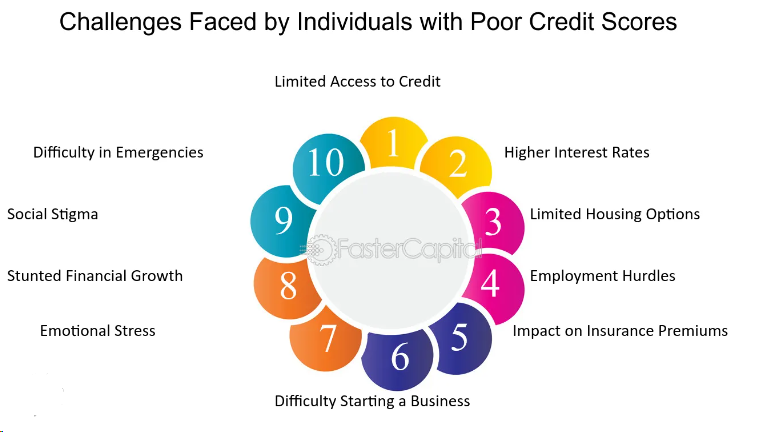

Challenges Faced by Individuals with Bad Credit

Limited Access to Financial Services

One of the primary challenges faced by individuals with bad credit is limited access to mainstream financial services. Traditional banks may hesitate to extend credit, leaving individuals with fewer options.

Higher Interest Rates

Even when individuals with bad credit manage to secure a loan, they often face higher interest rates. Lenders perceive them as riskier, necessitating increased interest to compensate for the potential default.

Difficulty in Loan Approvals

Loan approvals become a daunting task for those with bad credit. High-risk PSPs step in to bridge this gap, offering alternatives to individuals who might otherwise be excluded from the financial ecosystem.

Strategies to Improve Credit Score

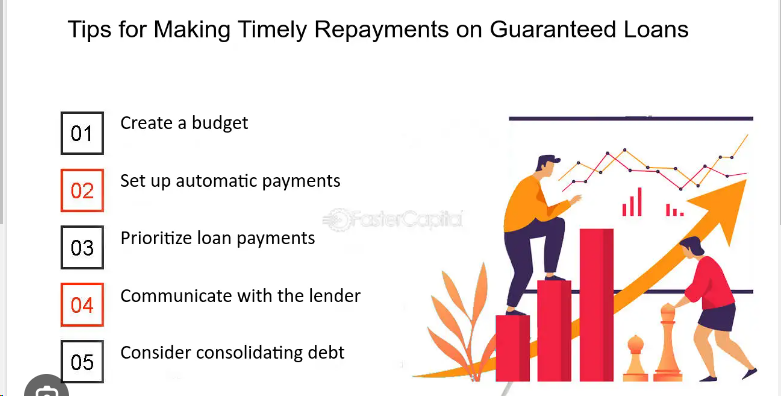

Timely Repayment of Debts

One of the most effective ways to improve a credit score is by making timely repayments of existing debts. This not only positively impacts the credit score but also reflects responsible financial behavior.

Monitoring Credit Reports

Regularly monitoring credit reports allows individuals to identify inaccuracies and address them promptly. It’s an essential step in maintaining an accurate representation of one’s creditworthiness.

Seeking Professional Assistance

Credit counseling services and financial advisors can provide valuable insights into improving credit scores. Their expertise can guide individuals in making informed financial decisions.

Alternative Financial Solutions for High-Risk Individuals

Specialized Lending Institutions

High-risk PSPs and other specialized lending institutions offer financial products designed to meet the unique needs of individuals with bad credit. These may include loans with flexible terms and lower entry barriers.

Government Initiatives

In some cases, government initiatives aim to support individuals facing financial challenges. These initiatives may include subsidies, loan programs, or financial education[1] campaigns to empower individuals in improving their financial situation.

The Role of Technology in Assessing Credit Risk

AI and Machine Learning Applications

Advancements in technology have led to the integration of AI and machine learning in credit risk[2] assessment [2]. These applications provide a more nuanced and accurate evaluation of an individual’s creditworthiness.

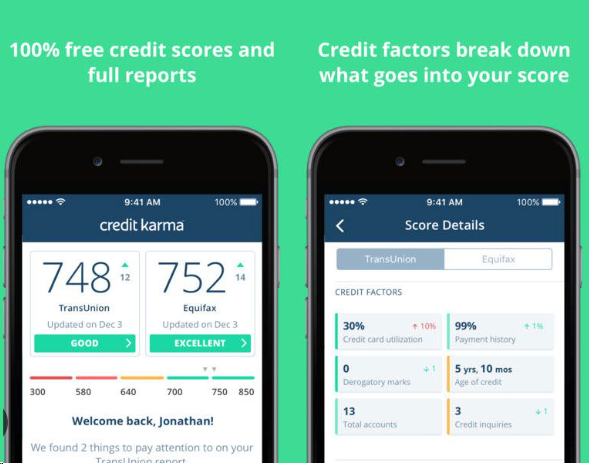

Mobile Apps for Credit Monitoring

Several mobile apps offer real-time credit monitoring, allowing individuals to track changes in their credit score and receive alerts for potential issues. This proactive approach empowers users to stay on top of their financial health.

Exploring High-Risk PSP in Other Countries

Global Perspectives

High-Risk PSPs exist not only in India but are a global phenomenon[3]. Exploring their role in other countries provides insights into the variations and similarities in addressing the financial needs of high-risk individuals.

Comparative Analysis with India

Comparing the approaches of different countries in managing high-risk individuals offers a broader perspective on the effectiveness of various strategies and policies.

Testimonials from Financial Experts

Insights from Credit Analysts

Credit analysts share their insights into the challenges faced by high-risk individuals and the role of High-Risk PSPs in the financial ecosystem. Their perspectives provide a professional understanding of the dynamics at play.

Advice for Individuals with Bad Credit

Financial experts offer practical advice for individuals looking to improve their credit scores[4]. These tips may include budgeting strategies, debt management techniques, and long-term financial planning.

Future Trends in Credit Risk Assessment

Evolving Technologies

The future of credit risk assessment is intertwined with evolving technologies. From blockchain to advanced data analytics, the landscape is dynamic, promising more accurate evaluations and better financial solutions.

Anticipated Changes in Lending Practices

As technology[5] reshapes the financial industry, the way lending practices operate is likely to undergo significant changes. Anticipating these shifts is essential for individuals navigating the financial landscape.

Conclusion

Understanding the dynamics of high-risk PSPs and bad credit in India is crucial for individuals seeking financial stability. From identifying challenges to exploring alternative solutions, the journey towards financial health requires informed decision-making.For individuals facing the challenges of bad credit, there is hope. With proactive measures, informed choices, and a commitment to financial well-being, it’s possible to overcome the obstacles and build a secure financial future.

Unique FAQs

- Can a bad credit score be improved, and how long does it take?

Improving a credit score is possible through consistent efforts such as timely repayments and responsible financial behavior. The duration varies, but positive changes may be noticeable within a few months. - How do high-risk PSPs differ from traditional banks in serving individuals with bad credit?

High-risk PSPs specialize in catering to individuals with bad credit and offering tailored financial products. Unlike traditional banks, they often have more flexible terms and a higher acceptance rate. - Are government initiatives effective in supporting individuals with bad credit?

Government initiatives play a crucial role, offering financial support and education. While their effectiveness may vary, they contribute to creating a more inclusive financial environment. - What role does technology play in assessing credit risk, and is it reliable?

Technology, including AI and machine learning, enhances credit risk assessment. When implemented responsibly, these technologies provide a more accurate and reliable evaluation of an individual’s creditworthiness. - Can individuals with bad credit still access quality financial services?

Yes, individuals with bad credit can access quality financial services through high-risk PSPs and specialized lending institutions. These entities design products to meet the unique needs of this demographic.