AUTHOR : JAYOKI

DATE : 21/12/2023

Introduction

In the dynamic landscape of the financial sector, Payment Service Providers (PSPs) play a pivotal role in facilitating seamless transactions. However, the realm of PSPs isn’t one-size-fits-all, with some businesses falling under the category of high-risk PSPs. This article delves into the intricacies of high-risk PSP business development in India, shedding light on the challenges, opportunities, and strategies for success.

Understanding High-Risk PSP Business

High-risk PSPs, by definition, operate in industries or markets that pose elevated risks, such as e-commerce, gaming, or adult entertainment. Recognizing the unique characteristics of these businesses is crucial for comprehending the challenges they face and the potential rewards they can reap.

Current Scenario in India

India’s payment landscape has undergone a significant transformation, with a surge in digital transactions and the widespread adoption of mobile payment platforms. Despite this, the regulatory environment presents hurdles for high-risk PSPs, requiring a nuanced understanding of the local market.

Challenges Faced by High-Risk PSPs in India

Navigating legal and regulatory complexities tops the list of challenges for high-risk PSPs in India. Additionally, societal perceptions and the associated stigma can hinder the growth and acceptance of these businesses.

Opportunities for Growth

Amidst the challenges, there lie ample opportunities for growth. Emerging markets and industries, coupled with the increasing digitization of services in India, provide a fertile ground for high-risk PSPs to expand their operations.

Strategies for Success

Building robust compliance frameworks and forming strategic partnerships with local businesses and financial institutions are key strategies for success in the high-risk PSP landscape. Adapting to the local regulatory environment is vital for sustainable growth.

Examining successful high-risk PSPs in India offers valuable insights into their journeys. Learning from their experiences and understanding the pivotal decisions that led to their success can guide aspiring businesses in this sector.

Technological Advancements

In an era dominated by technology, high-risk PSPs can leverage advancements to mitigate risks. From artificial intelligence to blockchain, technological innovations play a crucial role in shaping the future of these businesses in India.

Regulatory Compliance

Strict adherence to local and international regulations is non-negotiable for high-risk PSPs. Working closely with regulatory authorities fosters a cooperative environment and helps in overcoming hurdles.

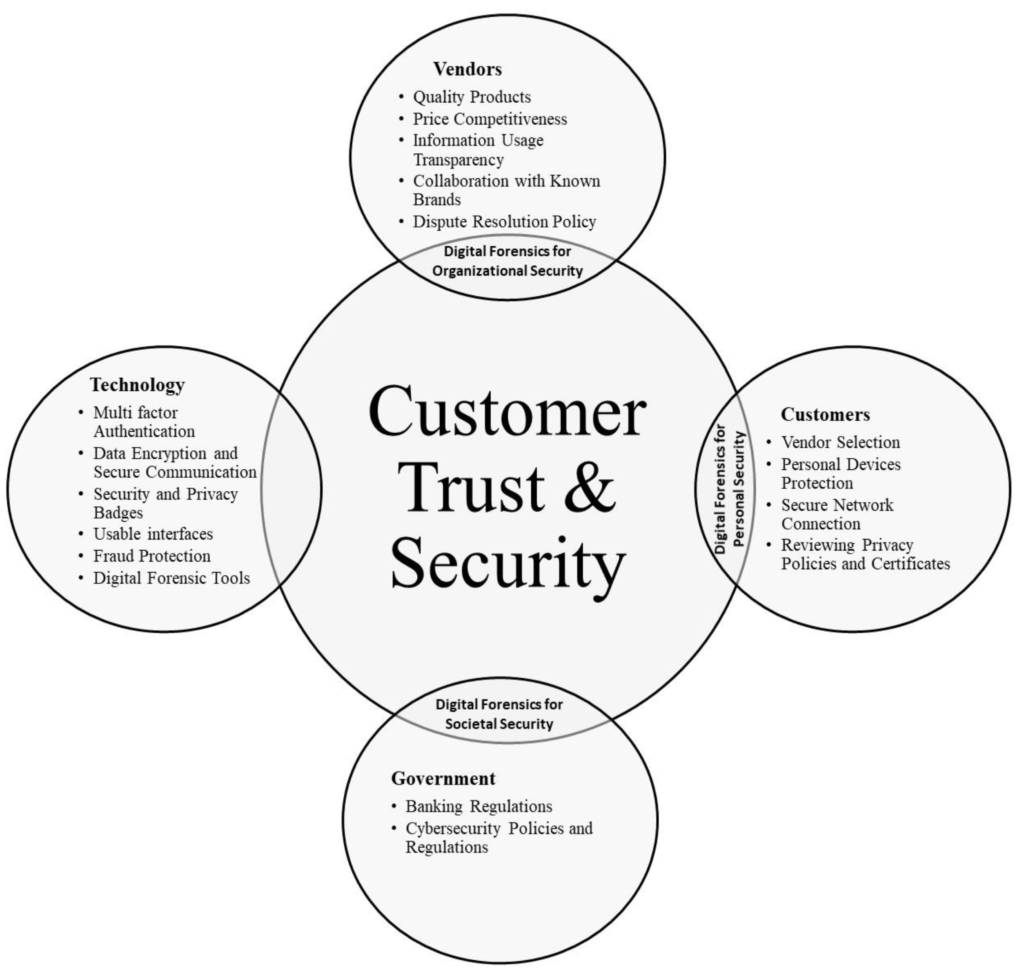

Customer Trust and Security

Establishing trust is paramount in high-risk industries[1]. Implementing robust security measures not only safeguards transactions but also instills confidence in users, contributing to the growth of these businesses.

Marketing and Branding

Tailoring marketing strategies[2] to address the unique challenges of industries is essential. Effective branding can help in overcoming negative perceptions and creating a positive image in the market.

Future Outlook

The future of high-risk PSPs in India looks promising, with anticipated growth in emerging markets[3] and positive changes in the regulatory landscape. Adapting to technological and evolving customer needs will be key to sustained success.

Innovation in Customer Service

Beyond technology, innovation in customer service is a key differentiator for high-risk PSPs. Providing responsive and personalized customer support can set these businesses apart in a competitive market[4]. Utilizing AI-driven chatbots, real-time query resolution, and proactive communication further enhance the overall customer experience.

Future-Proofing Strategies

The fast-paced evolution of the financial sector demands future-proofing strategies from PSPs[5]. Staying ahead of industry trends, investing in research and development, and fostering a culture of adaptability are crucial. Businesses that can anticipate and respond to future challenges are better positioned for sustained success.

Conclusion

High-risk PSP business development in India is a nuanced journey filled with challenges and opportunities. Navigating regulatory hurdles, building trust, and technology are pivotal for success in this dynamic sector. As India embraces digital transactions, high-risk PSPs have the potential to carve a niche for themselves and contribute significantly to the financial landscape.

FAQs

- Are high-risk PSPs legal in India?

- Yes, high-risk PSPs are legal in India, but they face stringent regulatory requirements.

- What industries are considered high-risk for PSPs?

- Industries such as gaming, adult entertainment, and e-commerce are often considered high-risk.

- How can high-risk PSPs build customer trust?

- Building trust involves implementing robust security measures and effective branding strategies.

- What role does technology play in high-risk PSPs?

- Technology, including AI and blockchain, helps mitigate risks and shapes the future of these businesses.

- Is there a growth potential for high-risk PSPs in India?

- Yes, the increasing digitization of services and emerging markets present growth opportunities.