AUTHOR NAME : JASMINE

DATE : 25/12/2023

Introduction

In a dynamic and evolving business landscape, High Risk Payment Service Providers (PSPs) are becoming increasingly prevalent, especially in the context of Business-to-Business (B2B) connections in India. Navigating the complexities of high risk PSP B2B transactions requires a deep understanding of the landscape, regulatory nuances, and effective risk mitigation strategies.

High Risk PSPs Business-to-business refer to financial entities that cater to businesses facing higher risks, often associated with factors like elevated chargeback rates, industry type, and geographical considerations.

Significance of B2B Connections in India

B2B connections in India form the backbone of the Indian business ecosystem, driving economic growth and fostering collaborations across diverse industries B2B Payment Solutions[1]. In the world of business, transactions can be complicated and involve a lot of money.

Understanding the High Risk PSP Landscape

Overview of High Risk Payment Service Providers

High Risk Business-to-business operate in a niche where traditional financial institutions may hesitate to tread. Understanding their role is pivotal for businesses exploring B2B connections Small or medium-sized businesses make payments to each other called B2B payments[2], which stands for Business-to-Business payments.

Factors Contributing to High Risk in B2B Transactions

Identifying the factors that elevate risks in B2B transactions is crucial for businesses to make informed decisions and implement effective risk management strategies High risk B2B connections in India. Businesses use special platforms or systems to make these transactions easier, safer, and cheaper. These systems are the rules that help businesses know how much to pay, when to pay, and ensure that the payment is made safely.

Impact on Businesses Engaging in High Risk PSP B2B Connections

The repercussions of engaging in high risk B2B connections are far-reaching, impacting financial stability, reputation, and overall business resilience Businesses can make these payments in different ways, using cards, like debit or credit cards, just like when you buy something online B2B payment processing solutions[3].

Regulatory Environment in India

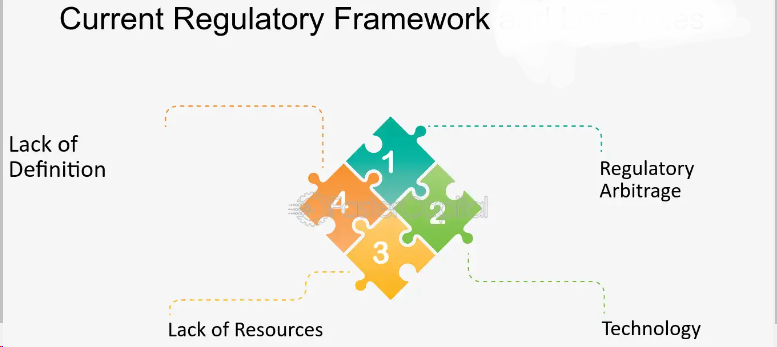

Current Regulatory Framework for PSPs

India’s regulatory environment for PSPs is evolving, presenting both challenges and opportunities for businesses operating in the high risk space. which are set up to transfer money automatically from one bank account to another B2B payment automation[4].

Challenges and Opportunities for High Risk PSPs

While you may not realize it, there is tremendous economic upside if you take a strategic approach to processing B2B payments. Indian B2B payment platforms[5] Navigating the regulatory landscape poses challenges, but it also opens doors for innovation and growth for those willing to adapt.

Compliance Measures for B2B Connections

Businesses must prioritize compliance in order to mitigate risks, thereby ensuring adherence to regulatory standards and, ultimately, building a foundation for secure B2B collaborations. In the same vein, every invoice your company receives represents an opportunity: either an opportunity to capitalize on the rewards of sound planning and execution, or conversely, an opportunity to fall victim to the perils of disorganization.

Navigating Challenges in High Risk PSP B2B Transactions

Identifying Potential Risks

A proactive approach to risk identification is crucial for businesses to safeguard their interests and maintain the integrity of B2B connections. Business-to-business (B2B) payment processing often requires different tools than business-to-consumer (B2C) processing.

Mitigation Strategies for Businesses

Implementing effective risk mitigation strategies involves a combination of technology, due diligence, and strategic partnerships. Therefore, it’s crucial to partner with a payments provider that has B2B experience. In this regard, Worldpay stands out as the ideal partner who can not only help you accept more payments but also attract more customers and, ultimately, boost revenue.

Case Studies of Successful B2B Connections

Examining real-world examples of successful high-risk PSP B2B collaborations provides valuable insights and practical lessons for businesses. Moreover, the B2B world is fast-paced, and as such, you need organized and efficient payment processing. Additionally, along with the latest payment options, these elements are crucial to effectively manage day-to-day operations, drive customer loyalty, and stay ahead of new payment trends.

Building Trust in High Risk B2B Connections

Establishing Credibility in High Risk Transactions

Building credibility involves transparent communication, reliable performance, and consistent adherence to ethical business practices. You deserve a business-to-business solution designed for high-volume operations selling low to medium-priced products and services online.

Venerating Technology in B2B Connections

Case Studies on Technological Solutions

Business-to-business (B2B) payment automation is the process of using technology to manage and automate payments between businesses. In fact, real-world examples clearly showcase how businesses have successfully integrated technology to not only overcome challenges but also thrive in the high-risk PSP B2B landscape. Furthermore, these examples highlight the transformative impact of automation in streamlining operations and enhancing efficiency.

Successful High Risk PSP B2B Collaborations in India

Key Takeaways from Case Studies

B2B payment automation means using software and technology to automate the business-to-business payment process. Here’s a look at how it works Extracting key takeaways helps distill the essence of successful collaborations, offering actionable insights for businesses seeking to venture into high risk B2B connections.

Lessons Learned for Businesses

Learning from both successes and challenges, businesses can refine their strategies and approaches to ensure sustainable and fruitful high risk PSP B2B connections.

Future Trends in High Risk PSP B2B Connections

Preparing for Future Challenges

Based on the agreed upon terms, the system schedules payments and selects the best payment method. Businesses can set up rules to optimize payment times to take advantage of early payment discounts

Conclusion

Summarizing the key points reinforces the critical aspects businesses need to consider when engaging in high risk PSP B2B connections. Closing with encouragement empowers businesses to explore the immense potential in high risk PSP B2B connections, provided they approach it with due diligence and strategic planning.

FAQs

1. What defines a high risk PSP in the B2B context?

In the B2B context, a high risk PSP is characterized by factors such as elevated chargeback rates, industry type, and geographical considerations.

2. How can businesses ensure compliance in high risk transactions?

Ensuring compliance involves staying informed about regulatory standards, conducting thorough due diligence, and implementing robust risk management protocols.

3. Are there specific industries more prone to high risk PSP connections?

Certain industries, such as e-commerce, adult entertainment, and travel, are often considered high risk for PSP connections due to their unique challenges.

4. What role does technology play in mitigating risks in B2B transactions?

Technology plays a pivotal role in mitigating risks by offering innovative solutions, enhancing security measures, and providing real-time monitoring capabilities.

5. How can businesses build long-term trust in high risk collaborations?

Building trust involves transparent communication, consistent performance, and adherence to ethical business practices over time.