AUTHOR : RUBBY PATEL

DATE : 21/12/23

Introduction

In the dynamic landscape of India’s financial sector, High-risk Payment Service Provider (PSP) commercial relationships have become a focal point of concern and interest. Understanding the intricacies of these relationships is crucial for businesses seeking secure and sustainable financial partnerships in the country.

High-risk PSP Commercial Relationships

High-risk PSPs often exhibit specific traits, including irregular transaction patterns, ambiguous ownership structures, and inadequate compliance measures. Identifying these characteristics is essential for businesses to assess potential risks accurately Commercial relationships.

Several factors contribute to the emergence of high-risk PSP commercial relationships, relationships in India ranging from rapid technological advancements to the evolving regulatory landscape. A comprehensive understanding of these factors is vital for proactive risk management.

Regulatory Landscape in India

Indian regulations governing PSPs play a pivotal role in determining risk classifications. Navigating through the regulatory landscape is crucial for businesses to comply with legal requirements and assess the risk associated with high risk PSP Commercial .

Identifying High-risk PSPs under Indian Laws

Regulators in India have outlined specific criteria for identifying high risk relationships in India. Familiarizing oneself with these criteria is essential for businesses to make informed decisions and mitigate potential risks.

Risks Associated with High-risk PSP Commercial Relationships

High-risk PSP commercial relationships pose significant financial risks, including fraudulent activities, monetary losses, and potential legal repercussions. Businesses must adopt robust risk management strategies[1] to safeguard their financial interests.

Legal and Compliance Risks

Navigating legal and compliance challenges is a constant concern in high-risk PSP relationships. Understanding and addressing these risks are imperative to ensure regulatory compliance and maintain the integrity of business operations Procurement Risk Management[2].

Reputational Risks

Reputation is a valuable asset in the business world. High-risk PSP relationships can tarnish an organization’s reputation, impacting customer trust and loyalty. Mitigating reputational risks requires proactive measures and effective crisis High Risk Merchant Accounts[3].

Mitigation Strategies

Implementing thorough due diligence processes is a cornerstone in mitigating risks associated with Business risks[4] PSPs. Comprehensive background checks, financial assessments, and regulatory compliance reviews are essential components of due diligence.

Implementing Robust Compliance Programs

Businesses must establish and maintain robust compliance programs to align with regulatory requirements. Regular audits and Enterprise Risk Management[5] assessments ensure ongoing compliance and identify areas for improvement in risk management.

Monitoring and Reporting Mechanisms

Continuous monitoring of PSP relationships is critical for early detection of potential risks. Establishing efficient reporting mechanisms facilitates swift responses to emerging threats, minimizing the impact on the business. Risk management involves understanding, analyzing and addressing risk to make sure people and organizations

Case Studies

Examining real-world case studies provides valuable insights into the consequences of high-risk PSP relationships. Learning from past incidents helps businesses refine their risk management strategies and avoid similar pitfalls.

Lessons Learned from Past Incidents

Analyzing lessons learned from past incidents enhances the industry’s collective knowledge. Businesses can adapt and fortify their risk management practices based on these lessons, contributing to a more resilient financial ecosystem.

Future Trends and Considerations

The rapid evolution of payment technologies introduces new dynamics to PSP relationships. Anticipating and adapting to emerging technologies is essential for businesses to stay ahead of potential risks.

Regulators are likely to adapt to the evolving landscape by introducing new measures and guidelines. Staying informed about regulatory changes is crucial for businesses to align their practices with evolving standards.

Best Practices for Businesses

Choosing secure payment partners is fundamental to mitigating risks. Businesses should prioritize partnerships with PSPs that demonstrate a commitment to security, compliance, and ethical business practices.

Periodic Risk Assessments and Audits

Regular risk assessments and audits are proactive measures to identify and address potential vulnerabilities. Periodic reviews ensure that businesses stay vigilant in their risk management efforts. As a society, we need to take risks to grow and develop. From energy to infrastructure, supply chains to airport security, hospitals to housing, effectively managed risks help societies achieve

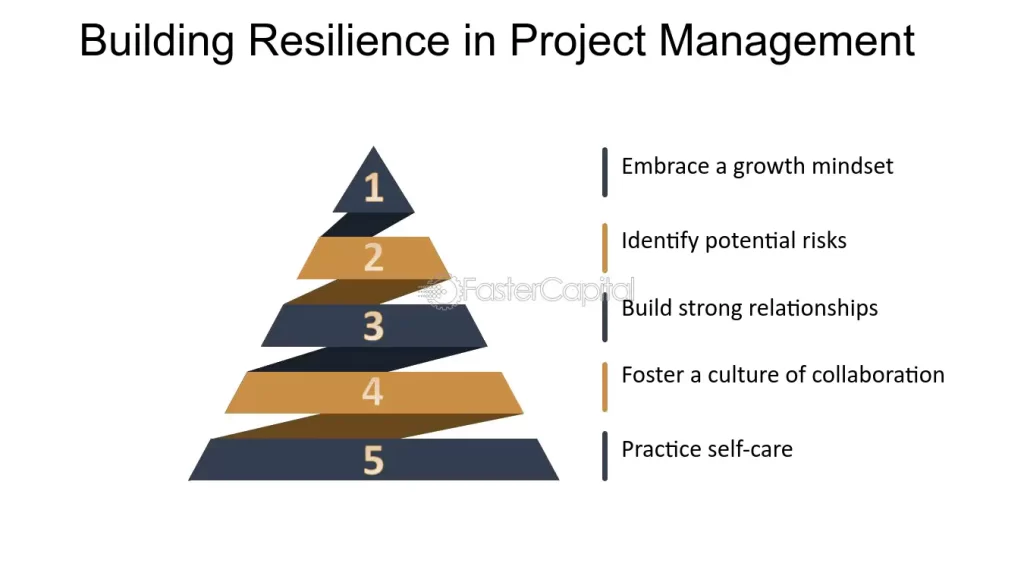

Building Resilience in PSP Commercial Relationships

Building resilience involves continuously improving risk management protocols. Businesses should adapt to changing circumstances, update risk strategies, and embrace a proactive approach to risk mitigation.

Collaborative Industry Initiatives

Collaboration within the industry is crucial for addressing common challenges. Sharing insights, best practices, and collaborating on risk mitigation initiatives contribute to a stronger, more secure financial ecosystem.

Conclusion

In conclusion, navigating high-risk PSP commercial relationships in India demands a multifaceted approach. Businesses must stay abreast of regulatory changes, implement robust risk management strategies, and learn from past incidents to build resilient partnerships.

FAQs

- Q: How can businesses identify high-risk PSPs in India? A: Businesses can identify high-risk PSPs by conducting thorough due diligence, assessing regulatory compliance, and monitoring transaction patterns.

- Q: What are the financial risks associated with high-risk PSP relationships? A: Financial risks include fraudulent activities, monetary losses, and potential legal repercussions.

- Q: How often should businesses conduct risk assessments in PSP relationships? A: Businesses should conduct periodic risk assessments and audits to ensure ongoing vigilance and identify potential vulnerabilities.

- Q: How can collaboration within the industry enhance the resilience of PSP relationships? A: Collaborative initiatives enable the sharing of insights, best practices, and collective efforts to address common challenges, strengthening the overall financial ecosystem.

- Q: Where can businesses access more information on building resilient PSP relationships? A: For further insights, businesses can explore industry publications.

Get In Touch-

contact-form-7 id=”7f3607c” title=”Contact Us”]