AUTHOR : JAYOKI

DATE : 26/12/2023

Introduction

In the dynamic landscape of financial services, payment service providers[1] (PSPs) play a pivotal role in facilitating transactions. However, some PSPs find themselves categorized as entities, necessitating strategic consolidation for sustained growth and stability, especially in the Indian market.

Understanding PSPs

Payment service providers are entities that enable electronic transactions between parties. From online purchases to fund transfers, they form the foundation of the digital payment[2] ecosystem ensuring seamless financial interactions.

Identifying High-Risk PSPs

Various factors contribute to the classification of PSPs as high-risk, including volatile revenue streams, cybersecurity threats, and regulatory challenges. Understanding these factors is crucial for devising effective consolidation strategies[3].

Consolidation Strategies

Consolidation is not merely a survival strategy but a proactive approach to enhance operational efficiency and ensure regulatory compliance. Different consolidation approaches, such as mergers, acquisitions, or strategic partnerships, can be tailored to the specific needs of high-risk PSPs.

The regulatory landscape in India

Navigating the regulatory landscape is critical for PSPs, considering. Complying with regulations ensures a smoother transition and builds trust among stakeholders.

Case Studies

Examining successful consolidation stories provides valuable insights into what works and what doesn’t. Learning from both triumphs and failures is essential for formulating effective strategies.

Benefits of High-Risk PSP Consolidation

Consolidation brings about stability, improved compliance, and increased operational high-risk PSP consolidation strategies in India. Understanding the benefits is crucial for high-risk PSPs pondering this strategic move.

Risks and Mitigations

While consolidation offers numerous advantages, it is not without risks. Identifying potential challenges and implementing effective mitigation strategies is essential for a successful process.

Future Outlook

The rapidly evolving PSP industry requires a careful approach. high-risk PSP Consolidation strategies in india [4]Understanding future trends and changes in consolidation strategies is key to long-term success.

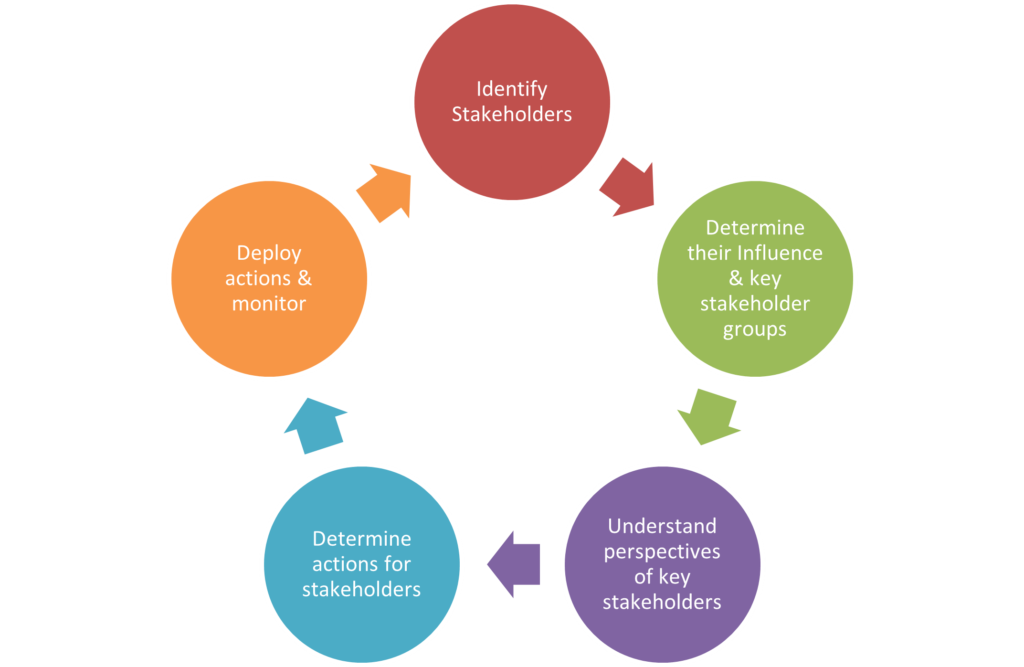

Steps to Implement Consolidation

Practical steps for implementing consolidation, along with the roles of key stakeholders, provide a roadmap for high-risk PSPs[5] on this transformative journey.

Impact on Stakeholders

Consolidation affects various stakeholders, including customers, employees, and investors. Building trust post-consolidation is crucial for positive relationships.

Success Metrics

Measuring success involves tracking key performance indicators (KPIs) to ensure the intended benefits are realized.

Realizing Cost Efficiencies

Beyond stability, amalgamation offers economic benefits through cost efficiencies. Identifying and implementing cost-saving measures is integral to the amalgamation process.

Challenges in the Indian Market

High-risk PSPs in India face unique challenges that require strategies. Understanding the local landscape is crucial for success.

Consolidation Strategies Tailored to High-Risk PSPs

High-risk PSPs operating in the diverse and dynamic market of India require amalgamation strategies that are not one-size-fits-all. It’s crucial to tailor these strategies to address the specific challenges and opportunities inherent in the region.

Innovative Approaches to High-Risk Identification

Identifying high-risk PSPs goes beyond the obvious financial indicators. Innovative approaches, such as advanced data analytics and machine learning, are becoming increasingly crucial in addressing risk factors. Integrating these technologies can provide a more nuanced understanding of targeted consolidation efforts.

Collaboration as a Consolidation Tool

In the digital age, collaboration is a powerful tool for mergers. High-risk PSPs can explore partnerships with established financial institutions or technology companies to utilize their existing infrastructure and expertise. Collaborative consolidation not only mitigates risk but also fosters innovation.

Navigating the Regulatory Maze

The regulatory landscape in India is complex, and compliance is non-negotiable. High-risk PSPs need to proactively engage with regulatory bodies, staying abreast of developing regulations. Developing a compliance roadmap is essential to guaranteeing a smooth integration process without regulatory hiccups.

The Human Element in PSP Consolidation

Amidst the data-driven strategies, it’s crucial not to overlook the human element. Effective communication with employees, customers and investors occurs during. Addressing concerns, providing clear information, and creating a sense of security can significantly impact the success of the consolidation process.

Conclusion

In conclusion, high-risk PSP consolidation strategies in India are not only a response to challenges but a proactive approach to thrive in a dynamic market. By understanding the nuances of the Indian financial landscape and implementing effective strategies, PSPs can achieve stability and growth.

FAQs

- What is the primary motivation behind PSP consolidation?

- The primary motivation is to enhance stability, achieve efficiency, and ensure regulatory compliance.

- How can high-risk PSPs navigate the regulatory landscape in India?

- Navigating the regulatory landscape involves staying informed, engaging with regulatory bodies, and ensuring proactive compliance.

- What role do case studies play in the consolidation process?

- Case studies provide valuable insights into successful and unsuccessful consolidation stories, guiding PSPs in formulating effective strategies.

- What are the key success metrics for evaluating consolidation efforts?

- Key success metrics include improved stability, increased compliance, and economic benefits through cost efficiencies.

- How can PSPs address the challenges specific to the Indian market during consolidation?

- Addressing challenges in the Indian market involves tailoring strategies to the local landscape and understanding the unique dynamics of the region.