Author : Sweetie

Date : 26/12/2023

Introduction

In the dynamic landscape of the Indian financial sector, the management of credit by Payment Service Providers (PSPs) holds immense significance. This article delves into the Complex realm of High-Risk PSP Credit Management, Discovering its nuances, challenges, and strategies for effective risk Reduction.

Definition of High-Risk PSP Credit Management

High-Risk PSP Credit Management involves the careful assessment and handling of credit transactions by deemed high-risk. Payment Service Providers These entities often operate in industries with elevated levels of uncertainty and Fluctuation.

Importance in the Indian Financial Landscape

In India, the evolving financial ecosystem relies on the seamless functioning of PSPs. Understanding and managing credit risks[1] become Essential considering the diverse economic activities and the growing digital transactions landscape.

Understanding High-Risk PSPs

Characteristics of High-Risk Payment Service Providers

High-risk PSPs exhibit specific traits, such as high chargeback rates, fluctuating transaction volumes, and susceptibility to fraud. Recognizing these characteristics is crucial for Successful Debt Collection[2] management. Challenges include regulatory scrutiny, evolving consumer behavior, and the need for adaptive technologies.

Credit Management Strategies

Robust Risk Assessment Models

Implementing robust risk assessment models enables PSPs to evaluate transactional risks accurately. This involves analyzing historical data, identifying patterns, and predicting potential credit issues. Tailored credit scoring systems, aligned with the specificities of Credit Management in India[3], contribute to better decision-making. Customized algorithms enhance the accuracy of credit assessments.

Regulatory Framework

Overview of Indian Financial Regulations

Navigating the complex regulatory landscape is integral for Business Risk[4] PSPs. An overview of Indian financial regulations provides insights into compliance requirements. Understanding and adhering to compliance requirements are non-negotiable for high-risk PSPs. This ensures legal standing and builds trust among consumers and stakeholders.

Technology and Innovation

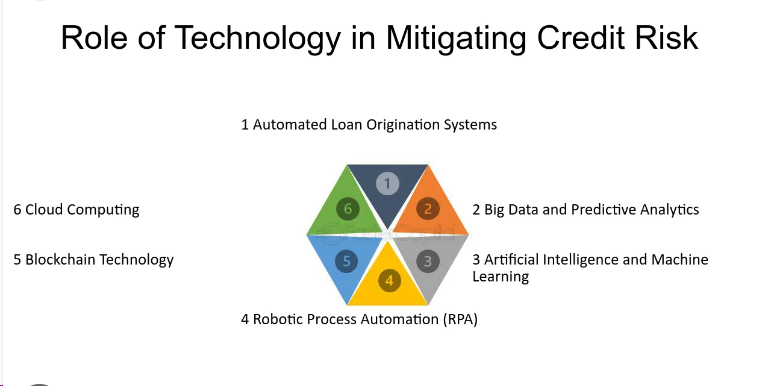

Role of Technology in Mitigating Credit Risks

Leveraging cutting-edge technology, such as artificial intelligence and machine learning, enhances the ability to identify and respond to credit risks[5] promptly. Exploring innovative solutions, such as blockchain and biometric authentication, adds layers of security to credit transactions. Staying ahead of technological advancements is key to risk mitigation.

Collaboration and Partnerships

Importance of Collaborations in Credit Management

Collaborations with financial institutions, regulatory bodies, and technology providers strengthen the credit management ecosystem. Shared insights and resources contribute to a more resilient industry. Establishing strong partnerships within the industry fosters a collaborative approach to credit management. Knowledge-sharing and joint initiatives enhance the overall risk management landscape.

Future Trends

Emerging Trends in High-Risk PSP Credit Management in India

Exploring emerging trends, such as decentralized finance (DeFi) and digital identity verification, provides a glimpse into the future of credit management for high-risk PSPs. Anticipating developments in technology, regulations, and consumer behavior allows high-risk PSPs to prepare for future challenges and opportunities.

Benefits and Challenges

Positive Impacts of Effective Credit Management

Effective credit management yields benefits, including increased trust, better customer relations, and sustained business growth. These positive impacts contribute to long-term financial stability. Challenges in credit management are inevitable, but strategies outlined in this article equip high-risk PSPs with the tools needed to overcome hurdles and achieve sustainable growth.

Tips for Businesses

Advice for Businesses Dealing with High-Risk PSPs

Businesses engaging with high-risk PSPs should exercise due diligence, understanding the credit management in India practices in place and ensuring alignment with their risk tolerance. Proactivity in credit management is key. Businesses should implement strategies that allow them to stay ahead of potential risks and respond promptly to evolving credit landscapes.

Consumer Perspective

How High-Risk PSPs Affect Consumers

Understanding the impact of high-risk PSPs on consumers emphasizes the need for consumer protection measures. Transparent communication and fair practices build trust in the financial ecosystem. Regulatory frameworks and industry initiatives play a crucial role in ensuring consumer protection. High-risk PSPs must prioritize ethical practices to safeguard consumer interests.

Industry Insights

Experts’ Opinions on High-Risk PSP Credit Management

Gaining insights from industry experts provides a holistic understanding of the challenges and opportunities in high-risk PSP credit management in India. Expert opinions guide strategic decision-making Exploring industry reports and surveys offers statistical evidence and trends, aiding high-risk PSPs in shaping their credit management policies based on empirical data.

The Global Context

Comparative Analysis with Global High-Risk PSPs

Comparing Indian high-risk PSPs with their global counterparts provides valuable benchmarks. Understanding global practices informs local strategies for enhanced credit management. Learning from international experiences allows Indian high-risk PSPs to adopt proven practices, accelerating the maturity of credit management processes.

Conclusion

Navigating high-risk PSP credit management in India requires a multifaceted approach. Understanding industry dynamics, leveraging technology, and building collaborative networks contribute to resilience. Emphasizing sustainable practices ensures the long-term viability of high-risk PSPs. Responsible credit management is not only a regulatory requirement but a cornerstone of financial stability.

FAQs

- How can businesses identify high-risk PSPs?

Businesses can identify high-risk PSPs by assessing chargeback rates, transaction volumes, and industry-specific risk factors. - What role does technology play in credit management for PSPs?

Technology, including AI and blockchain, enhances the accuracy of risk assessments and adds layers of security to credit transactions. - How can collaborations benefit high-risk PSPs in credit management ?

Collaborations with financial institutions and technology providers provide shared insights and resources, strengthening credit management practices. - What are the anticipated future trends in high-risk PSP credit management?

Emerging trends include decentralized finance (DeFi) and digital identity verification, shaping the future of credit management for high-risk PSPs. - How does effective credit management benefit consumers?

Effective credit management builds trust, ensures transparent practices, and safeguards consumer interests in financial transactions.