AUTHOR NAME : JASMINE

DATE : 26/12/2023

Introduction

In a country as diverse and dynamic as India, the landscape of financial transactions is constantly evolving. One crucial aspect that significantly influences an individual’s financial journey is the PSP (Payment Service Provider) credit score. This unique metric goes beyond traditional credit scores, providing a nuanced[1] assessment of an individual’s creditworthiness.

What is a PSP Credit Score

A PSP credit[2] score, short for Payment Service Provider credit score, is a comprehensive metric[3] that evaluates an individual’s financial behavior and transactions. Unlike traditional credit scores, which often focus on banking[4] and loan history, PSP scores consider a broader spectrum of financial interactions. This includes digital transactions, bill payments, and online purchases, providing a more holistic[5] view of a person’s financial responsibility.

Understanding High-Risk PSP Credit Score

A high-risk PSP credit score is a cause for concern as it indicates a higher likelihood of defaulting on payments or financial irresponsibility. Various factors contribute to a high-risk score, including late payments, frequent overdrafts, and a history of bounced checks. Individuals with high-risk scores may face challenges in securing loans and credit cards, and they may encounter higher interest rates when they do.

Common Misconceptions

Misinformation[1] about high-risk PSP credit scores abounds, leading to unnecessary anxiety and confusion among individuals. It’s essential to dispel myths surrounding these scores, such as the belief that they only consider online transactions. Understanding the nuanced criteria for evaluating risk can empower individuals to take proactive steps towards improving their scores High risk PSP Credit score in india.

Challenges Faced by Individuals with High-Risk Scores

The repercussions of a high-risk PSP credit score extend beyond the digital realm. Individuals with such scores may find it difficult to access financial services, leading to a potential exclusion from mainstream banking. Moreover, the higher interest rates imposed on loans and credit cards can create a cycle of financial strain.

How to Check Your PSP Credit Score

Fortunately, checking your PSP credit score is a straightforward process with various online platforms offering this service. Regular monitoring is crucial, as it allows individuals to identify areas for improvement and track their progress over time. Being proactive in monitoring[2] one’s credit score is the first step towards financial empowerment.

Improving a High-Risk PSP Credit Score

Reversing a high-risk PSP credit score is challenging but not impossible. By adopting disciplined financial habits, such as timely bill payments, reducing debt, and avoiding overdrafts, individuals can gradually rebuild their creditworthiness. Patience and consistency are key in this journey towards financial recovery.

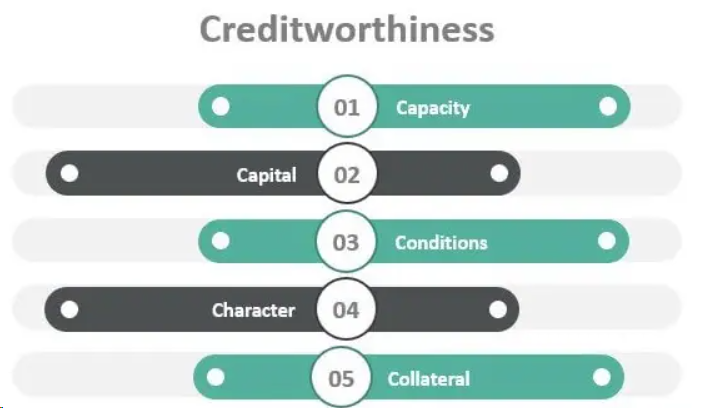

The Role of PSPs in Assessing Creditworthiness

Payment Service Providers play a pivotal role in evaluating creditworthiness by considering factors beyond traditional metrics. Digital payment histories, online purchases, and bill payments contribute to a more comprehensive understanding of an individual’s financial behavior. This innovative approach reflects the changing dynamics of the financial landscape

Impact on Loan Approvals and Interest Rates

While a high-risk PSP credit score can pose challenges in obtaining loans, it doesn’t necessarily mean automatic rejection. Understanding how credit scores influence loan approvals and interest rates empowers individuals to negotiate better terms with lenders. Taking proactive steps to address the factors contributing[3] to the high-risk score can make a significant difference.

Government Regulations and Consumer Rights

Legal safeguards exist to protect individuals with high-risk PSP credit scores. Understanding these regulations is crucial for asserting one’s rights and disputing inaccuracies in the credit report. The regulatory framework aims to ensure fair treatment and opportunities for financial recovery for all individuals, regardless of their credit history High risk PSP Credit score in india.

Case Studies

Real-life examples of individuals overcoming high-risk PSP credit scores offer valuable insights. By exploring these case studies, individuals can draw inspiration from others who have successfully navigated financial challenges and improved their creditworthiness. These stories provide practical tips and motivation for those on a similar journey.

The Future of PSP Credit Scores in India

As technology advances and financial landscapes evolve, the future of PSP credit scores holds exciting possibilities[4]. Innovations in data analytics and artificial intelligence are likely to refine credit evaluation processes further. Staying informed about these trends can help individuals adapt their financial strategies accordingly High risk PSP Credit score in india.

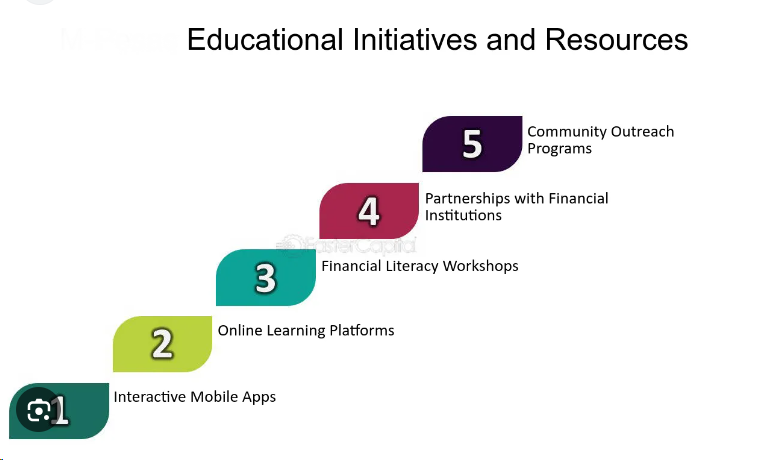

Educational Initiatives and Resources

Empowering individuals with knowledge about credit scores[5] is essential in promoting financial well-being. Various resources, both online and offline, provide valuable insights into understanding and improving credit scores. Investing time in financial literacy enhances one’s ability to make informed decisions and proactively manage their financial health.

Conclusion

In conclusion, a high-risk PSP credit score in India presents challenges, but with awareness and proactive measures, individuals can navigate these challenges successfully. Understanding the factors contributing to a high-risk score, dispelling myths, and adopting disciplined financial habits are crucial steps towards financial recovery. As technology continues to shape the financial landscape, staying informed and adapting to changes will be key in maintaining a healthy credit profile.

FAQs

- Q: Can a high-risk PSP credit score be improved?

- A: Yes, with consistent efforts and disciplined financial habits, it is possible to improve a high-risk PSP credit score over time.

- Q: How often should I check my PSP credit score?

- A: Regular monitoring is recommended. Checking your PSP credit score annually or before major financial decisions is a good practice.

- Q: Are there government programs to assist individuals with high-risk scores?

- A: While specific programs may vary, legal protections exist to ensure fair treatment and opportunities for financial recovery.

- Q: Do all lenders consider PSP credit scores when approving loans?

- A: While not universal, many lenders consider PSP credit scores alongside traditional metrics to assess creditworthiness.

- Q: How long does it take to see improvements in a PSP credit score?

- A: The timeline varies, but consistent positive financial behavior can lead to gradual improvements. Patience is key.