AUTHOR : ZOYA SHAH

DATE : 27-12-2023

Dealing with high-risk PSP (Payment Service Provider) debt can be overwhelming, and for many individuals in India, finding a way out of this financial burden is a top priority. In this article, we’ll delve into the world of high-risk PSP debt consolidation services, understanding the challenges, benefits, and the process involved. Let’s navigate the landscape of debt consolidation and discover how it can provide a lifeline to those struggling with financial uncertainties.

Introduction

In the vast tapestry of personal finance, high-risk PSP debt consolidation emerges as a beacon of hope for individuals grappling with multiple debts[1]. The Indian financial landscape has seen a surge in demand for effective debt consolidation services, making it crucial to comprehend the intricacies involved.

Understanding High-Risk PSP Debt

High-risk PSP debt is a financial situation where individuals find themselves burdened with debts that are categorized as high-risk by payment service providers. This could be due to various factors such as late payments, defaults, or other financial challenges.

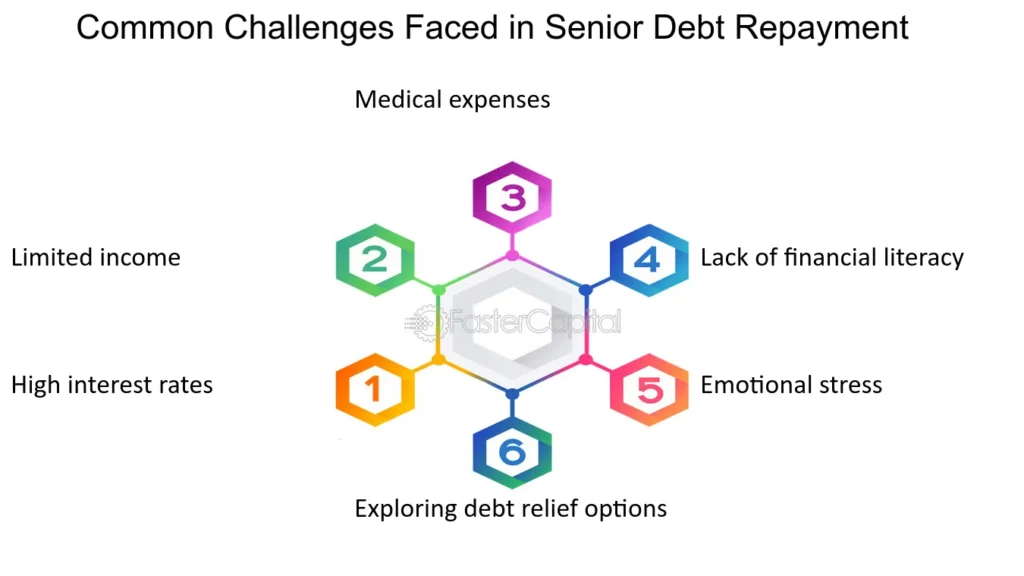

Challenges Faced by Individuals in Debt

The challenges posed by high-risk PSP debt are not merely financial but extend to the emotional and psychological realms. From constant creditor calls to the anxiety of mounting debt, individuals in this situation face a myriad of difficulties that impact their overall well-being. High Risk PSP Debt Consolidation Services In India.

Role of Debt Consolidation Services

Enter debt consolidation services[2] – a lifeline for those drowning in the sea of debts. These services aim to simplify the complex web of multiple debts, offering individuals a chance to regain control over their finances.

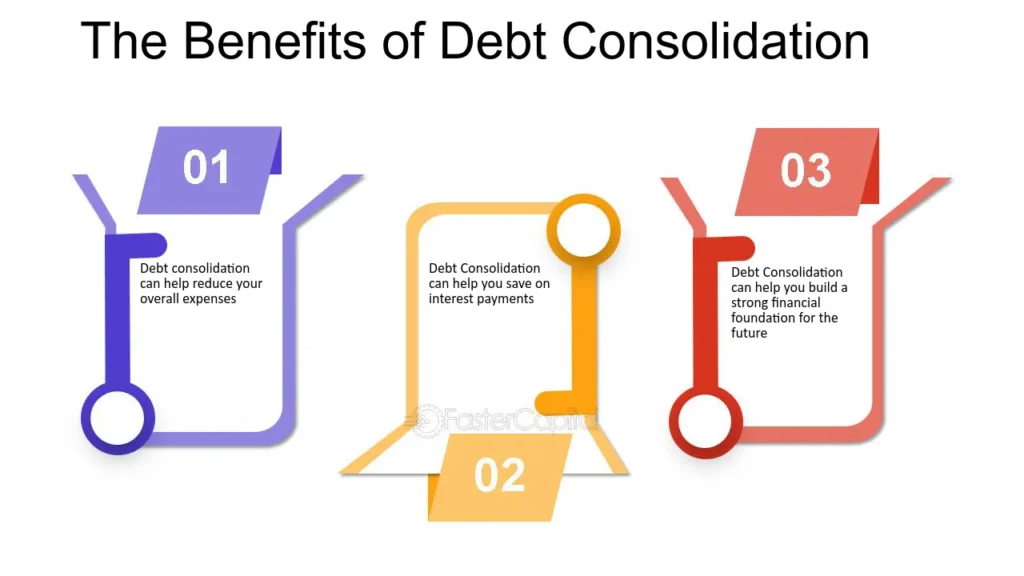

Benefits of Debt Consolidation

The benefits of debt consolidation[3] are multifaceted. Not only does it provide a structured approach to debt repayment, but it also often results in reduced interest rates and a more manageable monthly payment.

High-Risk PSP Debt Consolidation Process

The process involves a series of strategic steps. Firstly, a thorough assessment of the individual’s financial situation[4] is conducted, followed by the creation of a consolidated repayment plan. This plan aims to merge various debts into a single, more manageable payment.

Choosing the Right Debt Consolidation Service

Selecting the right debt consolidation service is paramount. Factors such as interest rates, repayment terms, and customer reviews play a crucial role in making an informed decision.

Impact on Credit Score

One of the concerns individuals have when considering debt consolidation is its potential impact on their credit score. However, when done responsibly, debt consolidation can contribute to rebuilding a damaged credit history.

Success Stories

Real-life success stories serve as powerful testimonials to the efficacy of debt consolidation services. From escaping the clutches of debt to rebuilding credit, these stories inspire hope and confidence in those considering this financial path.

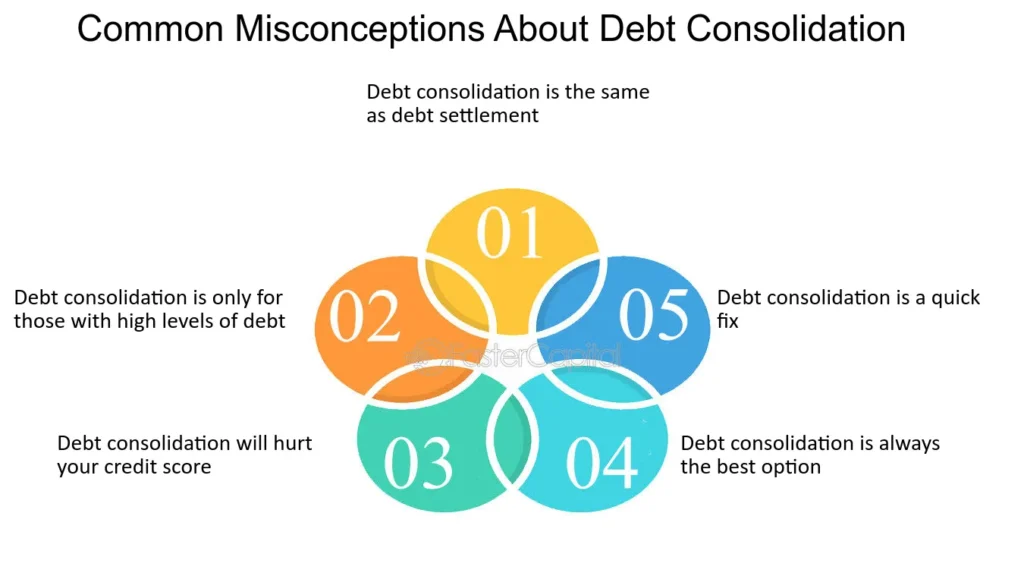

Common Misconceptions about Debt Consolidation

Misconceptions surrounding debt consolidation often deter individuals from exploring this option. Addressing these myths is crucial to providing accurate information and dispelling fears.

Debt Consolidation vs. Bankruptcy

While debt consolidation is a viable option for many, exploring the alternatives is essential. Contrasting debt consolidation with bankruptcy sheds light on when each option may be more suitable for individuals.

Legal Aspects of Debt Consolidation in India

Understanding the legal framework governing debt consolidation services is essential for consumer protection. Individuals have rights, and being aware of them ensures a fair and transparent debt consolidation process.

Tips for Successful Debt Management

Beyond debt consolidation, effective debt management is an ongoing process. Practical tips for budgeting, saving, and making informed financial decisions contribute to long-term financial stability.

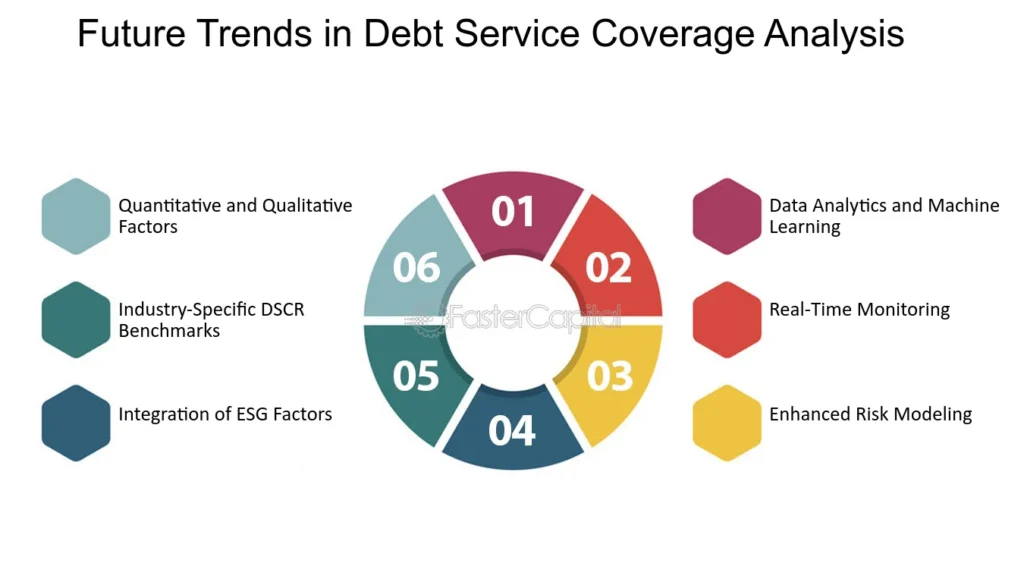

Future Trends in Debt Consolidation

As technology continues to shape the financial landscape, future trends in debt consolidation are worth exploring. From advanced algorithms to personalized financial solutions, the future holds promising developments in the realm of debt relief[5].

Conclusion

In conclusion, high-risk PSP debt consolidation services in India offer a ray of hope for individuals drowning in financial stress. Understanding the intricacies, benefits, and considerations involved is crucial for making informed decisions about one’s financial future.

Frequently Asked Questions

- Is debt consolidation the same as debt settlement?

- No, debt consolidation involves combining multiple debts into a single payment, while debt settlement involves negotiating to pay less than the total owed.

- How long does the debt consolidation process take?

- The duration varies, but it typically takes a few weeks to a few months, depending on the complexity of the individual’s financial situation.

- Can I consolidate high-risk PSP debt without collateral?

- Yes, many debt consolidation services in India do not require collateral, making it accessible to a broader range of individuals.

- Will debt consolidation hurt my credit score?

- Initially, there may be a slight impact, but responsible debt consolidation can contribute to improving your credit score over time.

- Are there government programs for debt consolidation in India?

- While there aren’t specific government programs, various financial institutions and private companies offer debt consolidation services in compliance with existing regulations.