AUTHOR : ZOYA SHAH

DATE : 27-12-2023

In today’s fast-paced financial landscape, many individuals in India find themselves grappling with dangerous PSP (Payment Service Provider) debt. This predicament can significantly impact their financial well-being and credit scores. In this article, we will explore the intricacies of high-risk PSP debt and delve into effective debt consolidation solutions available in India.

Understanding High-Risk PSP Debt

High-risk PSP debt refers to financial obligations incurred through payment service providers with an elevated level of risk. This can stem from various factors, including economic downturns, unexpected expenses, or poor financial planning. Individuals facing dangerous PSP debt[1] often experience challenges in meeting their financial obligations, leading to a detrimental impact on their credit scores.

Challenges Faced by Individuals in India

In the Indian context, many individuals encounter financial challenges, ranging from medical emergencies to job losses. These unforeseen circumstances contribute to the accumulation of dangerous PSP debt, making it crucial to address these challenges promptly to prevent further financial distress. Additionally, the adverse effect on credit scores poses long-term repercussions for individuals seeking financial stability[2].

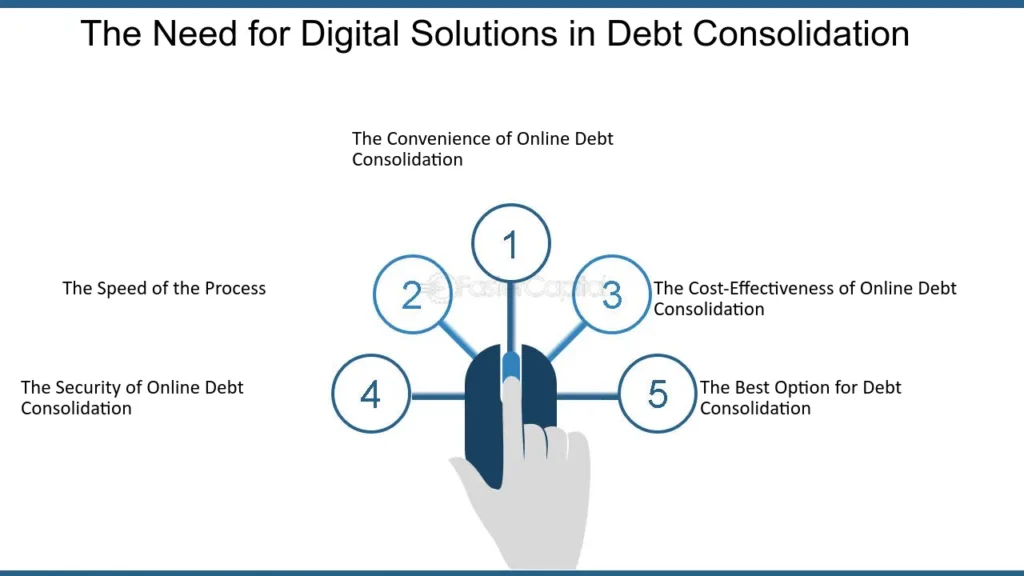

The Need for Debt Consolidation Solutions

Recognizing the need for effective debt management, individuals are increasingly turning to debt consolidation solutions. Consolidating dangerous PSP debt can streamline multiple payments into a single, manageable installment, easing the burden on individuals and providing a structured approach to financial recovery.High Risk PSP Debt Consolidation Solutions In India.

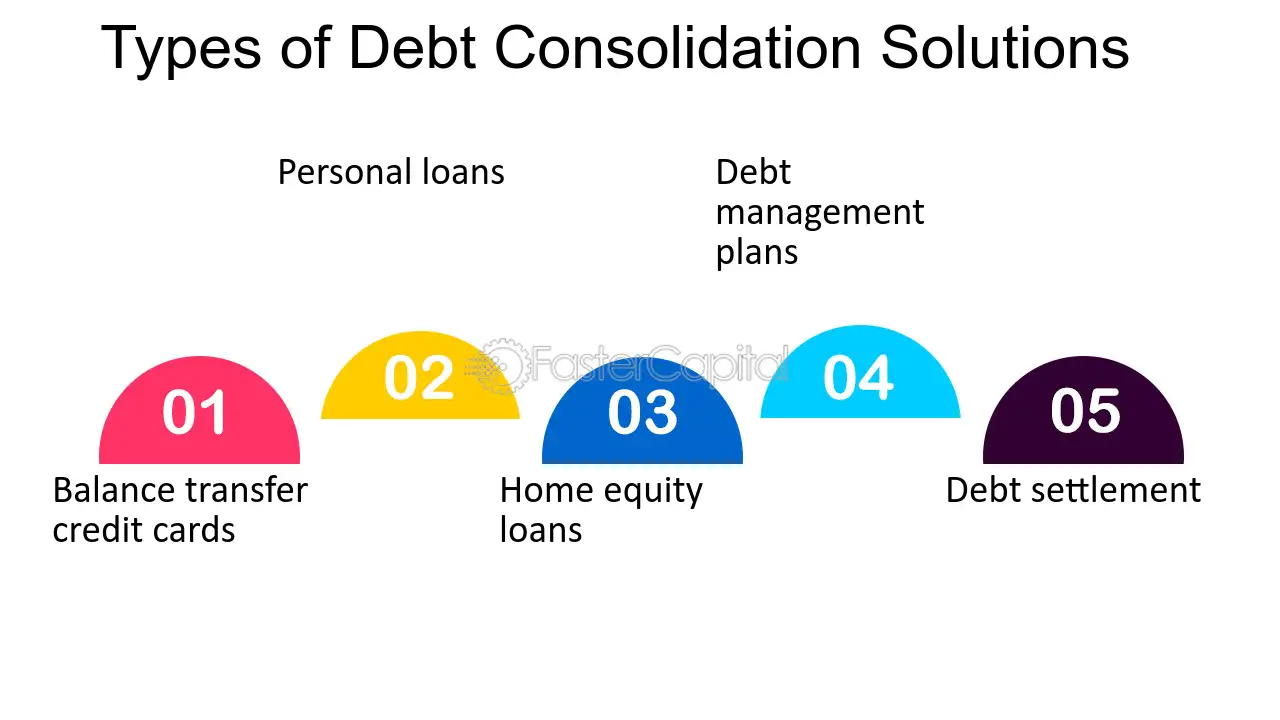

Debt Consolidation Options in India

Several debt consolidation options are available in India, catering to the diverse needs of individuals facing dangerous PSP debt. From debt consolidation loans[3] to debt management plans, understanding the range of solutions is crucial for making informed decisions.

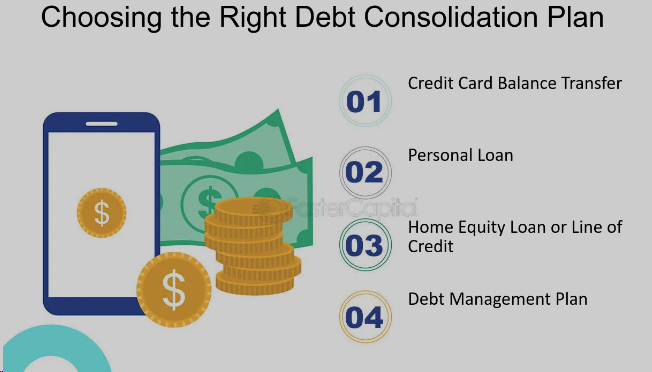

Choosing the Right Debt Consolidation Plan

Selecting the right debt consolidation plan requires careful consideration of various factors, including interest rates, repayment terms, and eligibility criteria. A comparative analysis of different plans ensures that individuals choose a solution tailored to their specific financial circumstances.

Steps to Initiate Debt Consolidation

Initiating the debt consolidation[4] process involves a straightforward application process and the submission of necessary documentation. Understanding these steps is vital for individuals seeking relief from dangerous PSP debt.

Impact on Credit Scores

Contrary to common misconceptions, debt consolidation can have a positive impact on credit scores. This section explores how the consolidation process contributes to rebuilding credit and establishing a foundation for future financial success[5].

Success Stories

Real-life success stories serve as inspiration for individuals navigating high-risk PSP debt. These anecdotes highlight the tangible benefits of debt consolidation and also motivate others to take proactive steps toward financial recovery.

Common Misconceptions

Addressing common misconceptions surrounding debt consolidation dispels myths and provides clarity. By debunking these misconceptions, individuals can make well-informed decisions about their financial futures.

Professional Guidance and Assistance

Seeking professional guidance from financial advisors can significantly enhance the effectiveness of debt consolidation efforts. Expert opinions and advice contribute to a more comprehensive and sustainable debt management strategy.

Tips for Successful Debt Management

Incorporating practical tips for successful debt management, such as budgeting strategies and financial discipline, empowers individuals to take control of their financial destinies and avoid relapses into high-risk debt situations.

Government Initiatives and Support

An overview of government initiatives and support programs aimed at debt relief provides valuable information for individuals exploring various avenues for financial assistance Understanding eligibility criteria and the application process is crucial for accessing these resources.

Future Financial Planning

Looking beyond immediate debt consolidation, individuals can benefit from long-term strategies for financial stability. This section explores proactive measures to prevent future financial challenges and maintain a secure financial footing.

Conclusion

In conclusion, addressing dangerous PSP debt through consolidation solutions is a proactive step toward financial recovery. By understanding the challenges, search available options, and implementing effective debt management strategies, individuals can pave the way for a more secure financial future.

FAQs – High-Risk PSP Debt Consolidation in India

- Q: How long does it take to see improvements in credit scores after debt consolidation?

- A: The program for credit score improvement varies, but positive effects can be observed within a few months of consistent payments.

- Q: Are there government programs that specifically address dangerous PSP debt in India?

- A: Yes, some government initiatives provide support and relief for individuals facing dangerous PSP debt; however, eligibility criteria apply.

- Q: Can debt consolidation impact my eligibility for future loans?

- A: Debt consolidation, when managed responsibly, can enhance your creditworthiness and, in turn, positively influence your eligibility for future loans.

- Q: What is the role of financial advisors in the debt consolidation process?

- A: Financial advisors play a crucial role in offering personalized guidance, helping individuals choose the most suitable debt consolidation plan.

- Q: Is debt consolidation the right choice for everyone facing dangerous PSP debt?

- A: Debt consolidation is a viable option for many, but individual circumstances vary. Consulting with financial experts can help determine the most appropriate solution.