AUTHOR : SELENA GIL

DATE : 22/12/2023

Introduction

Career coaching in India has undergone a remarkable transformation in recent years. With the advent of digital platforms and increased reliance on technology, the coaching landscape has expanded significantly. Nevertheless, this progression has not been without its challenges. Moreover, while new opportunities have arisen, these advancements have also brought about new complexities that need to be addressed. One of the prominent issues affecting this domain is the emergence of High-Risk Payment Service Providers (PSP) and their impact on career coaching.

Understanding High-Risk PSP

High-Risk PSPs are financial service providers that, due to various factors, carry a higher probability of financial risk, including potential fraudulent activities, chargebacks, or non-compliance with regulations. In the realm of career teaching, these entities can significantly disrupt the coaching process and jeopardize the security of sensitive information.

Challenges Faced in India

India’s career teaching industry faces distinct challenges that amplify the risks associated with High-Risk PSPs. The rapidly growing market, coupled with evolving consumer behaviors, has created sensitivity. that these PSPs exploit, leading to financial uncertainties and data insecurities.

Factors Contributing to Risk

Several factors contribute to the high-risk nature of PSPs in the Indian teaching sector. Lack of stringent regulations, inadequate cybersecurity measures, and High-Risk PSP for Career Coaches In India[1] the ever-evolving nature of digital transactions are among the primary factors amplifying the risks.

Mitigating High-Risk PSPs

To address these challenges, the industry must implement robust strategies to mitigate the risks associated with High Risk Population PSPs. This includes stringent vetting processes, enhanced cybersecurity measures, and leveraging advanced technologies for secure transactions and data protection.

Role of Technology and Compliance

The integration of cutting-edge technologies like blockchain and AI-driven security measures can bolster the industry’s resilience against high-risk PSPs Additionally, career coaching[2] strict adherence to regulatory compliance is imperative to ensure ethical practices and consumer trust.

Impact and Future Prospects

The implications of High-Risk PSPs on the career development[3] training industry are profound. Stakeholders must adapt to these challenges, fostering innovation while prioritizing consumer security. Success stories and case studies highlighting effective risk mitigation strategies can guide the industry toward a more secure and sustainable future.

Success Stories and Case Studies

Several instances showcase successful resolutions and proactive measures taken to counter the challenges posed by High-Risk PSPs in career training. One such case involved a prominent training institute that implemented a comprehensive vetting process for Payment service provider[4] . By conducting thorough due diligence and adopting stringent criteria, they managed to identify and partner with reliable PSPs, significantly reducing financial risks and secure data security for their clients.

Additionally, another noteworthy example is the integration of advanced secure techniques by an online training platform. This step not only safeguarded sensitive financial transactions but also established a robust shield against potential cyber threats, earning trust and loyalty from their clientele.

The Future of Career Coaching with High-Risk PSP

As the career training landscape evolves, the industry is poised for transformative changes. Innovations in coaching[5] Innovations in technology, coupled with a growing emphasis on data security and compliance, will redefine the training experience. Integrating cutting-edge advancements like biometric authentication, blockchain based transactions, and AI-driven cybersecurity measures will be pivotal in fortifying the industry against High-Risk PSP vulnerabilities.

These progress will not only enhance the security of financial transactions but also foster a more transparent and trustworthy ecosystem for career training in India.

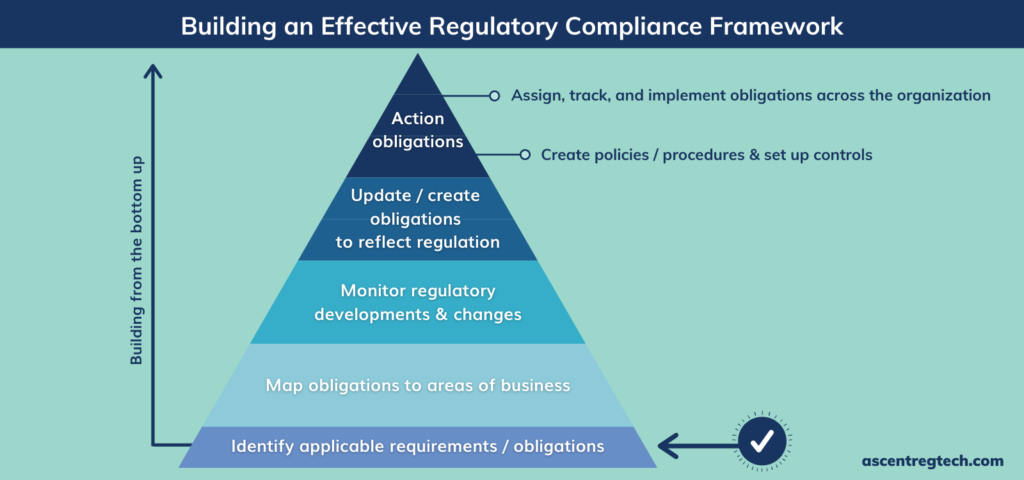

Regulatory Framework and Compliance

Understanding the regulatory landscape control financial transactions and training practices is essential in addressing the challenges posed by High-Risk PSPs. India’s regulatory framework continues to evolve, aiming to enhance consumer protection and mitigate financial risks associated with these service providers.

Overview of Regulations

Regulatory bodies in India, such as the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI), have been actively working to strengthen regulations governing payment service providers. These regulations encompass stringent guidelines for Know Your Customer (KYC) protocols, transaction monitoring, and data protection measures to safeguard consumer interests.

Importance of Compliance in Coaching

For career training entities, compliance with these regulations is non-negotiable. Adherence to regulatory standards not only ensures ethical practices but also instills trust and High-Risk PSP for Career Coaching in India confidence among clients. By aligning with these standards, training institutes and High-Risk PSP for Career training in India platforms can navigate the challenges posed by High-Risk PSPs more effectively.

Impact on Career Coaching Industry

The influx of High-Risk PSPs has had a significant impact on the entire career training ecosystem, affecting stakeholders at various levels.

Conclusion

Navigating the complexities posed by High-Risk PSPs in career training demands a proactive approach. By adopting robust preventive measures, leveraging technology, and adhering to compliance standards, the industry can surmount these challenges and continue to empower individuals in their career pursuits.

FAQs

- What defines a High-Risk PSP in career training?

- How do High-Risk PSPs impact data security in training transactions?

- What measures can training professionals take to mitigate risks associated with High-Risk PSPs?

- Are there any success stories where High-Risk PSP challenges were effectively addressed in career training?

- What role does regulatory compliance play in combating High-Risk PSP vulnerabilities in India’s training sector?