AUTHOR : JENNY

DATE :22-12-2023

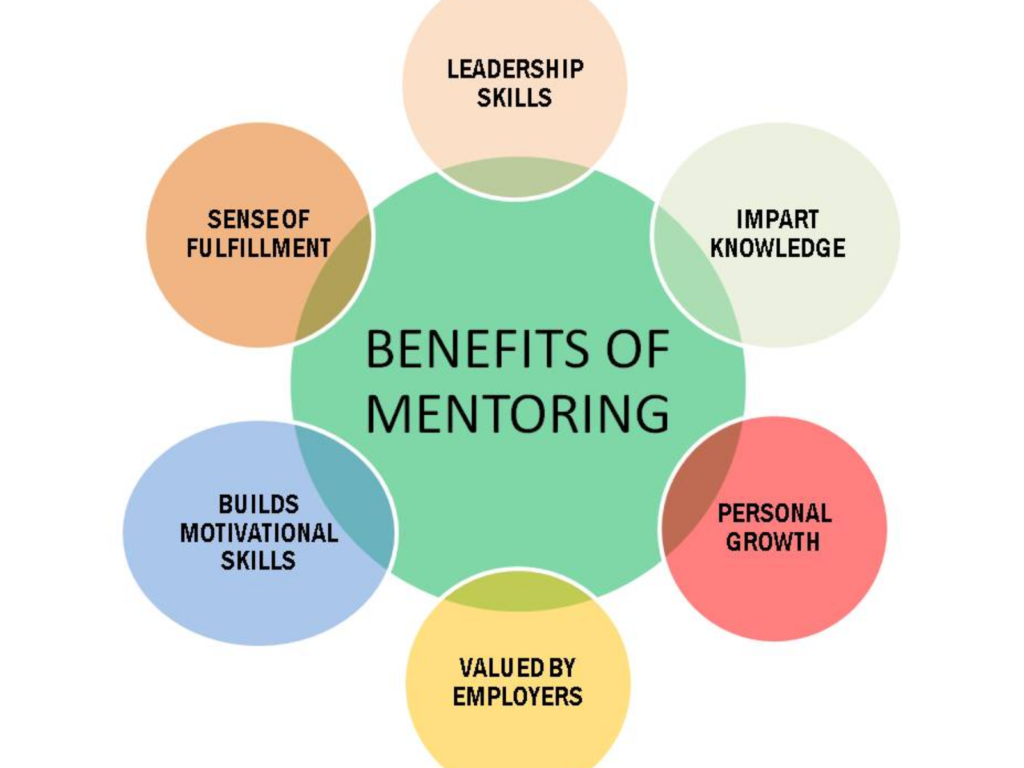

Entrepreneurship in India has seen a remarkable surge in recent years, fostering innovation, creativity, and economic growth. However, for budding entrepreneurs to thrive, mentorship plays pivotal role. To support these ventures, the utilization of High-Risk Payment Service Providers (PSPs) has emerged as a crucial component in facilitating transactions and also mitigating risks.

Introduction to High-Risk Payment Service Providers

Significance in Entrepreneurial Mentorship

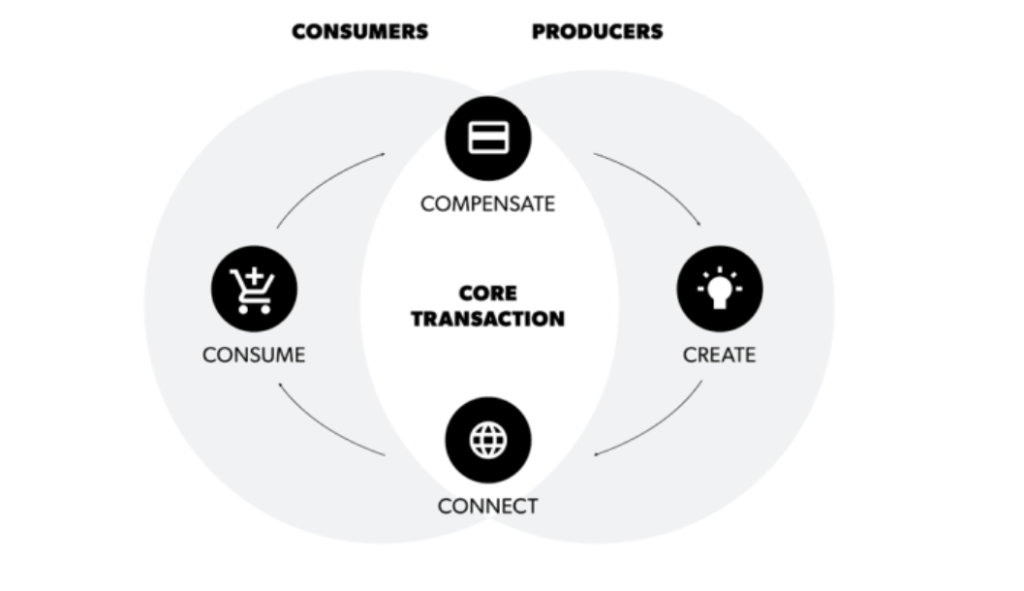

High-risk PSPs cater to businesses deemed riskier due to various factors, such as high chargeback rates or operating in industries with increased vulnerability.

In the context of entrepreneurial mentorship, PSPs serve as the backbone for financial transactions, enabling smoother operations and fostering growth opportunities.

Entrepreneurial Mentorship in India

Challenges Faced

India boasts a vibrant entrepreneurial ecosystem[1], with a burgeoning number of startups seeking guidance and support.

Despite the potential, many entrepreneurs face challenges in securing reliable payment solutions, hindering their growth prospects.

Role of PSPs in Mentorship Programs

Mitigating Risks for Entrepreneurs

High Risk people[2] PSPs play a pivotal role in ensuring seamless and secure transactions, enabling mentors and mentees to focus on their core activities.

By offering tailored services and risk mitigation strategies, these PSPs empower Entrepreneurship[3] to navigate the complexities of financial transactions.

Benefits and Drawbacks of High-Risk PSPs

Regulatory Framework in India

Compliance and Regulations for PSPs

These PSPs provide flexible solutions, accommodating the specific needs of mentorship programs[4] programs and also fostering a conducive environment for growth.

India’s regulatory landscape imposes certain compliance measures on PSPs, impacting their operations within the entrepreneurial network[5] realm.

Limitations and Risks Involved

Impact on Entrepreneurial Initiatives

However, there are inherent risks and limitations associated with high-risk PSPs, including higher transaction fees and potential regulatory challenges.

Understanding and adhering to these regulations is crucial for mentorship programs, influencing their choice of PSPs and operational strategies.

Strategies for Entrepreneurial Mentorship Using High-Risk PSPs

Case Studies

Implementing robust risk management strategies and leveraging technology can optimize the use of high-risk PSPs in mentorship programs.

Exploring successful cases of utilizing these PSPs can provide valuable insights into effective implementation and overcoming challenges.

Future Prospects and Innovations

Technology Integration

Continual advancements in technology and changes in consumer behavior will shape the future landscape of high-risk PSPs in mentorship initiatives. Integration of emerging technologies like and AI can payment systems, potentially minimizing risks and enhancing efficiency.

Conclusion

Entrepreneurial mentorship in India stands to benefit significantly from leveraging high-risk PSPs. While presenting opportunities for growth, understanding the associated risks and regulatory frameworks is imperative for sustainable and also effective implementation.

FAQs

What Defines a High-Risk PSP?

High-risk PSPs cater to businesses that traditional payment processors may deem riskier due to various factors. These could include industries with a history of high rates, such as adult entertainment or online gambling, or businesses operating in regions with economies. They often fill the gap for businesses considered too risky for conventional financial services.

Are High-Risk PSPs Suitable for All Entrepreneurial Ventures?

While high-risk PSPs offer opportunities for businesses typically labeled as high-risk, not all entrepreneurial ventures may benefit equally. Industries dealing with controversial products or services might find high-risk PSPs more accommodating, while conventional businesses could opt for lower-risk alternatives.

How Do Regulatory Frameworks Impact PSP Choice in India?

India, like many countries, has specific regulations governing financial transactions and also PSP operations. Compliance with these regulations is crucial for businesses utilizing PSPs. Mentorship programs need to navigate these frameworks to select PSPs aligned with their operations and also legal requirements.

Can High-Risk PSPs Reduce Transactional Risks for Mentorship Programs?

Yes, high-risk PSPs often come with tools and strategies to mitigate transactional risks. They offer tailored solutions that cater to the unique needs of programs, providing a secure environment for financial transactions.