Author : Sweetie

Date : 19/12/2023

Transportation in India is a dynamic and challenging sector, with terminal-to-terminal transport being a critical component. In recent times, the use of high-risk PSPs (Payment Service Providers) has gained prominence, revolutionizing the way goods move across the country. This article explores the intricacies of high-risk PSPs for terminal-to-terminal transport in India, examining their significance, challenges and potential for transforming the industry.

Introduction

In the bustling landscape of transportation, the need for secure and efficient terminal-to-terminal transport is undeniable. High-risk PSPs play a pivotal role in Improving the operational dynamics, providing a secure financial framework for transactions within the transport industry. As we delve into the nuances of these payment service providers, it becomes evident that they are not just financial intermediaries; they are the architects of a streamlined and secure transport ecosystem.

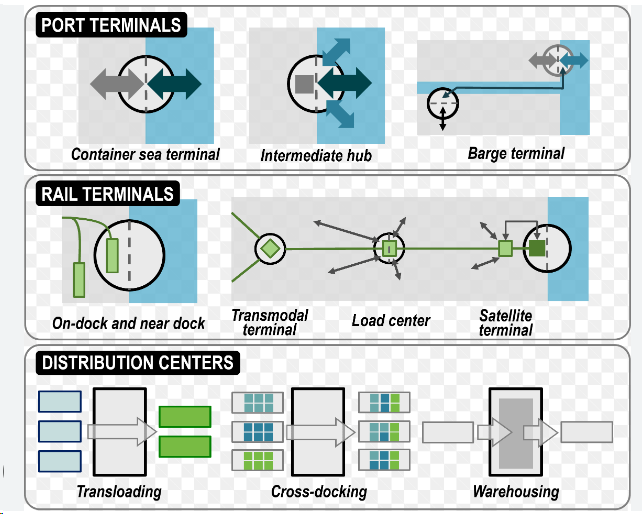

Understanding Terminal-to-Terminal Transport

Terminal-to-terminal transport involves the movement of goods from one transportation terminal to another, typically without intermediate handling. This process demands precision and efficiency, making it a cornerstone of the logistics network. High Risk Credit Card Processing[1], with their specialized services, bring an added layer of reliability to this intricate process, ensuring that transactions are smooth and secure.

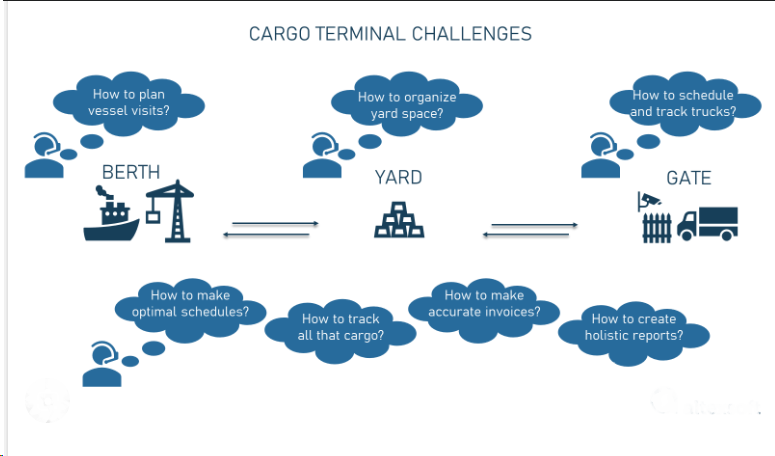

Challenges in Terminal-to-Terminal Transport in India

The Indian subcontinent presents a unique set of challenges for Terminal-to-Terminal shipping[2]. From infrastructural limitations to regulatory complexities and security concerns, the hurdles are diverse. High-risk PSPs step in as problem solvers, addressing these challenges with tailored financial solutions and risk management strategies.

Significance of High-Risk PSPs

High-risk PSPs are not just financial facilitators; they are strategic partners in the transport journey. Their significance lies in their ability to mitigate risks, enhance security, and streamline financial transactions in an otherwise complex and high-stakes environment. The Effortless integration of these services transforms Terminal to Terminal Auto Transport[3] making it more efficient and reliable.

Current Scenario in India

In the current Indian transport landscape, high-risk PSPs have begun to carve their niche. Existing providers are making strides in optimizing transactions, and the Transport industry[4]is witnessing a shift towards Adopting these specialized services. The current scenario sets the stage for a more robust and secure future in terminal-to-terminal transport.

Key Features of High-Risk PSPs

Security protocols, technology integration, and risk management strategies are the pillars of high-risk PSPs. These features ensure that transactions are not only secure but also technologically advanced, keeping pace with the rapidly Changing History of transport landscape[5]. Understanding these features is crucial for businesses looking to adopt high-risk PSPs in their operations.

Benefits and Drawbacks

The adoption of high-risk PSPs brings forth numerous benefits, from increased security to enhanced efficiency. However, it is essential to acknowledge potential drawbacks and devise strategies to mitigate them. Balancing the scales between advantages and challenges is key to making informed decisions regarding the incorporation of high-risk PSPs in terminal-to-terminal transport.

Case Studies

Future Trends and Innovations

Examining real-world examples of successful high-risk PSP implementation in India provides valuable insights.

As technology continues to evolve, so does the landscape of terminal-to-terminal transport. High-risk PSPs are not immune to these changes. Exploring future trends and innovations in the sector provides businesses with a forward-thinking approach, Assuring they stay ahead of the curve in adopting cutting-edge solutions.

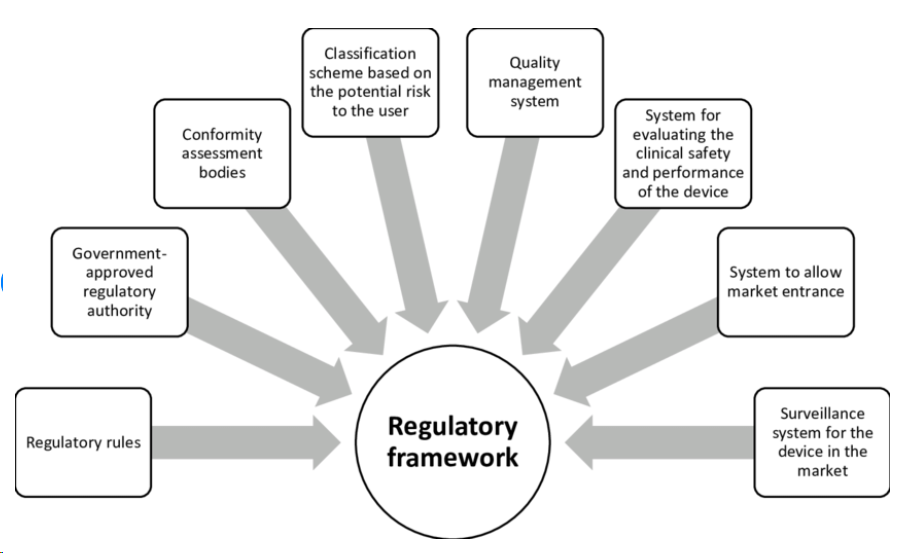

Regulatory Framework

Understanding the regulatory framework governing high-risk PSPs in India is crucial. Compliance with regulations is not only a legal requirement but also a factor that influences the overall success and sustainability of terminal-to-terminal transport operations.

Choosing the Right High-Risk PSP

Selecting the right high-risk PSP requires a nuanced approach. Factors such as security measures, technology compatibility, and case-specific considerations must be carefully weighed to ensure a Effortless integration that aligns with the unique needs of each business.

Cost Implications

While the benefits of high-risk PSPs are evident, businesses must also consider the financial aspect. Analyzing the cost implications of adopting these services is essential for making informed decisions that balance efficiency with budgetary constraints.

Training and Awareness

The successful integration of high-risk PSPs relies not only on technology but also on the training and awareness of personnel. Providing comprehensive training and raising awareness within the industry contribute to the effective utilization of these services.

Global Comparisons

Contrasting high-risk PSPs in India with those in other countries provides a broader perspective. Learning from global practices allows businesses to adapt and tailor their strategies, leveraging the best aspects of international experiences.

Conclusion

In conclusion, high-risk PSPs are catalysts for transforming terminal-to-terminal transport in India. Their significance in addressing challenges, Improving security, and streamlining financial transactions cannot be overstated. As businesses navigate the dynamic landscape of the transport industry, Adopting high-risk PSPs emerges as a strategic move towards a more secure and efficient future.

FAQs

- Q: What is a high-risk PSP?

- A: A high-risk PSP (Payment Service Provider) specializes in providing secure and efficient financial solutions for industries with inherently high-risk transactions, such as terminal-to-terminal transport.

- Q: How do high-risk PSPs enhance security in terminal-to-terminal transport?

- A: High-risk PSPs employ advanced security protocols, encryption technologies, and risk management strategies to ensure the secure and reliable transfer of funds in the transport industry.

- Q: Are there specific regulations governing high-risk PSPs in India?

- A: Yes, there are regulations in place to govern high-risk PSPs in India. Understanding and complying with these regulations are crucial for businesses in the transport sector.

- Q: What factors should businesses consider when choosing a high-risk PSP?

- A: Businesses should consider factors such as security measures, technology integration, and case-specific requirements when selecting a high-risk PSP for terminal-to-terminal transport.

- Q: How can businesses balance the benefits and drawbacks of high-risk PSP adoption?

- A: Balancing the benefits and drawbacks involves careful consideration of the specific needs of the business, potential challenges, and strategies to mitigate risks.