AUTHOR: HAANA TINE

DATE:01/01/2024

Introduction

In the ever-evolving landscape of online transactions[1], the demand for High-Risk Payment[2] service providers (PSPs) has witnessed a notable surge, particularly in the Indian market. This article delves into the nuances of high-risk PSP online software[3], shedding light on its significance and impact.

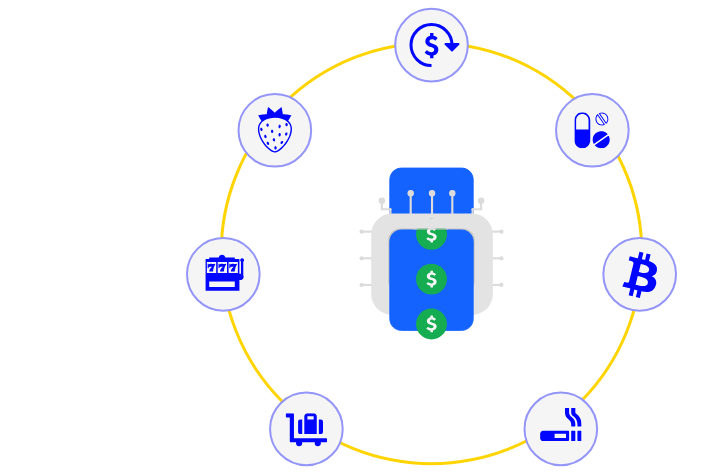

Understanding High-Risk PSPs

High-risk PSPs, often referred to as payment gateways[4] specializing in handling transactions[5] deemed high-risk, exhibit distinct characteristics. These transactions could range from industries like online gaming to adult content subscriptions. Understanding the intricacies of these services is crucial for businesses navigating the complex world of digital payments.

Online Payment Landscape in India

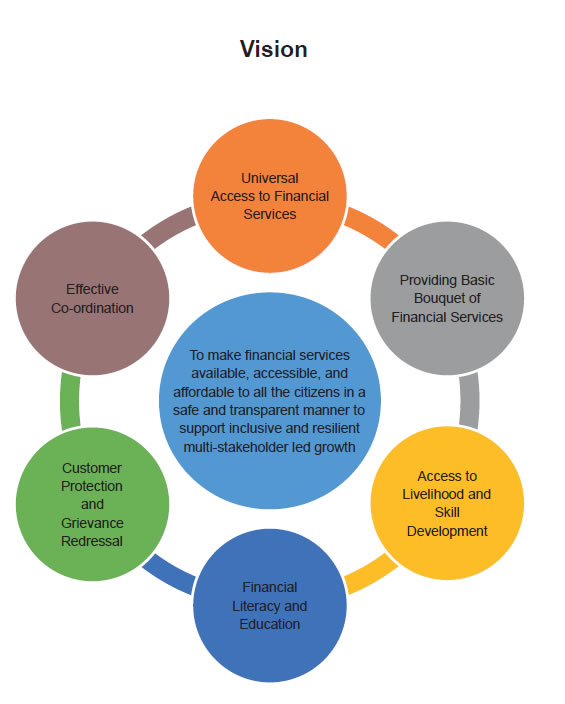

India’s digital payment ecosystem has experienced unprecedented growth, with millions embracing online transactions for their convenience. As the reliance on digital payments increases, the demand for specialized PSPs capable of handling high-risk transactions has become more pronounced.

Emergence of High-Risk PSPs in India

Several factors contribute to the rise of high-risk PSPs in the Indian market. From the growing acceptance of online gambling to the need for secure payment gateways for adult content platforms, these providers play a pivotal role.High-Risk PSP Online Software in India However, navigating the regulatory landscape remains a significant challenge.

Key Features of High-Risk PSPs

To effectively manage the inherent risks associated with high-risk transactions, these PSPs implement robust risk management protocols. From stringent identity verification processes to advanced security measures, these features ensure a secure environment for both businesses and consumers.

Challenges Faced by High-Risk PSPs in India

Despite the demand, high-risk PSPs in India face regulatory scrutiny and must grapple with building and maintaining customer trust.High-Risk PSP Online Software in India The article explores the specific challenges these providers encounter and how they navigate the delicate balance between innovation and compliance.

Benefits of High-Risk PSPs

High-risk PSPs bring tangible benefits to specific industries. By facilitating transactions that conventional payment gateways may shy away from, these providers open up new avenues for businesses. The global reach and accessibility they offer are additional advantages worth exploring.

Popular High-Risk PSPs in India

A closer look at the leading high-risk PSPs in India provides insights into market dynamics. Examining their market share, user base, and unique features helps businesses make informed decisions when choosing a payment service provider tailored to their needs.

Security Measures in High-Risk PSPs

Security is paramount in the world of high-risk transactions. This section delves into the encryption methods employed by these PSPs, along with the sophisticated fraud prevention techniques they implement to safeguard user data and financial transactions.

Case Studies

Examining real-world case studies provides a practical understanding of the successful implementation of high-risk PSPs in India. Additionally, the article explores the challenges faced by these providers and the innovative solutions[1] devised to overcome them.

Future Trends in High-Risk PSPs

The article takes a glimpse into the future, identifying emerging trends that could shape the landscape of high-risk PSPs. Technological advancements[2] and potential regulatory changes are key factors that businesses and consumers alike should keep an eye on.

Adopting High-Risk PSPs: A Guide for Businesses

For businesses considering the adoption of high-risk PSPs, this section offers valuable insights. It covers essential considerations, integration[3] into existing systems, and how businesses can leverage these services effectively.

Consumer Perspectives on High-Risk PSPs

Understanding the mindset of consumers is crucial. This section explores the trust factors and concerns associated with high-risk PSPs[4], providing a glimpse into user experiences and feedback.

Regulatory Framework in India

An overview of the current regulatory framework governing[5] high-risk PSPs in India is essential for businesses operating in this space. The article also discusses potential changes on the horizon that could impact the operations of these providers.

Conclusion

In conclusion, the article recaps key points discussed throughout. It offers a holistic view of high-risk PSP online software in India, summarizing the challenges, benefits, and future outlook for these specialized payment service providers.

FAQs

- Are high-risk PSPs legal in India?

- Yes, high-risk PSPs are legal, but they operate within a regulatory framework.

- What industries benefit the most from high-risk PSPs?

- Industries such as online gaming, adult content, and e-cigarettes often benefit from high-risk PSPs.

- In what ways do high-risk PSPs guarantee the security of financial transactions?

- High-risk PSPs employ robust encryption and advanced fraud prevention techniques to secure transactions.

- Can businesses seamlessly integrate high-risk PSPs into their existing systems?

- Yes, businesses can integrate high-risk PSPs into their systems with careful planning and consideration.

- What future trends are expected in the high-risk PSP industry?

- Future trends may include advancements in technology, increased global reach, and potential changes in regulatory policies.