AUTHOR : PUMPKIN KORE

DATE : 15/12/2023

Introduction

In the dynamic landscape of payment processing businesses, especially those deemed high-risk, face unique challenges. High Risk PSP Payment Processing Companies In India This article aims to shed light on high-risk PSP payment processing companies in India, offering insights into their benefits, risks, and the crucial factors businesses must consider when choosing a payment processing partner

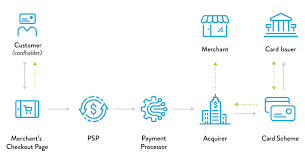

Understanding High-Risk PSPs

High-risk payment service providers cater to Risk Management PSPs India businesses facing increased uncertainties, often associated with specific industries such as online gaming, adult entertainment, and travel. These companies operate in sectors where chargebacks and fraud risks are elevated, High Risk PSP Payment Processing Companies In India requiring High-Risk Payment Gateway Providers specialized solutions to navigate these challenges effectively.

Factors to Consider When Choosing a PSP

Security, transaction fees, approval processes, and customer support are pivotal considerations when selecting a payment processing Indian High-Risk Payment Providers[1] company. For high-risk businesses, PSP High-Risk Merchant Services[2] these factors become even more critical, as the consequences of a wrong choice can be severe.

High-Risk PSPs in India

India, with its burgeoning digital economy, Secure High-Risk Payment Gateways[3] has witnessed the rise of several high-risk payment processing companies. Understanding the Indian market landscape and the regulatory framework is vital for businesses seeking reliable payment processing High Chargeback Payment Processing[4] partners.

Benefits of Using High-Risk PSPs

Despite the challenges, high-risk PSPs offer tailored solutions, robust fraud prevention measures, and global payment processing capabilities. Businesses in niche industries find value in the specialized services provided by these companies.

Drawbacks and Risks

However, it’s essential to acknowledge the drawbacks, such as higher transaction High-Risk Payment Gateway India[5] fees, stricter underwriting standards, and the potential for account freezes. Businesses must weigh these risks against the benefits before committing to a high-risk PSP.

Case Studies

Examining success stories and learning from challenges faced by businesses using high-risk PSPs provides[1] valuable insights. Real-world examples showcase the adaptability and effectiveness of these payment processing solutions.

How to Mitigate Risks

Mitigating risks involves implementing additional security measures, diversifying payment processing options, and regularly reviewing and updating security protocols. Proactive measures can significantly reduce the impact of potential challenges.

Making the Right Choice

To make an informed decision, businesses should conduct thorough research, seek recommendations, and evaluate their specific needs. A one-size-fits-all approach does not apply when choosing a high-risk PSP, emphasizing the importance of tailored solutions.

Future Trends in High-Risk PSPs

As technology evolves, so do high-risk payment processing solutions. Businesses should stay abreast of technological advancements and changing regulations to ensure their payment processing partner remains aligned with their needs.

Navigating the Indian Market

India, with its diverse economic sectors, poses unique challenges and opportunities for businesses. High-risk PSPs operating in India must navigate through a myriad of regulations, consumer behaviors, and industry dynamics. It’s not just about processing payments; it’s about understanding the intricacies of the local market.

Regulations and Compliance

As businesses explore high-risk PSPs in India, compliance with local regulations is paramount. The Reserve Bank of India (RBI) and other regulatory bodies set guidelines to ensure the security and integrity of financial transactions. Understanding and adhering to these regulations is crucial for both businesses and payment processors.

Tailored Solutions for Niche Industries

One of the significant advantages of high-risk PSPs is their ability to offer tailored solutions. Traditional payment processors might shy away from industries like online gaming or adult entertainment due to perceived risks. However, specialized PSPs in India understand the unique needs of these industries and provide services customized to mitigate specific challenges.

Conclusion

In the complex realm of high-risk PSP payment processing companies in India, informed decision-making is crucial. Businesses must weigh the benefits against the risks, conduct due diligence, and choose a partner aligned with their unique requirements. The evolving landscape calls for adaptability and a proactive approach to navigate challenges successfully.

FAQs

Q1: What industries are considered high-risk? A1: Industries such as online gaming, adult entertainment, and travel are commonly deemed high-risk due to elevated chargeback and fraud risks.

Q2: How do high-risk PSPs prevent fraud? A2: High-risk PSPs implement robust fraud prevention measures, including advanced security protocols and real-time monitoring, to mitigate fraud risks effectively.

Q3: Are there alternatives to high-risk PSPs? A3: While high-risk PSPs specialize in tailored solutions, businesses can explore alternative payment processing options, depending on their risk tolerance and specific needs.

Q4: What steps can businesses take to lower their risk profile? A4: Businesses can lower their risk profile by implementing additional security measures, diversifying payment processing options, and staying updated on industry best practices.

Q5: How often should security protocols be updated? A5: Security protocols should be regularly reviewed and updated to align with evolving threats and industry standards, ensuring robust protection against potential risks.