AUTHOR : RIVA BLACKLEY

DATE : 15/12/2023

Introduction

In a rapidly evolving digital landscape, the significance of robust payment security measures cannot be overstated. This article delves into the realm of High Risk Payment Service Providers (PSPs) in India, examining the challenges they face and the measures they employ to safeguard financial transactions. High Risk PSP Payment Security Measures In India.

High Risk PSPs in India

Understanding what categorises a PSP as High Risk PSP Payment Security Measures In India In India, the proliferation of digital transactions has led to the emergence of high-risk PSPs. These entities handle sensitive financial data, making them susceptible to various security threats. High Risk PSP Payment Security Measures In India

Payment Security Challenges

High-risk PSPs grapple with a myriad of challenges, including fraud, data breaches, and cyber threats. As digital transactions surge, the need for comprehensive security measures becomes paramount to ensure the integrity of the payment ecosystem.

Regulatory Framework

To combat these challenges, regulatory bodies in India have established frameworks to govern PSPs. We explore existing regulations and recent updates aimed at fortifying payment security in the country.

Best Practices for High Risk PSPs

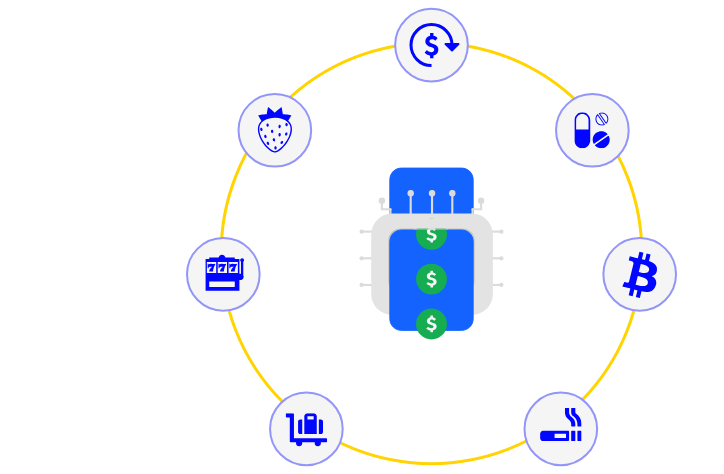

Implementing effective security Fraud Detection Systems[1] for PSPs measures is imperative. This section provides a detailed guide on best practices, emphasizing encryption, secure APIs, and multi-factor authentication. Real-world Advanced Payment[2] Protection Solutions examples showcase high-risk PSPs that have successfully implemented security strategies. These case studies offer valuable insights and lessons for others in the industry.

Technological Innovations

The landscape of payment High-Risk Transaction[3] Security Protocols security is evolving, with technologies like AI, blockchain, and biometrics playing a pivotal role. We delve into how these innovations contribute to enhancing security. Industry Data Encryption for Secure payment systems[4] collaboration is key in combating security threats. This section explores platforms that facilitate information sharing and collaboration among PSPs.

User Education and Awareness

Future Trends in Payment Security

Ensuring secure transactions also involves educating users. We discuss strategies for PSPs to promote security awareness and responsible financial practices among consumers. Anticipated advancements in technology and regulations are examined, providing insights into the future of payment security measures in India.

Benefits of Robust Security Measures

Challenges in Implementation

PSPs with robust security measures not only protect their clients but also attract more business. This section explores the positive impact on the overall payment ecosystem. Despite the benefits, implementing security measures comes with challenges. We address common hurdles faced by PSPs and strategies for overcoming them.

Global Perspectives on Payment Security

Continuous Monitoring and Adaptation

A comparative analysis of payment security measures in other countries offers valuable perspectives and lessons for the Indian payment industry. Security is an ongoing process. This section emphasizes the importance of continuous monitoring and adapting security protocols to address evolving threats.

Emerging Trends in Payment Security

Biometric Authentication: A Game-Changer

As the landscape of payment security evolves, several trends are shaping the industry. We explore the latest advancements and their impact on high-risk Risk Mitigation in Payment Gateways[5] PSPs in India. Biometric authentication, including fingerprints and facial recognition, is gaining prominence in the payment sector. High-risk PSPs are increasingly adopting these technologies to enhance user verification, providing a secure and convenient payment experience.

Tokenization for Enhanced Security

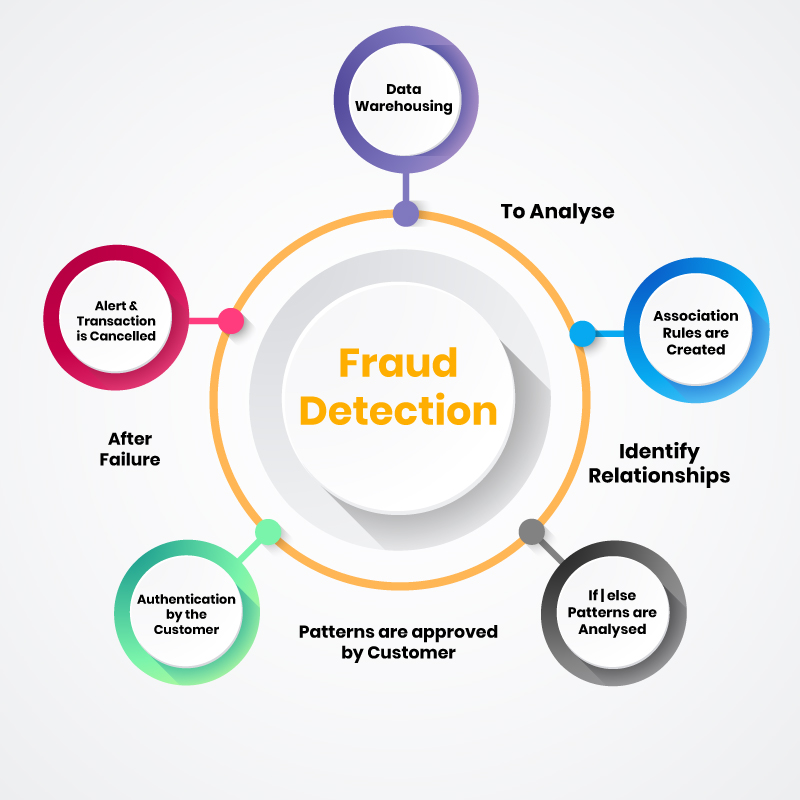

Artificial Intelligence in Fraud Detection

Tokenization replaces sensitive data with unique tokens, reducing the risk of data breaches. High-risk PSPs in India are leveraging tokenization to protect customer information during transactions, ensuring an additional layer of security. Artificial Intelligence (AI) is playing a pivotal role in identifying and preventing fraudulent activities. High-risk PSPs utilize AI algorithms to analyze transaction patterns and detect anomalies, enabling swift response to potential security threats.

Blockchain for Transparent Transactions

Blockchain technology ensures transparency and immutability in transactions. High-risk PSPs are exploring blockchain to enhance the security and traceability of payments, providing users with a more trustworthy financial environment.

Conclusion

In conclusion, the article highlights the critical role high-risk PSPs play in ensuring secure transactions. By implementing and adapting effective security measures, these entities contribute to the overall trust and stability of the digital payment ecosystem in India.

FAQS

- Are high-risk PSPs more prone to security breaches?

- A: While high-risk PSPs handle sensitive data, implementing robust security measures can significantly mitigate the risk of breaches.

- What role do regulations play in ensuring payment security?

- A: Regulations provide a framework for PSPs, outlining the necessary security measures and holding them accountable.

- How can users contribute to payment security?

- A: Users play a crucial role by adopting secure practices, such as using strong passwords and being vigilant about phishing attempts.

- What are the emerging technologies in payment security?

- A: Technologies like AI, blockchain, and biometrics are emerging as powerful tools to enhance payment security.

- How often should PSPs update their security protocols?

- A: Continuous monitoring and regular updates are essential to adapt to evolving threats, so PSPs should revisit their security protocols regularly.